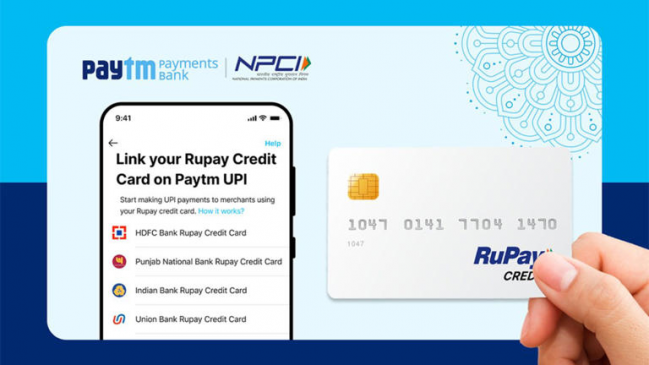

Home-grown Paytm Payments Bank Limited (PPBL), in its bid to enhance the payment experience for both the consumers and merchants, has introduced RuPay credit card on UPI.

As per PPBL, it is a leader in the UPI space in P2M (peer to merchant) transactions, with the highest merchant partners in its ecosystem. PPBL registered 1,726.94 million transactions in December 2022. Further, the company said that it is one of the leading issuers and acquirer banks for National Electronics Toll Collection (NETC) FASTag.

Read More: PhonePe Allows International UPI Transactions; First Indian Fintech To Have This Facility

“The rewards and benefits of RuPay Credit Cards will further be enhanced with the experience of digital enablement and convenience of making all types of payments through a single UPI app. This will lead to a widespread usage of RuPay credit cards with convenient and faster payments across online and offline modes. We are very excited to launch RuPay Credit Cards on UPI with our home-grown Paytm Payments Bank.”

PPBL said that with the linkage of RuPay credit cards on UPI, customers will benefit from the increased opportunity to use their credit cards, and merchants will benefit from the increase in consumption by being part of the credit ecosystem with the acceptance of credit cards using assets like QR codes.

The Reserve Bank of India approved linking of RuPay credit cards with UPI for a digitally enabled credit card lifecycle experience for users. For seamless and secure transactions, users need to link their RuPay credit card to their UPI ID. After linking the RuPay credit card to UPI ID, users can simply pay the merchants by scanning the UPI-enabled QR code via Paytm app, eliminating the need to carry cards all the time.

Read More: ‘New leave rule: Non-government staff to gain ₹20,000/year’

Both offline and online payments will become faster as transactions can be done using the UPI ID linked to the RuPay credit card seamlessly.

“We are launching payments through RuPay Credit Card on UPI in partnership with NPCI, and believe that this will enable convenience of payments, while also leading to greater penetration of the credit ecosystem in India.” said Surinder Chawla, MD and CEO, Paytm Payments Bank.