The company also addressed The Ken report later in the day, saying it had paid off share-backed financing amounting to $2.15 billion and that the stock pledged for those facilities had been released.

Also Read– Adani Group, Vedanta, JSW Energy, TII, Jindal Stainless, L&T, Britannia Industries stocks in focus

New Delhi: Adani Group listed companies once again saw a steep downfall yesterday after two separate media reports flagged concerns about the conglomerate’s debt repayment. While the Economic Times quoted sources saying that the Adani Group is seeking to renegotiate the terms of $4 billion worth loans, The Ken raised concerns over the group’s repayment of $2.15 billion of share-backed loans.

Also Read– LIC Dhan Varsha Plan Ending On March 31: Pay Single Premium Of Rs 10 Lakh And Get Millions

As per the ET report, Adani Group had started talks with lenders to extend the tenor of a $3 billion bridge loan to a period of five years or beyond from the existing 18 months. It said the group is seeking to increase the maturity of another $1 billion mezzanine loan.

Read More: PAN-Aadhaar Link failure: What to do if PAN and Aadhaar linking fails after paying Rs 1000

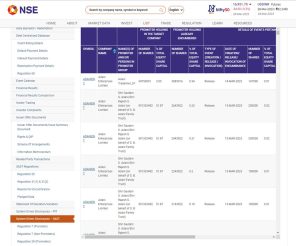

According to The Ken, regulatory filings showed that banks have not yet released a large portion of founder Gautam Adani’s shares. The report said the large portion of promoters’ shares held by banks as collateral, which hasn’t been released, indicates that the debt hasn’t been fully paid off.

Also Read- Rising Covid cases may lead to surge in hospitalisation, ICU stays: Doctors

“All share-backed facilities availed by the promoters have been paid off,” the group said in its statement late Tuesday. Listed company positions for the flagship, the ports unit, Adani Green Energy Ltd. and Adani Transmission Ltd. have been reduced substantially, with only residual share pledges corresponding to operating company facilities still outstanding, the statement said.

Read More: SBI Credit Card Charges: New Changes to Know About in March 2023

ADANI GROUP FIGHTS BACK

In separate statements on Tuesday, Adani Group refuted these reports. It called the Economic Times’ claims “baseless speculation.” The company also addressed The Ken report later in the day, saying it had paid off share-backed financing amounting to $2.15 billion and that the stock pledged for those facilities had been released.

Jugeshinder Singh, the Chief Financial Officer of Adani Group, tweeted that the report was a “deliberate misrepresentation.”

“Deliberate misrepresentation ( and if i speculate out right lies) of @TheKenWeb (@SudzzBTS and @nimishshp) they know that relevant exchanges will update end of quarter. The deliberate subterfuge will be clear to all once exchanges update the data post end of quarter,” said Jugeshinder Singh in a tweet.

Also Read– PAN-Aadhaar Linking Date Extended: Know How To Check Status Online Here

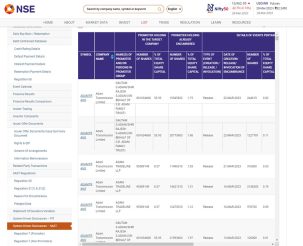

Jugeshinder Singh also added a screengrab from the National Stock Exchange to substantiate his claims.

The reports came at a moment when Adani Group was slowly building up confidence among the investors who seemed to have lost it following explosive allegations by short seller Hindenburg Research in January.

Adani Ports & Special Economic Zone Ltd. fell 5.7 per cent to close at 593.40 rupees on Tuesday — lower than the price investor GQG Partners paid to buy a stake earlier this month. It plummeted more than 9 per cent at one point in the session. The sharp selloff in all Adani stocks erased about $6.2 billion from their combined market value, the biggest decline since early February.

Read More: SBI Credit Card Charges: New Changes to Know About in March 2023

After the reports, dollar-denominated Adani debt also fell.

The group said that operating company facilities are part of the units’ existing debt structures, and no new facilities have been availed since the Hindenburg report. These facilities don’t have covenants like cash margin calls or share-price linked put options, according to the statement.

Also Read- PAN-Aadhaar Link failure: What to do if PAN and Aadhaar linking fails after paying Rs 1000

As per Indian capital market regulations, companies must disclose obligations on the pledge or release of shares that amount to 5 per cent or more in listed entities. These rules only apply to Adani Ports and not the transmission or green energy units, the conglomerate said.

Read More: Indian Railways Update: IRCTC Cancels THESE Trains On March 29; Check Full List

Before the rebuttal, Sameer Kalra, founder of Target Investing, said The Ken report “increases the risks,” for the group in refinancing. “The global banking crisis has resulted in a tightening of liquidity and the cost of it,” the investor said.