The majority of consumer loans, including auto, personal, and house loans, are fixed at the one-year rate.

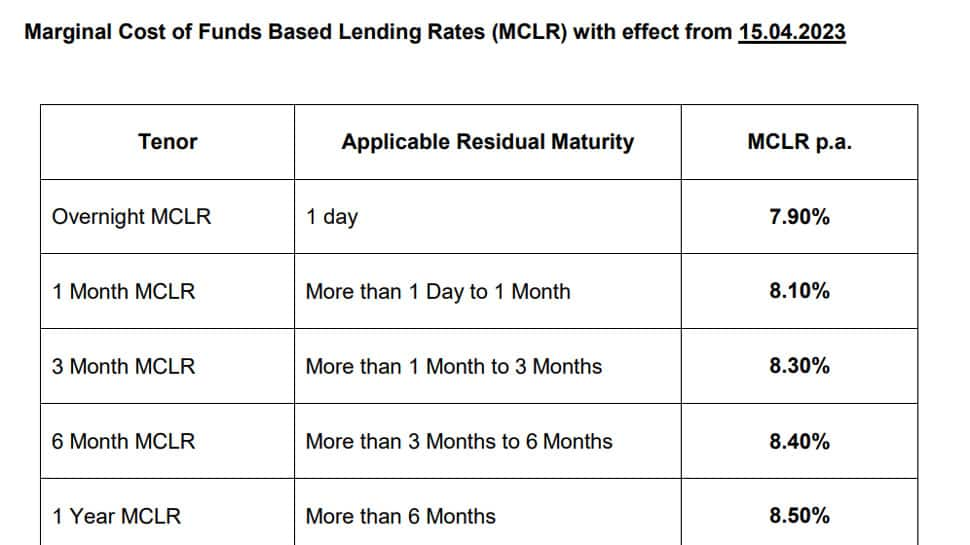

New Delhi: State-owned Bank of Maharashtra (BoM) has announced that the Marginal Cost of Funds based Lending Rate (MCLR) across all tenors would increase by 10 basis points. The change to MCLR is effective from April 15, 2023, said the bank.

Read More:- CLOSING BELL: Sensex Falls 180 Points, Nifty Ends Below 17.7K; Banks, IT Stocks Gain

According to the statement issued by Bank of Maharashtra, the benchmark one-year MCLR is now 8.50%, up 10 basis points. The majority of consumer loans, including auto, personal, and house loans, are fixed at the one-year rate.

The six-month maturity bucket climbed to 8.40%, while the overnight and one-month MCLRs increased by 0.10 percent each to 7.90% and 8.10%.

Read More:- How To Know If Your PAN Is Linked With Aadhaar?

Several banks have hiked their MCLR rates recently after the Reserve Bank of India (RBI) on April 6 announced its key policy rates. Bank of Baroda and Indian Overseas Bank have increased their marginal cost of fund-based lending rates (MCLR), following a hike in the interest rates on loans and deposits by their largest public sector peer SBI.

Read More:- Struggling To Repay Loan? Here’s How You Can Pay On Time And Avoid Default

Last week, Canara Bank hiked marginal cost of funding-based lending rate (MCLR) across all tenors. The new MCLR rates are applicable from 12 April 2023, Canara Bank said.

Canara Bank also added that existing borrowers of the Bank shall have an option to switch over to interest rates linked to MCLR (other than Fixed Rate Loans). Borrowers willing to switch over to the MCLR based interest rate may contact the branch, the bank said.

Even though inflation is heading above its tolerance level, the RBI announcing its bi-monthly monetary policy on April 6 chose to hit the pause button and maintain its important benchmark policy rate at 6.5 percent.

Read More:- Stocks to buy: Infosys, HDFC Bank, Zomato, Bharti Airtel among analysts’ top short-term picks

After six consecutive rate rises totaling 250 basis points since May 2022, the rate hike was put on hold.

The Monetary Policy Committee (MPC), according to RBI Governor Shaktikanta Das, will not hesitate to act in the future while announcing the bi-monthly monetary policy.