Wealth cannot be generated overnight. Building wealth is a steady process that requires discipline, planning, and strategising. Since only savings would not suffice, investing it in a good investment tool is necessary. While there is a plethora of investment options available in the market choosing the right one customised to one’s needs and financial goals can be challenging. Financial experts suggest having a balanced portfolio of gold, equity, fixed-income, and real estate investments.

Read More: How multiple loans and credit cards impact your CIBIL Score

Talking about fixed-income instruments the fixed deposit is one tool that stabilises portfolios and is a sound option when it comes to investing one’s hard-earned money. With the power of compounding investors can earn good returns over time. This instrument can surely help one secure their finances for the future.

Out of all the financiers that offer FD, the Bajaj Finance Fixed Deposit offers higher FD rates along with the ultimate safety of deposit. Read on to know more about why this FD is the best way to save for your future:

Earn more with the higher FD rates and special tenures

Bajaj Finance FD offers one of the higher FD rates in the market. Investors can earn up to 8.60% p.a. on their deposits. With such attractive interest rates, investors can save up a corpus and get a generous yield at maturity. Since this is a fixed-income instrument, the interest rate gets locked in at the time of booking the FD and it stays the same throughout the tenure irrespective of the market movements.

Read More: PNB revises FD rates effective from today, promising up to 8.05% to these customers

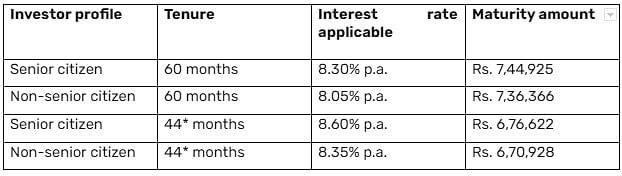

To get an estimate of the potential earnings, let us have a look at an example. Here a senior citizen and a citizen aged below 60 years invest Rs. 5 lakh in a Bajaj Finance FD.

Investors can use the online FD calculator to estimate their returns, which can help in choosing the right tenure and initial deposit amount based on their income, needs, and future financial goals.

With special tenures, investors can earn higher fixed deposit interest rates. This is a relatively new offering by Bajaj Finance, the tenures of (15, 18, 22, 30, 33, and 44) months are special tenures. Simply choosing any of these tenures can expedite one’s earning process. Senior citizens get additional rate benefit of up to 0.25% p.a. on the base rate.

Enjoy liquidity with multiple payout options

While opening an FD, investors can choose between a cumulative and non-cumulative FD. This is another advantage as investors choose the frequency of their payouts. They choose between monthly, quarterly, half-yearly, or annually as per their recurring expenses and liquidity requirements like paying EMIs or even making other regular investments.

Read More: Sukanya Samriddhi Yojana Calculator: Invest Rs 10000 Per Month, Get Rs 52 Lakh On Maturity

Save for the future monthly

If one is not very keen on freezing a corpus in one go with an FD that affects liquidity, one can always opt for the Systematic Deposit Plan (SDP). Instead of delaying investments one can start making small monthly contributions towards their investments and earn significant returns early. Bajaj Finance offers the Systematic Deposit Plan (SDP) which is an industry-first offering where one start savings amounts as small as Rs. 5000 monthly.

This plan works just like a Systematic Investment Plan (SIP) without the mutual fund market risks and fixed deposit combined. Every deposit one makes goes into a separate smaller FD, which either can be realised in two ways. Either at maturity with the Single Maturity Scheme (SMS) or monthly by selecting the Monthly Maturity Scheme (MMS). These two variants offer different solutions for investors based on their goals and needs.

Along with these features, investors can also benefit from the loan against FD facility where one can get cash without breaking their FD and the online booking system. Investors can open an FD in under 10 minutes right from their couches without having to stand in any queues. Bajaj Finance FD is accredited with the highest credit ratings of AAA/STABLE given by ICRA and CRISIL, so investors can be assured that their money is in good hands. Consider investing in a Bajaj Finance FD, it is certainly the best way to save and plan.