Old vs New Tax Regime: The month of April is considered crucial as employees have to make sure that they choose the right income tax regime for maximum saving

Old vs New Tax Regime: Tax planning is crucial as it helps in reducing tax liability and ensuring maximum tax savings. As the new financial year has begun, employers have started taking down details of which tax regime their employees are opting for in order to deduct TDS (tax deducted at source).

Read More:-Mankind Pharma IPO to open for subscription on 25 April. Details here

The month of April is considered crucial as employees have to make sure that they choose the right income tax regime for maximum saving. If employees do not inform about their tax regime choice, TDS will be deducted as per the new tax regime.

“Based on the amendments proposed in Union Budget 2023, the new tax regime has been made as a default one, and the taxpayers will have to select the old tax regime if they wish to use it, “said CA Ruchika Bhagat, MD, Neeraj Bhagat & Co.

Also Read– Stock Market Updates: Sensex Trades Flat, Nifty Below 17,650; Infosys Down 2%

Let’s have a quick glance at some things taxpayers should consider before choosing the tax regime.

Old tax regime vs New tax regime: Deductions, exemptions available

The first step in deciding on a tax regime is to compare the two (old tax regime and new tax regime). A salaried taxpayer can claim many deductions, exemptions, and allowances for tax savings under both tax regimes

The old tax regime has exemptions available such as House Rent Allowance (HRA) and Leave Travel Allowance (LTA). It also has the most popular Section 80C option that allows taxpayers to reduce their taxable income by up to Rs 1.5 lakh. Under the old regime, the tax rebate under Section 87A is available up to an income of Rs 5 lakh.

On the other hand, the new tax regime also has HRA, standard deduction, and leave travel concession. There are also other deductions available under Sections 80C; 80CCC; employee contribution u/s 80CCD; 80D; 80DD; 80DDB; 80E; 80EEA except those under 80CCD(2) and 80JJAA. Taxpayers can also claim a rebate on an income of up to Rs 7 lakh.

“A tax rebate on income earned up to Rs 7 lakh, which was Rs 5 lakh earlier under section 87A,” said Bhagat.

Also Read : Do You Know How India Pays? With UPI And Cards, Indians Making Digital Payments A First Choice

Old tax regime vs New tax regime: How to choose

According to Bhagat, in case any person has a gross salary of up to 7.5 lakhs with no investment deduction, one can definitely opt for the new tax regime, as the tax liability, in this case, would be NIL.

To put things into perspective, if a person has an income of Rs 7.5 lakhs, he/she can claim a rebate of Rs 7 lakh under the new tax regime and can get a standard deduction of Rs 50,000. So, the tax liability will be nil.

Taxpayers belonging to higher tax brackets should consider the quantum of deductions as deciding factor.

“While one goes into the higher tax bracket, the deciding factor would be the quantum of deductions that taxpayers intend to claim. In case taxpayers have invested in all the eligible deductions and have a substantial amount in it, they can surely opt for the old tax regime,” said the MD of Neeraj Bhagat & Co

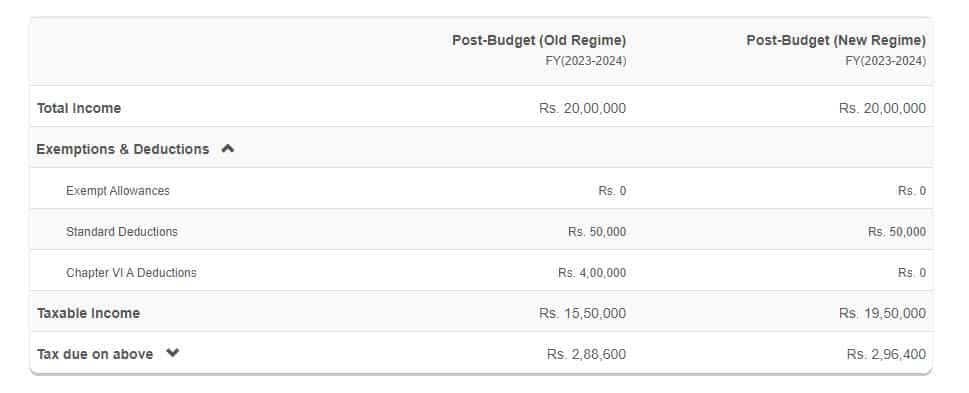

To put things into perspective, for an Income of Rs 20 lakh, the total deductions taxpayers can apply will be of 4 lakhs. In this case old tax regime will be better as one can save taxes of Rs 7,800.

Also Read : How To Know If Your PAN Is Linked With Aadhaar?

| Particulars | Deduction under old tax regime amount (Rs) |

| Total Income | 20,00,000 |

| Basic Deduction 80C | 1,50,000 |

| Medical Insurance | 50,000 |

| Interest on Education loan | 1,00,000 |

| Employee’s contribution | 50,000 |

| Donation to Charity | 50,000 |

| Total Deduction | 4,00,000 |