In 2020, India’s oil to telecom behemoth Reliance Industries led by Mukesh Ambani, announced that it had become net-debt free after raising Rs 1.68 lakh crore via rights issue and investments. Major conglomerates including Reliance’s competitor Adani have been prepaying loans to address debt concerns among investors.

Read More:- Centre’s High-level Covid Meet Today as India Sees 6,050 New Infections, Cases ‘Triple’ in 7 Days

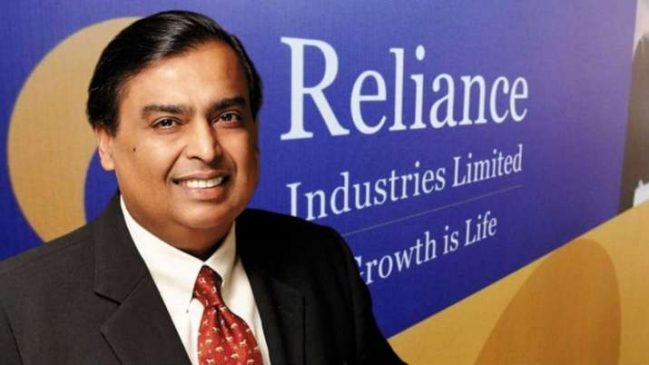

Now Mukesh Ambani’s firm has raised the largest loan in India’s corporate history, by borrowing $5 billion from multiple banks.

The debt came from back to back approvals, with Reliance Industries raising $3 billion from 55 banks, and its subsidiary Jio bagging $2 billion from 18 lenders.

Both loans come with the same terms, and will boost the expansion of 5G coverage in India along with Reliance’s capital expenditure.

The dollar loans have been secured as Reliance enjoys deep banking relationships and is highly favoured for credits.

Lenders also lined up to provide credit for Reliance Industries, since it is a blue-chip entity and hasn’t been very active in the market for a while.

Mukesh Ambani back on top

The firm’s chairman Mukesh Ambani has retained his place as Asia’s wealthiest man after Gautam Adani tumbled.

He is also the only Indian among the world’s top 10 billionaires and the richest sports owner.

Apart from Reliance Jio capturing the telecom sector in India, Reliance Retail is also moving towards aggressive expansion.