If you are yet to link the PAN card with Aadhaar, then you need to link them before March 31, 2023.

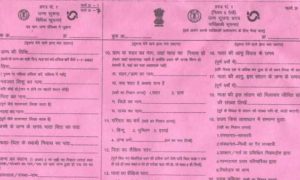

PAN is a ten-digit unique alphanumeric number issued by the Income Tax Department. PAN is issued in the form of a laminated plastic card as given below (commonly known as PAN card).

There is also an option of e-PAN, which is a digitally signed PAN card issued in electronic format. It’s an Aadhaar e-KYC based process and allotment of PAN is free of cost. A pdf file of PAN is generated and issued to the applicant.

Read More: HDFC Bank hikes fixed deposit (FD) rates. How they compare with SBI, PNB

Utility of PAN

PAN enables the department to identify/ link all transactions of the PAN holder with the department. These transactions include tax payments, TDS/TCS credits, returns of income, specified transactions, correspondence etc, and so on.

It facilitates easy retrieval of information of PAN holders and matching of various investments, borrowings and other business activities of PAN holders.

Linking of PAN with Aadhaar

The Finance Act, 2017 had inserted a new section 139AA in the Income-tax Act, 1961, requiring every person who is eligible to obtain Aadhaar to quote his/her Aadhaar number while applying for PAN or furnishing return of income with effect from July 1, 2017.

If any person does not possess the Aadhaar number but he/she has applied for the Aadhaar card then the person can quote the Enrolment ID of the Aadhaar application Form in the ITR.

If you are yet to link the PAN card with Aadhaar, then you need to link them before March 31, 2023. Otherwise, you will not be able to use the same from April 1, 2023. Once the PAN card holders miss this deadline, the 10-digit unique alphanumeric number will become inoperative.

Read More: Aadhaar card update: Ministry urges users to update UIDAI details; check how to do it online

Here’s a step-by-step guide to check if your PAN card is valid or not.

1) Log on to www[dot]incometax[dot]gov[dot]in/iec/foportal/ and click on ‘Verify your PAN’ which is on the left column under the ‘Quick Links’ section.

2) As soon as you click on the Verify your PAN’ tab, you’ll be redirected to a page where you are required to fill in your details like PAN number, name, date of birth and contact number.

3) Once you have submitted the required details, you will be redirected to another page where you will have to put the OTP sent on your registered mobile number. (Pls ensure that the your mobile number is linked to PAN).

4) Enter the OTP received and click on ‘Validate’.

5) If your PAN card details haven’t been duplicated or issued to multiple people, the last page will show ‘PAN is Active and details are as per PAN’.

6) If you have more than one PAN card registered under the same personal details, a pop-up message will appear that says, “There are multiple records for this query. Provide additional information.” In this case you’ll have to provide your father’s name and other identification details.