To access your credit report, simply open the Google Pay app and tap on the “Credit Report” tab. You will need to provide your PAN number and date of birth to view your credit report.

New Delhi: Google Pay is offering free CIBIL score check to its users and get insights into their credit history. The platform also provides suggestions on how to improve your credit score. The credit report service is available to all Google Pay users in India. To access your credit report, simply open the Google Pay app and tap on the “Credit Report” tab. You will need to provide your PAN number and date of birth to view your credit report.

Read More: Massive Discount On Hotel Bookings In Himachal Pradesh Amid Monsoon Mayhem

Your credit report is updated monthly, so you can track your progress over time. Google Pay also provides you with a summary of your credit report, so you can easily understand your credit score and history.

Steps To Check Your CIBIL Score For Free:

- Open the Google Play App and scroll down to “Check your CIBIL score at no cost.”

- The page for CIBIL score check will be displayed; click on “Check your score now.”

- Add your first and last names as per your PAN Card.

- Agree on the terms and conditions.

- Your CIBIL score is displayed on your screen.

Google Pay CIBIL Score Check

Read More: Paytm Launches Two New Versions Of The ‘Soundbox’ To Lure More Types Of Vendors

What is a CIBIL Score?

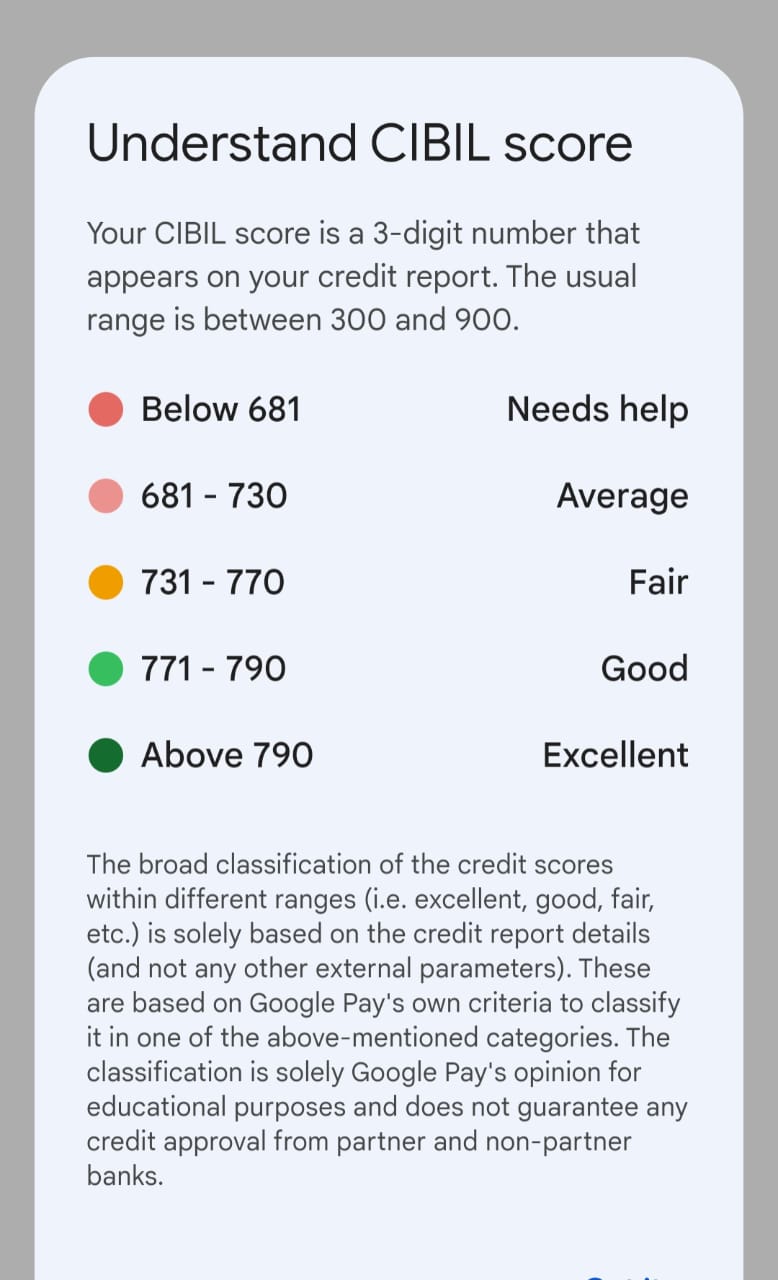

A CIBIL score is a three-digit number that lenders use to assess your creditworthiness. It is a measure of how well you have managed your credit in the past, and it is used to determine whether you will be approved for a loan or credit card.

How is a CIBIL Score Calculated?

Your CIBIL score is calculated based on a variety of factors, including your payment history, the amount of debt you have, the length of your credit history, and the types of credit you have used. Lenders use a proprietary scoring model to calculate your CIBIL score, and the exact factors that are considered can vary from lender to lender.

What is a Good CIBIL Score?

A good CIBIL score is typically considered to be 700 or above. However, the exact score that you need to qualify for a loan or credit card will vary depending on the lender and the type of credit you are applying for.

Read More: Gold Rate Today In India: Check Latest 22 Carat Price In Your City On August 6

How Can You Improve My CIBIL Score?

There are a number of things you can do to improve your CIBIL score, including:

- Making all of your payments on time

- Keeping your debt levels low.

- Extending the length of your credit history

- Using a variety of types of credit

Why is the CIBIL Score Important?

Your CIBIL score is important because it can affect your ability to qualify for a loan or credit card. A good CIBIL score can also help you get a lower interest rate on your loans and credit cards.

About Google Pay

Google Pay is a digital wallet and online money transaction system that allows users to make payments, send money, recharge their mobile phones, and shop online. Google Pay is powered by TransUnion CIBIL, which is one of the leading credit bureaus in India. In addition to its transactional features, Google Pay also offers a credit report service.