Understanding the annual return required to multiply an original investment is essential to understand how your money grows. It’s essentially a measure of the compound rate of growth necessary to double the invested amount within a specified period. The annual return rate depends on the type of investment vehicle selected and the level of risk associated with it.

Read More: Higher personal loan weight to check future risk build-up

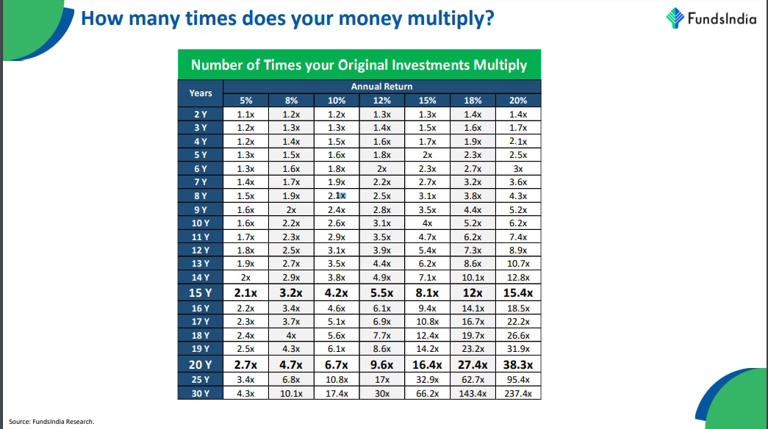

Take for instance the Rule of 72, which tells how many years it takes to double your money at a given rate of return. You take the number 72 and divide it by the investment’s assumed annual return. The result is the number of years your investment will take to double your money. For example, as per FundsIndia Wealth Conversations Report November 2023, if an investor chooses to place their money in a savings account offering a modest return of 3.5% per annum, then it would take approximately 20 years for their original investment to double. If you keep it for 30 years it will grow 4.3 times of the original investment. Although this type of investment is extremely low risk, it offers a limited growth potential. However, one can expedite this growth rate by choosing better investment vehicles. For example, fixed deposit, PPF or debt funds, can provide higher returns. Assuming an annual growth rate of 8% your principal sum can double in just 9 years, this is more than twice as fast as the savings account option. In 30 years, the original amount will be 10.1 times. Currently, Employees’ Provident Fund (EPF) is offering interest rate at 8.15% while Public Provident Fund or PPF is at 7.1%.

Here is a table on how your investments can multiply for different rate of return over the period of 30 years:

Read More: Soft vs hard credit inquiry: What’s the difference?

Entering into the realm of double-digit returns, an assumed annual growth rate of 10%, most commonly found in investments like equities, can more than double your investment (2.1X) in just 8 years. In 30 years, it will grow to 17.4 times. However, again the level of risk is also amplified. Lucrative investment options can be found in large cap mutual funds which can potentially yield an annual growth rate of 12%. In such investments, your money could double in a short span of 6 years and 30 times in 30 years. Although the returns are impressive, it’s important to note that the level of risk is likewise elevated. For those with a strong risk appetite, investing in riskier assets such as small and mid-cap funds can provide an assumed return rate of 15%. At this level, your initial sum can double in as little as 5 years and 66.2 times in 30 years.

However, the risk curve steepens considerably with assets offering a whopping 20% annual return. Although the potential of doubling your investment in just 4 years is enticing, the level of risk is equally very high. Investing in such assets could mean risking your entire capital sum.

Read More: Amid Rising Demand Of Credit Card Usage, RBI Tightens Norms For Personal Loans, Credit Cards

In conclusion, the annual returns required to multiply an original investment fundamentally depend on the investment vehicle as well as the investor’s risk tolerance. Wise investment decisions require a balance of both with the understanding that higher returns usually come with higher risks. It’s crucial for investors to carefully consider their financial goals, risk tolerance, and time frame before jumping into any investments.