LIC’s Dhan Varsha Plan is a Non-Linked, Non-Participating, Individual, Savings, Life Insurance plan which offers a combination of protection and savings.

New Delhi: Insurance Behemoth Life Insrance Corporation (LIC) of India is going to end two insurance plans after March 31. The two LIC plans –LIC Dhan Varsha and PM Vaya Vandan Yojana — will not be available for purchase from April 1, however those policy holders who have already bought the policies will not be impacted.

LIC’s Dhan Varsha Plan closing on March 31

LIC’s Dhan Varsha Plan is a Non-Linked, Non-Participating, Individual, Savings, Life Insurance plan which offers a combination of protection and savings. This plan provides financial support for the family in case of unfortunate death of the life assured during the policy term. It also provides guaranteed lumpsum amount on the date of maturity for the surviving life assured.

Also Read- PAN-Aadhaar Link failure: What to do if PAN and Aadhaar linking fails after paying Rs 1000

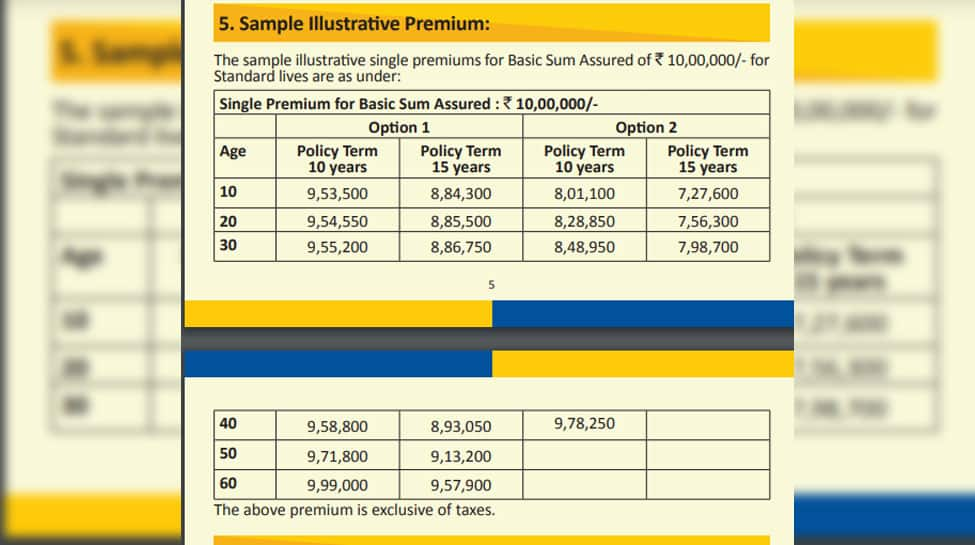

With the LIC Dhan Varsha 866 Plan, you can pay a single premium of Rs 10 lakh and get millions, given you choose from the two options provided by the Insurance Behemoth and start at an early age. In the event of an unfortunate death, you will also be able to financially keep a cushion for your nominee.

Death Benefit: Death benefit payable, on death of the life assured during the policy term after the date of commencement of risk but before the date of maturity, shall be “Sum Assured on Death” along with accrued Guaranteed Additions. “Sum Assured on Death” shall depend on the option chosen by the policyholder as under:

Option 1: 1.25 times of Tabular Premium for the chosen Basic Sum Assured

Option 2: 10 times of Tabular Premium for the chosen Basic Sum Assured

Calculation on 1st and 2nd option

Selecting 1st Option means the customer will get Sum Assured at 1.25 times the premium deposited. It means someone has paid 10 lakh single premium and there is an untoward event of death, then the nominee will get 12.5 lakhs along with the guaranteed addition bonus.

Selecting 2nd Option means that the customer will get 10 times the risk cover of the premium deposited. In the event of an untoward death, if for example the customer has madde Rs 10 lakh single premium, his nominee will get Rs 1 crore with guaranteed bonus.

Return Calculator on 1st and 2nd option

If a person at the age of 30 in option 1 paid one time premium of Rs 8,86,750 (Inclusive of additional GST Rs 9,26,654), the sum Assured is Rs 11,08,750. Now if he choses term policy as 15 years then he will get Rs 21,25,000 on maturity. In the case of an unfortunate death on first year, nominee will get Rs 11,83,438 and if death is on 15th year, nominee will get Rs 22,33,438.

If you choose the second option, and invest Rs 8,34,642 then the Basic Sum Assured will be Rs 10,00,000 and the Sum Assured on Death will be Rs 79,87,000

Eligibility Conditions and Other Restrictions:

i. Minimum Age at Entry

3 years (completed) for policy term 15 years

8 years (completed) for policy term 10 years

ii. Maximum Age at Entry

Option 1: 60 years (nearer birthday)

Also Read- Rising Covid cases may lead to surge in hospitalisation, ICU stays: Doctors

Option 2: 40 years (nearer birthday) for policy term 10 years

35 years (nearer birthday) for policy term 15 years

iii.Minimum Age at Maturity

18 years (completed)

iv. Maximum Age at Maturity

Option 1: 75 years (nearer birthday)

Option 2: 50 years (nearer birthday)

v. Policy Term 10 & 15 years

vi. Mode of Premium payment Single premium

vii. Minimum Basic Sum Assured: Rs 1,25,000

viii. Maximum Basic Sum Assured No Limit

Basic Sum Assured shall be in multiples of: Rs 5,000

This Plan can be purchased Offline through agent /other intermediaries including Point of Sales Persons-Life Insurance (POSP-LI) / Common Public Service Centers (CPSC-SPV) as well as Online directly through website www.licindia.in.