An NRO account is helpful in saving money you regularly receive through your sources within India.

An ordinary non-resident account (NRO) is for NRIs or Non-Resident Indians to store funds that existed before becoming an NRI and the funds earned within the country. These funds could be rent, salary, dividends and so on. Interest earned on this account is taxable under the Income Tax Act.

Although there is no time limit for converting a savings bank account into an NRO account, it is essential to convert as soon as you become a non-resident.

Read More: Sovereign Gold Bond scheme 2023: Check subscription date, price, discount and interest rate

NRO account holders can jointly hold the account with their Indian relatives or residents. This account is maintained in Indian currency and cannot be repatriated or converted to foreign currency. Customers can earn a higher interest amount and returns on rupee income as compared to savings or current account offers.

An NRO account is helpful in saving money you regularly receive through your sources within India.

All your earnings obtained in the form of Indian currency can be saved in the NRO account. The NRO account is typically preferred if you don’t want to convert the amount in your account and take it to another country. The funds in the NRO accounts can be used for any payment.

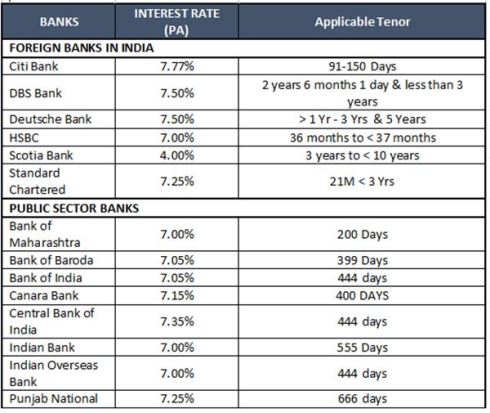

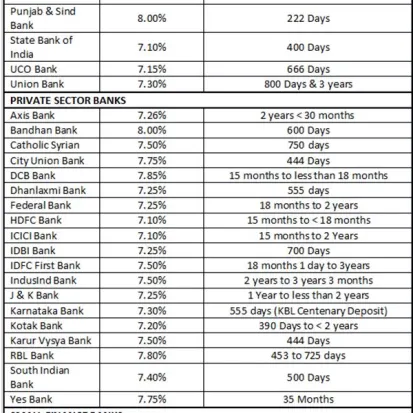

The interest rate applicable varies from bank to bank. It is important to check all the terms and conditions and facilities before parking your deposit with a bank. Also compare the interest rates and go for the institutions where you are getting a good deal.

Read More: Adani Enterprises, 9 other Adani firms add Rs 1.7 lakh crore m-cap in 4 days

INTEREST ON NRO DEPOSITS

(Best Offered Rate & Applicable Tenor)

Data as on respective banks’ website on 28 Feb 2023.

Higest Interest rate offered on NRO deposits of up to Rs 2 Cr for tenor up to 5 years for all listed (BSE) public & private banks, and foreign Banks cosidered for data compilation. Highest rate offered for up to 5 years (7 days to 5 years) period is considered in the table. Banks whose websites don’t mention the data are not considered.