Wipro’s mega buyback hit the Street on Thursday, June 22. The latest buyback by Wipro, India’s fourth largest IT company by market value, is its largest-ever wherein the company plans to purchase 26.96 crore shares at Rs 445 apiece, a premium of 15.3 per cent over the market price. Here’s what experts suggest on the Wipro buyback offer.

Wipro’s mega buyback, worth Rs 12,000 crore, hit Dalal Street on Thursday, June 22. India’s fourth largest IT company by market value, Wipro launched its largest-ever share buyback programme to purchase 26.96 crore shares at Rs 445 apiece through the tender route. The price of the Wipro share buyback marks a premium of 15.3 per cent over the market price.

The share buyback window will close on June 29. For retail investors, Wipro has reserved four crore shares under the buyback — about 15 per cent of the total shares.

Read More: To Pay Rs 1,183 Crore In Dividend To Policyholders

Should you participate in Wipro’s latest buyback offer?

“Shareholders should definitely tender their shares in the Wipro buyback offer,” Sandeep Jain, Director at Tradeswift Broking, told Zee Business.

“Wipro, TCS and Infosys started the buyback culture in India, and have rewarded investors heftily… Shareholders should encash this opportunity,” said Jain, in conversation with Zee Business Managing Editor Anil Singhvi. Even an expected acceptance ratio of 50 per cent will translate to a good return for participants, he added.

ICICIdirect suggests shareholders to participate in the buyback offer, especially retail investors.

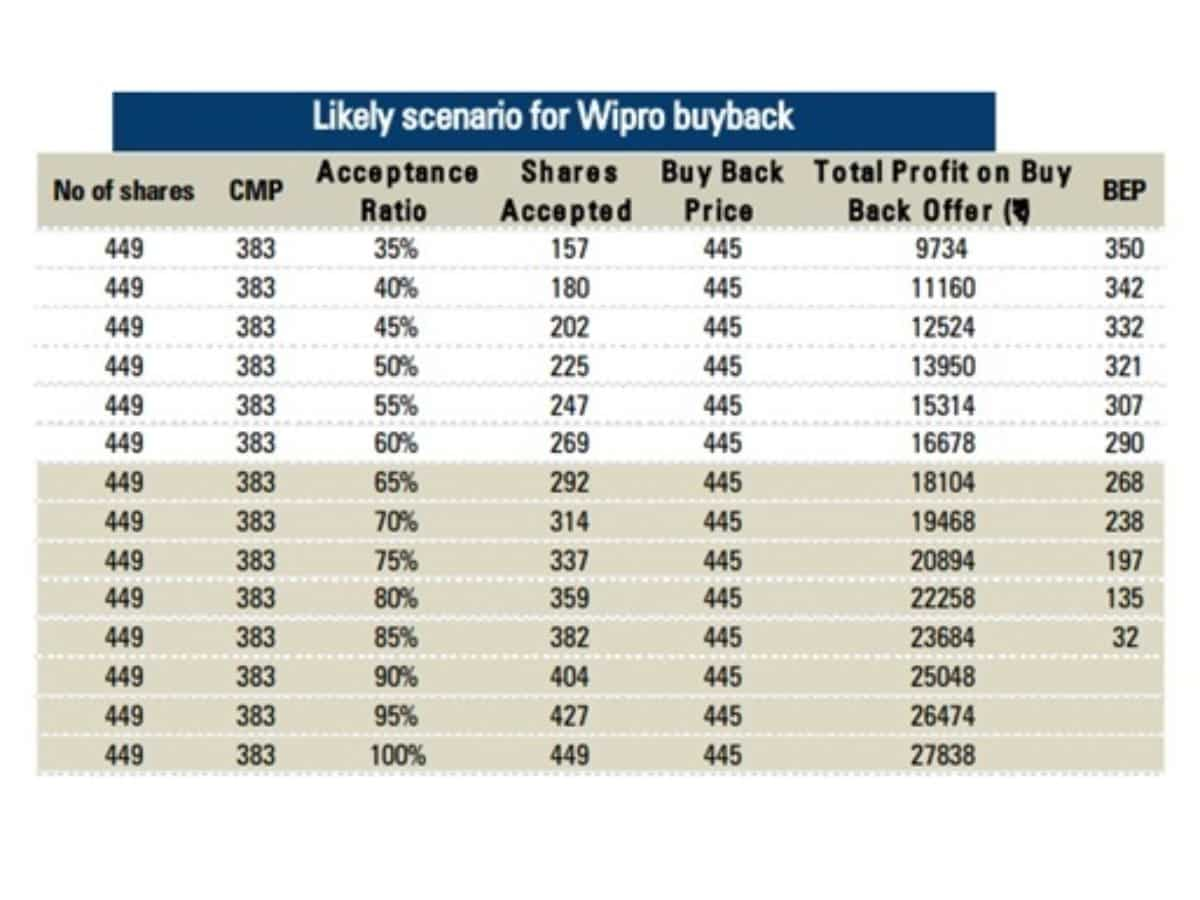

“This is a high risk trade in which acceptance ratio continuously varies. We have arrived at a breakeven price of Rs 290 per share based on the assumption of a 60 per cent acceptance ratio. However, if the acceptance ratio changes to 35 per cent, the breakeven would be at Rs 350 per share. We do believe that the acceptance ratio is likely to be north of 60 per cent,” the brokerage said in a report, dated May 19.

Read More: Aether Industries, Bank of Baroda among 70 NSE stocks to hit 52-week highs; 11 touch 52-week lows

Here’s the likely scenario for the Wipro buyback, as described by ICICIdirect:

Wipro’s latest share buyback is its biggest-ever

Prior to the current buyback, Wipro had announced its biggest buyback in 2017 (Rs 11,000 crore). Here’s a summary of the size of Wipro’s share buybacks in the past:

2020: Rs 9,500 crore

2019: Rs 10,500 crore

2017: Rs 11,000 crore

2016: Rs 2,500 crore

Read More: Delhivery shares soar 7% as 1.8 crore shares exchange hands; reports suggest Carlyle offloads stake

What is a share buyback?

A stock buyback is the repurchase of shares by a listed company. It enables companies to reward their shareholders.

Do buybacks boost stocks?

Typically, a share buyback raises the market price of the stock, as it leaves fewer shares in the market.

Share buyback: Tender vs open market

A share buyback can be launched in two ways: through the open market or through the tender route. In the tender route, a listed company buys its shares directly from existing shareholders, unlike the open market route.

Out of the total size of a buyback, 15 per cent is reserved for retail investors in tender mode. However, there is no such reservation for retail investors in the open market route, which is ‘open’ to all shareholders big or small.