A gold loan is a type of secured loan where individuals can borrow money from banks or a non-banking financial company by pledging their gold jewellery, coins, or other forms of gold as collateral.

Often we need funds urgently, but we have a few options to choose from. These options can have a huge impact on our finances if we don’t pay attention to the terms and conditions of the debt we are borrowing. If you are planning to avail a secured loan, one of the options you can opt for is a gold loan. A gold loan is a type of secured loan where individuals can borrow money from banks or a non-banking financial company by pledging their gold jewellery, coins, or other forms of gold as collateral.

In simple terms, you provide your gold possessions as security in exchange for a loan amount. This type of loan is commonly used to meet short-term financial needs. This type of loan has its own set of advantages and disadvantages. Here is what you must know before taking a gold loan.

Read More: Retirement Planning: How to choose the right retirement and pension plans

Pros

* Easy Access to Funds

Gold loans are relatively easy to obtain compared to other types of loans, as they are secured by the collateral (gold) provided. The approval process is typically quicker, and credit scores may not play a significant role.

* Quick Disbursement

Once the gold’s value is assessed and the loan terms are agreed upon, the disbursement of funds is usually swift, making it suitable for emergency financial needs.

* No Credit History Required

Since the loan is backed by the collateral, lenders are often less concerned about the borrower’s credit history, making it accessible to individuals with lower credit scores. However, if your credit score is good, you can negotiate for competitive interest rates.

* Flexible Repayment Options

Gold loans offer various repayment options, including interest-only payments and bullet payments, allowing borrowers to choose a plan that suits their financial capabilities.

Read More: Education Loan: Comparative Analysis Of Loans For India And Abroad: Which Should You Choose?

* Lower Interest Rates

Interest rates for gold loans are generally lower compared to unsecured loans like personal loans, making them a cost-effective borrowing option when you need money in emergency. Often gold loan is not recommended unless and until you are in a serious financial trouble.

* Shorter Tenure

Gold loans are usually short-term loans, which means borrowers are not burdened with long repayment periods.

* No Prepayment Penalties

Many gold loan schemes do not have prepayment penalties, allowing borrowers to repay the loan early without incurring additional charges.

* Minimal Documentation

The documentation process for gold loans is less cumbersome compared to other loans, reducing paperwork and processing time.

Cons

* Risk of Losing Collateral

One of the significant risks associated with gold loans is the potential loss of the pledged gold in case of default. If the borrower is unable to repay the loan, the lender has the right to auction the gold to recover the outstanding amount.

* Limited Loan Amount

The loan amount is determined by the value of the gold provided as collateral, which might limit the borrowing capacity, especially if the gold’s value is low.

* Fluctuating Gold Prices

The value of gold can be volatile and subject to market fluctuations. If the value of the gold drops significantly during the loan tenure, the borrower might face challenges in repaying the loan if the collateral’s value becomes insufficient.

* High Loan-to-Value Ratio

Lenders often lend only a percentage of the gold’s value (Loan-to-Value or LTV ratio), which might be lower than the actual market value of the gold.

Read More: Missed Home Loan EMI? Must Know What Happens Next

* Interest Accumulation

In case of longer tenures or inability to repay the loan promptly, the interest can accumulate, increasing the overall repayment amount.

* Limited Usage

Unlike other loans, which can be used for various purposes, a gold loan’s usage is restricted to the borrower’s immediate financial needs.

* Unethical Practices

In some cases, unethical lenders might take advantage of the borrowers’ desperation, leading to unfair terms and high-interest rates.

A gold loan can be a convenient and quick way to access funds, especially during emergencies, without requiring an extensive credit history check. However, borrowers must carefully consider the risks associated with potential loss of collateral and fluctuating gold prices. Before opting for a gold loan, it’s advisable to compare offers from different lenders, understand the terms and conditions, and ensure that the loan aligns with your financial needs and repayment capacity.

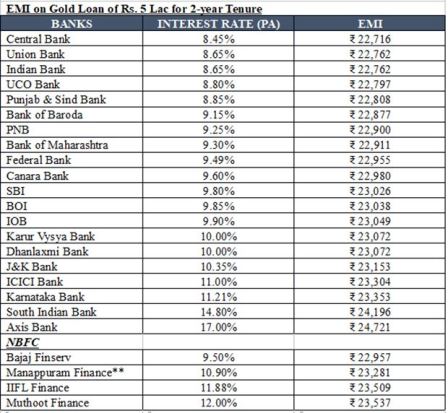

The table below helps you compare the interest rates and EMIs on loans of Rs 5 lakh for a 2-year tenure.

Interest Rates & EMIs on Gold Loan

Compiled by BankBazaar.com

Note: Interest rates on Gold Loan for all listed (BSE) Public-Pvt Banks and selected NBFCs considered for data compilation. Banks for which data is not available on their website are not considered. Data collected from respective bank’s website as on 15 Aug 2023. Banks are listed in ascending order on the basis of interest rate i.e. bank/NBFC offering lowest interest rate on gold loan (for various loan amount) is placed at top and highest at the bottom. Lowest rate offered by the banks/NBFCs is considered in the table (Irrespective of loan amount). EMI is calculated on the basis of interest rate mentioned in the table for Rs 5 Lakh Loan with a tenure of 2 years (processing and other charges are assumed to be zero for EMI calculation); **with rebate.