As a secured product, this loan requires the gold to be pledged as a collateral and valued

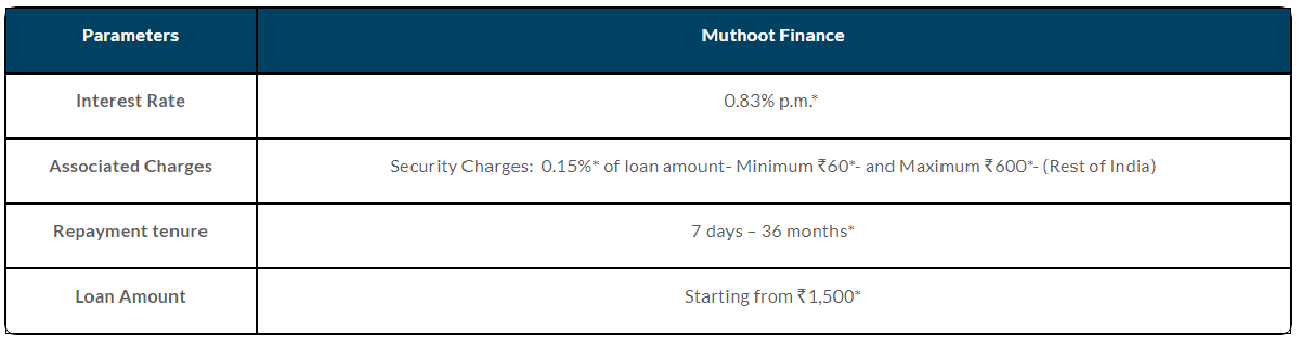

As interest rates in the country have been on the rise since last year amid high inflation, borrowers are looking for options to get a cheaper loan. One such option can be gold loan, which is cheaper than a personal loan. Here are details about Muthoot Finance Gold Loan:

As a secured product, this loan requires the gold to be pledged as a collateral and valued. However, Muthoot Finance offers the doorstep valuation of the gold. This adds to the convenience and assures the safety of gold items.

In addition to competitive interest rates, a gold loan from Muthoot Finance comes with the following benefits — Flexible repayment tenure, no restriction on end use, easy-to-meet eligibility criteria, minimal documentation, easy part and full prepayment facility, and no hidden charges.\

Read More:- Centre’s High-level Covid Meet Today as India Sees 6,050 New Infections, Cases ‘Triple’ in 7 Days

Muthoot Finance offers gold loan on interest rate as low as 0.83 per month. Its other charges include security charges: 0.15 per cent of loan amount (minimum Rs 60- maximum Rs 600). Its repayment tenure is 7 days-36 months.

How to Apply

Step 1: Click on ‘APPLY NOW’ on this page.

Step 2: Enter details like your name, mobile number, and date of birth. Then, select the state, city, and nearest branch.

Step 3: A loan representative will contact you to process your application further.

Eligibility

1) You should be older than 18 years

2) You must be an Indian citizen

Documents Required

1) Proof of identity (PAN Card, Aadhaar card, Voter ID card, Passport)

2) Address proof (Aadhaar card, Voter ID card, Passport) or utility bills.

The final purpose of a gold loan amount is not constrained, unlike the single objective of other secured loans like a home loan or education loan.