HENNAI: Walk-ins at physical bank branches for opening accounts is fast becoming a thing of the past as customers are shifting to digital platforms for the purpose. Private and public sector banks are witnessing a post Covid surge in digital accounts. However, this has not restricted lenders from expanding physically since customers prefer banks that have a branch located near their home or office.

Read More: Amazon Announces Cutting More than 18,000 Jobs Due to ‘Uncertain Economy’

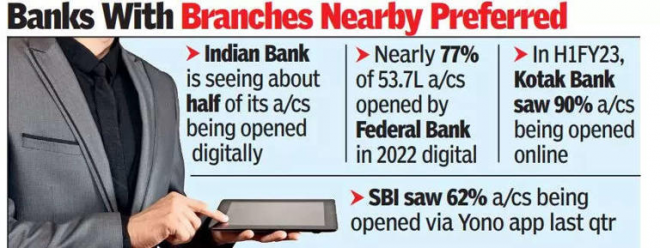

State-run Indian Bank, with a customer base of 10 crore, saw 45% of its new accounts in the current fiscal opened through ‘Tablet Banking’, a digital initiative that eliminates the need to visit a branch. Indian Bank MD & CEO S L Jain said the digital route eases the process of creating bank accounts as well as onboarding customers. “Our endeavour is to have more than 75% of new accounts created through tablets,” he told TOI. More than a crore of the bank’s customers are using its mobile app IndOASIS to access services, he added.

96751227

SBI chairman Dinesh Khara had said in a post-results analysts’ meeting last month, “During the quarter, we have sourced 62% of the savings accounts and 45% of the retail asset accounts digitally through YONO (app). ”

Private sector lender Federal Bank also recorded a substantial jump in digitally created accounts this year over 2019. While just 0. 1% of the nearly 14. 7 lakh accounts created during calendar year 2019 were done digitally, this share jumped to 77% of over 53. 7 lakh new accounts in calendar 2022. The bank’s senior VP & country head (deposits, fee income & business banking) Rathish R said fintech arrangements, introduction of online account-creation options and Covid were the reasons for the increase in the number of customers preferring the digital medium for opening accounts.

Read More: Walmart may have to pay $1 bn tax on PhonePe shift to India: Reports

Kotak Mahindra Bank offers digital accounts through app, biometric and tablet. It has acquired 85-90% of new accounts digitally during first half of FY23 — double from 45-50% in FY19. Group president &head (consumer bank) Virat Diwanji said digital adoption in rural areas has gone up. Opening digital accounts is a win-win for the customer and bank, he added, as they can be activated in a short time for customers and banks need not have to store hard copies of papers relating to the process.

Responding to a question on whether such digital transformations will have an impact on the bank’s expansion plans, he said 85-90% of new accounts are created digitally. He also said that new customers prefer the bank that has a branch situated within 1-2km of their residence or work place.