While PAN is mandatory for all income tax-related purposes, PRAN is important for all NPS transactions. The NPS subscribers need PRAN to track transaction details and to claim pension benefits under the National Pension System.

While PAN and PRAN may sound similar, their purposes are entirely different. Both are important for individuals for a range of financial transactions. While Permanent Account Number (PAN) is a 10-digit unique number, the Permanent Retirement Account Number (PRAN) is a 12-digit unique number. PAN is mandatory for all tax payers in India.

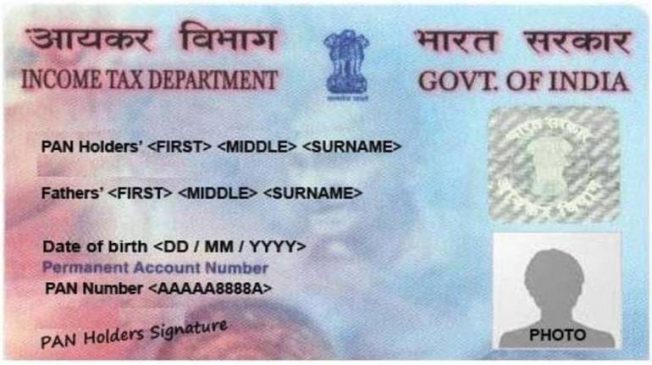

The PAN card, issued by the Income Tax Department, is needed for all tax-related purposes. On the other hand, the PRAN card is important for those who invest in the National Pension System.

Let’s know about them in detail.

Read More: Petrol, Diesel Fresh Prices Announced For October 3: Check Fuel Rates In Your City

What is a PAN?

Issued by the Income Tax Department, PAN or the Permanent Account Number is a unique 10-digit alphanumeric number. With the help of the number assigned to all taxpayers, the department manages to record all tax-related transactions and information. For all the taxpayers PAN is mandatory to perform a host of Income Tax related activities like filing ITR, claim of refund and filing revised return, among others.

What is a PRAN?

A Permanent Retirement Account Number or PRAN is a unique 12-digit number that is issued by the National Securities Depository Limited (NSDL). It is mandatory for all subscribers under the National Pension System (NPS). The PRAN helps to track all transactions related to NPS investment and to claim pension benefits.

Difference between PAN and PRAN

PRAN

– An individual can have two types of NPS accounts under PRAN including Tier-I and Tier-II.

– PRAN, which serves as an identification for all existing and new NPS subscribers, also helps them to keep track of their pension funds.

– It works as a unique ID and issued to all NPS investors.

– Applications for PRAN can be submitted on the NSDL portal.

– Subscribers will need a duly filled application form, photograph, and KYC documents for applying for PRAN.

– PRAN records are maintained by the Central Recordkeeping Agency (CRA).

– A subscriber can have only one PRAN account.

Read More: Indian Economy To Grow At 6.3% In FY24: World Bank

PAN

– PAN is used for all income tax-related transactions and many other financial transactions as well as investments.

– It is used by individuals and business entities performing financial transactions related to tax payments.

– It works as a valid KYC document.

– Applications for PAN are to be made on the NSDL portal or on the e-filing portal.

– Taxpayers will need an ID proof, address proof, a photograph, and date of birth proof for applying for PAN.

– PAN records are maintained by the Income Tax Department.

– As per the existing tax laws, holding more than one PAN is not allowed.