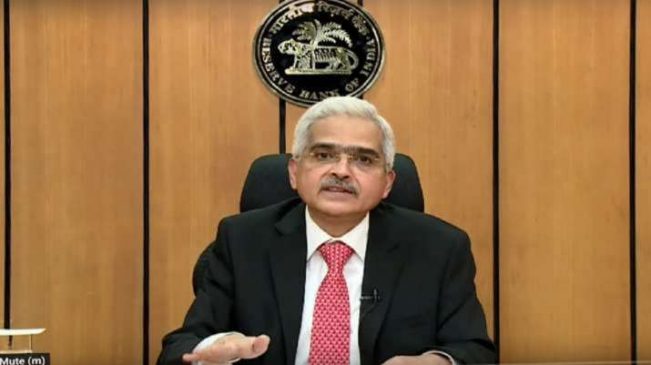

The six-member Monetary Policy Committee headed by Reserve Bank of India Governor Shaktikanta Das started deliberations on the bi-monthly policy review on Tuesday.

New Delhi: In a move that will raise borrowing costs for corporates and individuals even further, the RBI Monetary Policy Committee led by Governor Shaktikanta Das hiked Repo Rate by 35 basis points to 6.25 percent on Thursday.

Read More: IRCTC Latest Update: Indian Railways Cancels Over 300 Trains Today, Check Full List Here

Repo is the rate at which Reserve Bank of India lends funds to commercial banks when needed. It is a tool that the central bank uses to control inflation. This is the third hike since the beginning of the current financial year, taking the rate is back to pre-pandemic levels in order to tame the inflationary pressure.

The six-member Monetary Policy Committee headed by Reserve Bank of India Governor Shaktikanta Das started deliberations on the bi-monthly policy review on Tuesday.

The central bank had already hiked the key policy rate by 190 basis points since May to 5.9 per cent to cool off domestic retail inflation that has stayed above the RBI`s upper tolerance limit for over three quarters now. In October, retail inflation was 6.77 per cent as against 7.41 per cent the previous month.

Read More: PMJJBY: Get insurance coverage worth Rs. 2 lakh by investing Rs 436 yearly, here’s how

Under the flexible inflation targeting framework introduced in 2016, the RBI is deemed to have failed in managing price rises if the CPI-based inflation is outside the 2-6 per cent range for three quarters in a row.An out-of-turn meeting of the Monetary Policy Committee (MPC) of the Reserve Bank of India was held in early November to discuss and draft the report to be sent to the central government for having failed in maintaining the inflation mandate.

The meeting was called under Section 45ZN of the Reserve Bank of India (RBI) Act 1934, which pertains to steps to be taken if the central bank fails to meet its inflation-targeting mandate.