The Consumer Price Index (CPI) based inflation was at 4.87 in June and 6.71 per cent in July 2022.

Read More: UIDAI Extends Last Date For Free Aadhaar Update, Here’s How You Can Do It

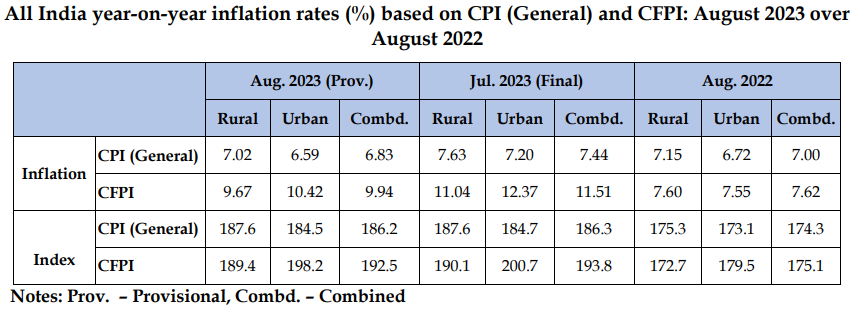

Retail inflation in India declined to 6.83 per cent in August compared to July, mainly due to easing food prices, according to latest government data. The Consumer Price Index (CPI) based inflation was at 7.44 per cent in July and at 7 per cent in August 2022, as per the data released by the National Statistical Office (NSO) on Tuesday.

Food inflation eased to 9.94 per cent in August from 11.51 per cent in July. The Reserve Bank of India (RBI) has projected the CPI inflation at 5.4 per cent for 2023-24.

The fall in August is due to vegetable prices falling to some extent compared to the previous month.

Source: Ministry of Statistics & Programme Implementation

The number is still above the RBI upper tolerance limit of 2 per cent-6 per cent for a second month. It is also the 47th month in a row that it has stayed above the central bank’s medium-term target of 4 per cent.

The CPI based inflation was at 4.87 in June and 6.71 per cent in July 2022.

The inflation in the food basket was 11.51 per cent in July compared to 4.55 per cent in June and 6.69 per cent in July 2022, as per the data.

In July, the retail inflation in vegetables year-on-year was 37.43 per cent while the rate of price rise in ‘cereals and products’ was 13 per cent.

Meanwhile, recently RBI Governor Shaktikanta Das said the central bank is firmly focused on bringing down inflation to 4 per cent and remains prepared to undertake policy responses to deal with supply shocks, which have become more frequent with profound implications.

The current episode of high global inflation and preceding overlapping shocks of the pandemic and Russia-Ukraine war have raised significant issues and challenges for the conduct of monetary policy, the governor had said.

He said the monetary policy framework in India has evolved in line with the developments in theory and country practices, the changing nature of the economy and developments in financial markets. Within the broad objectives, the relative emphasis on inflation, growth and financial stability has, however, varied across monetary policy regimes since independence.

Das listed out steps the central bank took to deal with the situation created in the wake of the COVID pandemic and the Russia-Ukraine war.

Read More: Ladli Behna Awas Yojana: Pakka House For Women, MP Govt Expands Scheme Benefits

Following the outbreak of the war, the central bank raised the policy rates by 250 basis points since May 2022.

“After a near-zero policy rate for a prolonged period, central banks in these (advanced) economies started raising interest rates aggressively in 2022, which contributed to stress in certain banks in these economies. In contrast, our battle against inflation is not constrained by financial stability concerns. In fact, even during the COVID phase, we continuously took measures to strengthen financial stability,” the governor said.

Having touched a 15-month high of 7.4 per cent in July, retail inflation was expected to remain elevated in August as well, due to rising prices of cereals.

However, it is expected to start moderating from September onwards due to fall in prices of vegetables like tomatoes, restrictions imposed on the export of non-basmati rice and cut in the prices of domestic LPG cylinders.

In another survey by news agency Reuters, inflation in India was expected to have eased in August, led by cooling vegetable prices, but held above the upper end of the RBI’s 2%-6% target for a second month.

The September 4-7 Reuters poll of 45 economists had predicted the consumer price index rose 7.00% in August compared to a year ago, a dip from 7.44% in July.

Read More: Ganesh Chaturthi 2023: SWR Railway announces special trains for Karnataka

Forecasts ranged between 6.50% and 7.65%, with almost two-thirds of respondents expected inflation to be 7.00% or higher.