SBI Foreign Travel Card variants and transaction charges in 2023: State Bank of India is offering prepaid multi-currency foreign travel cards that you can use to make your foreign trips trouble-free and convenient.

Read More:-New NPS rule from April 1: Want timely payment of pension and lump sum? Upload these documents

The State Bank Foreign Travel Card offers a convenient way of carrying cash across the world, except in India, Nepal and Bhutan. Read below for details about eligibility, supported foreign currencies, reload limit, and different variants of this card.

State Bank Foreign Travel Card (SBFTC) variants

State Bank Foreign Travel Card is available in two variants.

- On the Visa platform, this card is available as a single currency card in eight international currencies. The supported currencies are US Dollars(USD), Pound Sterling (GBP), Euro (EUR), Canadian Dollar (CAD), Australian Dollar (AUD), Japanese Yen (JPY), Saudi Riyal (SAR) and Singapore Dollar (SGD).

- On the MasterCard platform, SBFTC is available as a multi-currency card in seven foreign currencies – US Dollars(USD), Pound Sterling (GBP), Euro (EUR), Canadian Dollar (CAD), Australian Dollar (AUD), Singapore Dollar (SGD) and UAE Dirham (AED).

Read More:-Canada launches new small modular reactor funding programme

State Bank Foreign Travel Card: Eligibility

Any resident individual in India who wants to travel abroad, except Nepal and Bhutan, can apply for State Bank Foreign Travel Card, according to the SBI website.

State Bank Foreign Travel Card: How to apply

You can apply for SBI Foreign Travel Card online by visiting https://prepaid.sbi website. You can also apply for this card offline by visiting an authorised SBI branch.

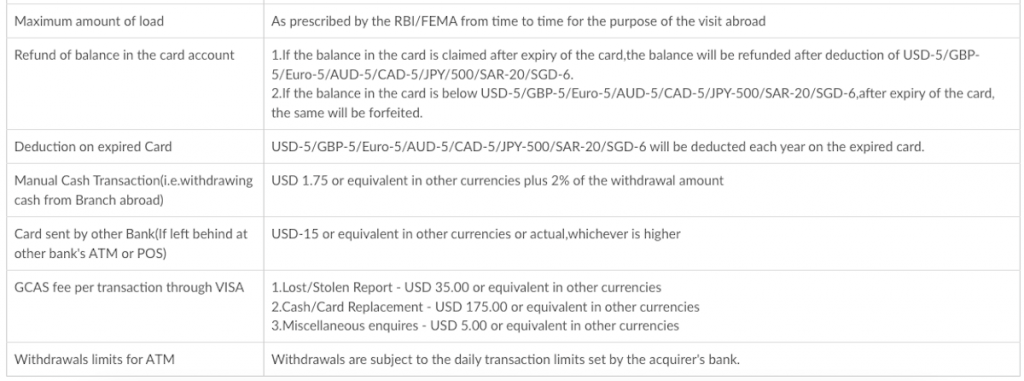

State Bank Foreign Travel Card: Fees and charges

USD | GBP | EURO | CAD | AUD | JPY | SAR | SGD | |

| FTC Issuance Fee | Rs.100+GST | Rs.100+GST | Rs.100+GST | Rs.100+GST | Rs.100+GST | Rs.100+GST | Rs.100+GST | Rs.100+GST |

| Add on Cards(Not exceeding 2) | Rs.100+GST each | Rs.100+GST each | Rs.100+GST each | Rs.100+GST each | Rs.100+GST each | Rs.100+GST each | Rs.100+GST each | Rs.100+GST each |

| Re-load on FTC | Rs.50+GST | Rs.50+GST | Rs.50+GST | Rs.50+GST | Rs.50+GST | Rs.50+GST | Rs.50+GST | Rs.50+GST |

| Replacement Card fee in case of lost/stolen card(postage US$-20 extra or Rs.50.00 for delivery within India) | USD 2.00 | Pounds 1.25 | Euros 1.60 | CAD 2.00 | AUD 2.00 | JPY 160.00 | SAR 8.00 | SGD 1.65 |

| Chargeback Fee # | USD 2.00 | Pounds 2.00 | Euros 2.00 | CAD 2.00 | AUD 2.00 | JPY 200.00 | SAR 7.00 | SGD 3.00 |

| ATM Withdrawal Fee | USD 1.75 | Pounds 1.25 | Euros 1.50 | CAD 1.75 | AUD 2.00 | JPY 175.00 | Rs.SAR 7.00 | SGD 2.00 |

| Pysical Statement of FTC @ | USD 2.00 | Pounds 1.25 | Euros 1.60 | CAD 2.00 | AUD 2.00 | JPY 160.00 | SAR 8.00 | SGD 1.65 |

| ATM Balance enquiry fee | USD 0.50 | Pounds 0.50 | Euros 0.50 | CAD 0.50 | AUD 0.50 | JPY 50.00 | SAR 2.00 | SGD 1.00 |

| Minimum amount of initial load | USD 200 | Pounds 120 | Euros 150 | CAD 200 | AUD 200 | JPY 15800 | SAR 750 | SGD 250 |

| Minimum amount of re-load | USD 200 | Pounds 120 | Euros 150 | CAD 200 | AUD 200 | JPY 15800 | SAR 750 | SGD 250 |

| Duplicate ATM PIN/WEB PIN issuance charges | USD 2.00 | Pounds 1.25 | Euros 1.60 | CAD 2.00 | AUD 2.00 | JPY 160.00 | SAR 8.00 |

Read More:-ICICI Bank FD interest rates 2023: Earn up to 7.50% return on fixed deposits

Who should apply for SBI Foreign Travel Card?

The State Bank Foreign Travel Card may be useful for anyone travelling abroad as it reduces the need to carry cash or go through the hassles of going around money changers for encashing traveller’s cheques. With the help of this card, travellers will be able to save the money lost in exchanging currencies. Travellers can use this card for making payments during shopping, dining or visiting places without worrying about carrying or losing cash.

SBI website says that this card reduces the need to pay annual fees, joining fees, credit limit etc. usually linked with international credit/debit cards.