If you have not yet linked the PAN card with Aadhaar, then you need to link them by March 31, 2023.

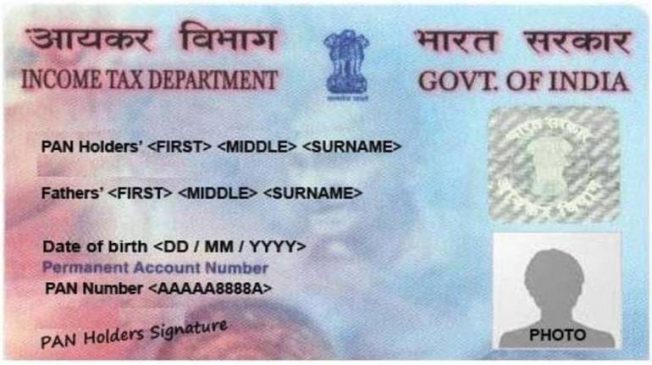

Even as the PAN-Aadhaar deadline is fast approaching, just a week is left for you to link these two key documents. Failing this will make your permanent account number, or PAN, inoperative, and thus you will not be able to get key government services using PAN. Here’s how you can link your Aadhaar card with PAN:

Via SMS

1. Type “UIDPAN < 12-digit Aadhaar number > < 10-digit PAN > “

2. Send this SMS to 56161 or 567678 using your registered mobile number.

Via Income Tax Department Portal

Step 1: Visit ‘https://www.incometax.gov.in/iec/foportal/‘, the e-filing portal of the I-T department.

Step 2: Click on the ‘Link Aadhaar’ option under the ‘Quick Links’ section of the webpage.

Step 3: This will redirect you to a new page where the PAN number, Aadhaar number and other required details like your name need to be entered.

How to Check If Your PAN is Already Linked With Aadhaar

1. View PAN-Aadhaar link status without signing in on www.incometax.gov.in/iec/foportal/

2. On the e-filing portal homepage, go to ‘Quick Links’ and click on ‘Link Aadhaar Status’.

3. Enter your PAN and Aadhaar Number, and click on ‘View Link Aadhaar Status’.

On successful validation, a message will be displayed regarding your Link Aadhaar Status.

If the Aadhaar-Pan link is in progress, then the below message will appear on the screen;

Your Aadhaar-PAN linking request has been sent to UIDAI for validation. Please check the status later by clicking on ‘Link Aadhaar Status’ link on Home Page

If the Aadhaar PAN linking is successful, then it will display the following message;

You PAN is already linked to given Aadhaar.

Read More: Govt extends Ujjwala Yojana LPG subsidy of Rs 200/gas cylinder for another year

If PAN is Not Linked to Aadhaar by March 31, These Services Will Be Stopped:

1) You will not be able to file tax return using the inoperative PAN

2) Pending tax returns will not be processed

3) Pending tax refunds cannot be issued to inoperative PANs

4) Pending proceedings as in the case of defective returns cannot be completed once the PAN is inoperative

5) Tax will be required to be deducted at a higher rate as PAN becomes inoperative.