The two largest business houses in India, the Adani Group and Reliance Industries Limited (RIL), are in the fray to acquire SKS Power, a Chattisgarh-based entity. This plant, which is coal-based, owes around Rs 1,900 crore to two lenders, Bank of Baroda and State Bank of India. Media reports have said other bidders include NTPC, Torrent Power, Sarda Energy and Minerals, Jindal Power and Singapore-based Vantage Point Asset Management.

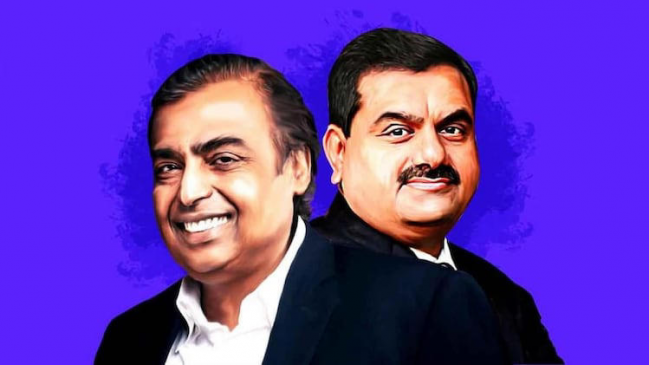

The more interesting part is the likely battle between Adani and Reliance to clinch the asset and, by the looks of it, probably for very different strategic reasons. A senior industry official points out that Adani is already in the business of thermal power (through group company, Adani Power, it has an installed capacity of 13,650 MW with a presence in Gujarat, Maharashtra, Rajasthan, Karnataka, Chattisgarh, and Madhya Pradesh) and it, therefore, gels well.

Read More: SBI General Insurance collaborates with Tonic Worldwide for #BachatKaShortcut campaign

“Besides, the mines they own in Australia gives them high calorific value coal giving them a substantial cost advantage,” he says.

In the case of Reliance, the focus, as Chairman Mukesh Ambani has already outlined, is on new energy. The plan is to have a giga complex in Jamnagar with four giga factories for power electronics and solar PV (photovoltaic) manufacturing, which will include cells and modules. The question is where does thermal power fit into all this?

Deven Choksey, MD, K R Choksey Securities, thinks Reliance wants a big play in the overall India infrastructure story. “With the government opening up the sector, the opportunity is huge and they would not want to miss it,” he says. Besides, the green hydrogen part will involve a lot of manufacturing where thermal energy is needed. “That means access to coal-based power plants is necessary. Thermal for Reliance will be the pathway to renewables energy and is likely that they will bid for any high-quality asset that comes up.”

Read More: HDFC assigns Rs 8,892 crore in loans to HDFC Bank

The power industry official quoted earlier says a “dual feed” is the norm in gas-based power plants. That means both gas and liquid fuel can fire at the same time. “It is not very clear if that is possible in a coal-based plant. Assuming it is, then it could lead to conversion at minimum cost and lay the foundation for hydrogen power,” he explains. If that is possible, it could be a serious disruption in hydrogen, which is still an expensive proposition.