Investing in the stock market can be a rewarding journey. But as a new investor, it’s crucial to understand the financial products you will be using. One such product is the Demat account. It’s your passport to the world of investing and trading.

As with every valuable product, a Demat account comes at a cost. Here is a quick guide covering all the charges associated with opening and maintaining a Demat account in India.

Read More: Indian Railways To Change Timings Of 182 Trains From October 1 | Check Out New Time table Here

Demat Account – Quick Look

A Demat account, short for a Dematerialized account, is a must-have for anyone interested in investing in the stock market. It holds your shares and securities in electronic format, making transactions seamless and secure. It’s a multifunctional tool that makes investing and trading a breeze.

Do you know in August 2023, about 31 lakh new demat accounts were opened, compared to 29.7 lakh additions a month ago? This growth trend is a clear sign that more and more people are recognizing the benefits of investing in the stock market.

But before you reach out to open a Demat account, let’s understand the various charges involved.

Understanding Demat Charges

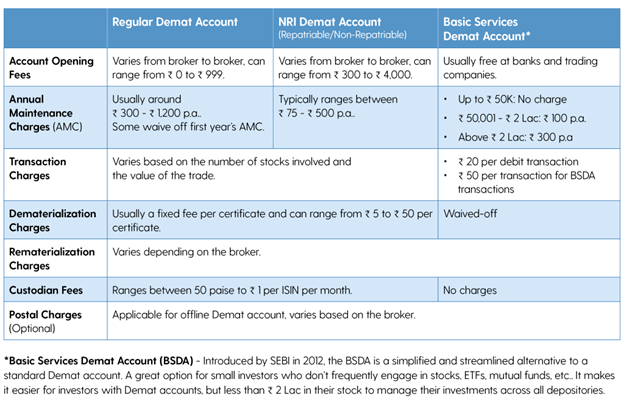

When you open a Demat account, you will encounter several types of charges. These charges can vary depending on the type of Demat account you choose to open.

Read More: Beware! Know what happens to cash when kept in a bank locker

- Account Opening Fee

These are the fees you pay when you open a new Demat account. The charges can vary significantly from broker to broker. Some brokers even offer free account openings. It’s important to check these charges as they can add to your initial investment cost.

- Annual Maintenance Charges (AMC)

These are recurring fees charged by your broker to maintain your Demat account. The AMC is usually applied at the end of the financial year and can range from Rs 300 to Rs 1,200 per annum depending on the broker.

- Transaction Charges

Each time you buy or sell shares, your broker charges a transaction fee. This fee is generally a percentage of the total transaction amount and can vary based on the broker and the type of transaction (buy/sell).

- Dematerialization Charges

When you decide to convert your physical share certificates into electronic format, you will incur dematerialization charges. These charges are usually applied on a per-certificate basis, meaning you will pay a fee for each physical share certificate you convert.

For example, if you have 10 physical share certificates, and the dematerialization charge is Rs 10 per certificate, the total cost for dematerializing these shares would be Rs 100.

- Rematerialization Charges

On the other hand, if you decide to convert your electronic shares back into physical certificates, you will incur rematerialization charges. Similar to dematerialization charges, these fees are also calculated per certificate.

For instance, if you have 5 electronic share certificates to be rematerialized, and the rematerialization charge is Rs 15 per certificate, the total cost for this process would amount to Rs 75.

- Custodian Fee

This fee is charged for the safekeeping of your securities within your Demat account. It’s generally assessed on a yearly basis and calculated based on the number of assets held by the firm for you. The fee may vary depending on the number of International Securities Identification Numbers (ISINs), which represent the number of distinct securities you hold in a given month.

For example, if you hold securities with 10 different ISINs in a month, and the custodian fee is Rs 1 per ISIN per month, the custodian fee for that month would amount to Rs 10.

Read More: SBI’s festive offer: Zero processing fees on car loans, discounts on home loan rates and more

- Postal Charges

Some brokers may charge additional fees for mailing physical statements or other documents related to your Demat account. This is usually an optional service and can be avoided by opting for electronic statements.

Other charges include

- Credit Charges

These charges may apply when securities are credited to your Demat account. They are usually nominal and are applied on a per-transaction basis.

- Goods and Services Tax (GST)

GST is applicable on all the above charges at the prevailing rate. As of 2023, the GST rate for financial services is 18 per cent.

Each broker has different rates for these charges, so it’s necessary to compare them before choosing where to open your Demat account. It’s always a good idea to check with your chosen brokerage firm for the most accurate and up-to-date information.

How to Choose the Right Demat Account?

Selecting the most suitable Demat account involves more than just comparing costs. Here are some vital factors to consider when making your choice:

- Broker’s Reputation

Look for a broker with an excellent reputation in the market. You can gauge their credibility by checking their industry experience followed by online reviews and ratings.

- Customer Service

Effective and responsive customer service is essential, especially for new investors. Prioritize brokers who offer prompt and efficient support, both online and offline.

- Platform Usability

The trading platform should be user-friendly, easy to navigate, and dependable. It should also provide advanced features such as real-time interactive charts, free price alerts, and more.

- Research Tools and Resources

Some brokers provide research tools and resources that can assist you in making well-informed investment decisions. A boon for both new and seasoned investors.

- Account Opening Process

Ensure that the account opening process is straightforward and hassle-free and that the broker offers prompt assistance in case you encounter any issues.

- Associated Charges

Besides brokerage charges, take into account other fees like annual maintenance charges, transaction fees, and any additional charges. Balance cost-efficiency with the quality of service offered.

Remember, the lowest-cost option may not always be the best fit for your unique requirements. Prioritize brokers that strike a balance between cost-effectiveness and quality service. Conduct thorough research and compare different brokers before deciding to open your Demat account.

Conclusion

Understanding the charges associated with a Demat account is crucial before you start your investing journey. By being aware of these costs, you can decide which broker to choose and how to manage your investments effectively.

Take the next step in your investment journey. Open your choice of Demat account today and start building your portfolio! For a trusted option, consider Choice as your Depository Participant.