In NCR’s Greater Noida West, average prices have increased by 27% in the period.

Buoyed by strong housing demand, the average residential prices in key micro markets across the top 7 cities saw a significant surge in the last three years between October-end 2020 and the corresponding period in 2023. Latest Anarock Research data indicated that among the key micro markets across top 7 cities, Hyderabad’s Gachibowli recorded the highest 33% jump in average residential prices between 10M 2020 and 10M 2023, followed by Kondapur with a 31% rise.

Read More: Kolkata Real Estate 2023: KMA Registers Highest Number Of Apartments In October: Report

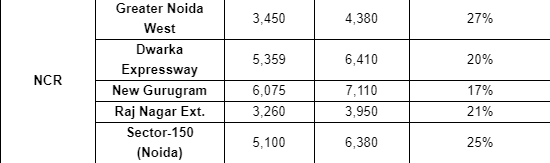

NCR’s top 3 localities for average price increases are Greater Noida West, Sector 150 (Noida) and Raj Nagar Extension (Ghaziabad) with 27%, 25% and 21% hikes, respectively.

In Gachibowli, the average residential prices as of October 2023-end stand at approx. Rs 6,355 per sq. ft. In the corresponding period of 2020, average prices in this locality were Rs 4,790 per sq. ft. Hyderabad’s Kondapur recorded a 31% average price rise in this period – from Rs 4,650 per sq. ft. by October-end 2020 to Rs 6,090 per sq. ft. by October-end 2023.

Read More: Saya Group to infuse Rs 4,000 crore in next three years in Noida, Ghaziabad projects

Bengaluru’s Whitefield comes in third with a 29% jump in this three-year period – from Rs 4,900 per sq. ft. as on 10M 2020 to Rs 6,325 per sq. ft. by 10M 2023.

Key areas in MMR and NCR also saw average prices surge between 13-27% in this three-year span. In NCR’s Greater Noida West, average prices have increased by 27% in the period. In MMR, Lower Parel saw average prices appreciate by 21%.

Prashant Thakur, regional director & head – research, Anarock Group, said, “The end of October, marking the end of the festive season, typically denotes the culmination of the year’s peak housing sales period. Barring discounts, 2020 was a year of price stagnation and a year most developers would prefer to forget. The scenario in 2023 is markedly different – backed by strong demand, housing sales across the top 7 cities have created a new peak this year with sales far exceeding the previous peak of 2014. Led by both robust demand and increased input costs, there has been a significant surge in average housing prices across key micro markets in the top 7 cities.”

Read More: Realty Boost In Gurugram! Ganga Realty to Invest Over Rs 1,000 Crore to Build Luxury Housing Units

Up to the pandemic year of 2020, average residential prices across cities had remained largely range bound.

“Among the top 7 cities, key areas in the IT-led cities Hyderabad, Bengaluru and Pune saw the highest surge in average prices,” said Thakur.

“Hyderabad also has a higher scope of price appreciation because pre-Covid-19, the city’s average prices were relatively lower than in Bengaluru’s IT/ITeS hubs. As of 10M 2023, the average prices in Hyderabad’s key micro markets are almost at par with Bengaluru’s IT-led housing hotspots.”

Hyderabad’s top 3 micro-markets to see high average price rises in the last 3 years are Gachibowli, Kondapur and Miyapur with 33%, 31% and 28% hikes, respectively.

Bengaluru’s top 3 localities – Whitefield, Thanisandra Main Road and Sarjapur Road – saw average prices appreciate by 29%, 27% and 26%, respectively in the period.

Pune’s prominent localities for average price increases are Wagholi (25%), Hinjewadi (22%) and Wakad (19%) – all three in the city’s IT influence zone.

MMR’s top 3 micro-markets to witness high price rises are Lower Parel, Andheri and Worli with 21%, 19% and 13% increases, respectively.

Chennai’s prominent localities for price rises are Perumbakkam (19%), Guduvanchery (17%) and Perambur (15%).

Kolkata’s top 3 prominent micro-markets which recorded high price rises are Joka, Rajarhat and EM Bypass, with a surge of 24%, 19% and 13%, respectively.