Non-Residents are required to furnish certain specified documents to claim the benefit of the provisions of the Double Taxation Avoidance Agreement.

Question: Can you guide us on the mandatory filing of Form 10F and whether non-residents would be required to obtain a PAN for the same?

Read More: 35 Lakh Tax Refund Cases ‘Held Up’ For Various Reasons; Here’s What Top Official Said

Answer by Dr Suresh Surana, Founder, RSM India: Non-Residents are required to furnish certain specified documents such as Tax Residency Certificate, Form 10F, etc. in order to claim the benefit of the provisions of the Double Taxation Avoidance Agreement. Initially, the said form had to be prepared manually offline and furnished to the Tax Deductor making foreign remittance.

However, the CBDT vide Notification No. 03 2022 w.e.f. 16th July, 2022, provided for mandatory online furnishing of Form 10F. For online furnishing of such Form 10F, the non-resident was required to register on the income tax portal using their PAN. Since not many non-residents obtained PAN in India, such process of online furnishing of Form 10F was becoming cumbersome. As a result, the CBDT provided a relaxation from such online furnishing to such category of non-resident taxpayers who are not having PAN and are not required to have PAN under the Income Tax Act, 1962. Such relaxation was provided till 30th September 2023 vide Notification No. F. No. DGIT(S)-ADG(S)-3 dated 28th March 2023.

Read More: Net direct tax collection rises 22% to over Rs 9.57 lakh cr; touches 52.5% of BE: Govt data

As such partial relaxation has come to an end, the Income Tax Department has introduced a functionality for “Non-residents not holding and not required to have PAN” to register on the Income Tax Portal. Such functionality enables non-residents to furnish Form 10F electronically.

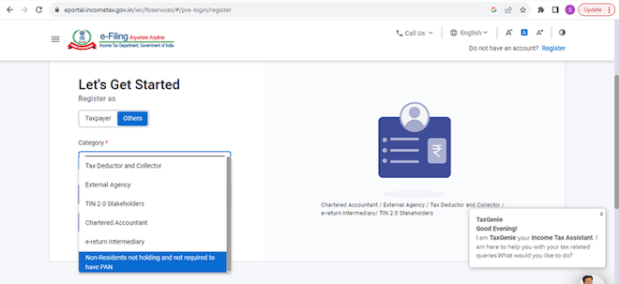

In order to get registered, the non-resident taxpayer would be required to go on the Income Tax portal – https://www.incometax.gov.in/iec/foportal/. Further, click on “Register”> “others” category> “Non-Residents not holding and not required to have PAN”.

Read More: Income Tax Department to Scrutinize Indian Accounts in Swiss Banks

After clicking on “Continue”, the taxpayer would be required to fill in the required details, attach prescribed documents and complete the registration process in order to furnish Form 10F.

It is pertinent to note that the Income Tax Department has directly introduced such functionality on its portal and there is no specific Circular or clarification regarding the same.