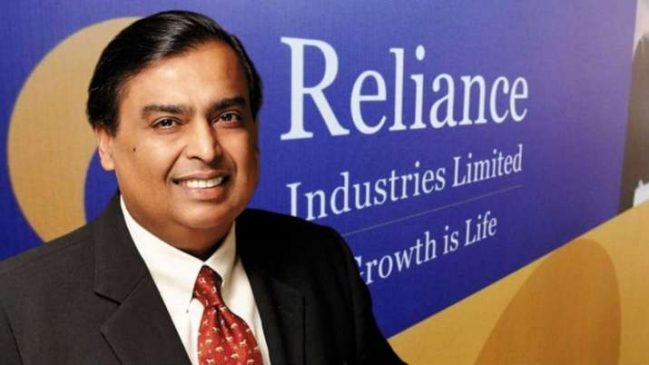

Reliance Industries acquired the German wholesale chain in India last year in a ₹2,850 crore deal.

Reliance Industries has paid a whooping sum of ₹254 crore to German multinational company METRO AG till September 2023 for using the company’s brand name in India.

Reliance Industries acquired Dusseldorf-based METRO AG’s wholesale chain in India last year in a ₹2,850 crore deal.

Read More: Sovereign Gold Bonds Series III Now Open For Subscription: Here’s How To Buy SGBs Online

“METRO AG is providing certain transitional services and licences as part of the transaction to enable the new owner to operate the business,” the German company said in its annual report. “…As part of the sale of METRO India, a licence payment of €28 million (around ₹254 crore) received in advance for using the METRO brand is recognised in the financial year.”

On December 22, 2022, METRO AG signed an agreement to sell METRO India to Reliance Retail Ventures Limited (Reliance). The sale of METRO India, including all 31 wholesale stores and the entire real estate portfolio (6 store locations), to Reliance was successfully concluded on 11 May 2023.

Read More: Unclaimed Deposits With Banks Increases 28% To Rs 42,270 Crore In FY23

“Due to the increasing level of market consolidation, the accelerated digitalisation and the intense competition, the business of METRO India no longer aligns with METRO’s Core growth strategy,” the multinational said in its annual report.

Metro AG, in its report, added that after taking into account the outgoing cash and including the prepayment for the use of the METRO brand, the preliminary net cash inflow for the disposed assets and liabilities amounted to €0.3 billion ( ₹2,731 crore).

“The positive EBITDA-effective earnings from the disposal of METRO India amounts to €150 million, including transaction costs. It is fully attributable to the segment East and is allocated to transformation gains as a portfolio measure,” it added.

“The components of other comprehensive income from currency translation differences attributable to the shareholders of METRO AG still included in the equity of METRO India until the date of de-consolidation had an effect of €−44 million in the financial result due to the de-recognition through profit or loss.”