A no-cost EMI allows you to buy the desired good and make the payment in monthly instalments of either 3, 6 or 9 months.

You must have come across a no-cost EMI option while buying goods at e-commerce platforms like Amazon and Flipkart. These deals are mostly offered on electronic goods, smartphones and costly items. A no-cost EMI allows you to buy the desired good and make the payment in monthly instalments of either 3, 6 or 9 months. This is different from normal EMIs as you are not required to pay any additional interest on the EMI. However, since the Reserve Bank of India doesn’t permit zero-interest rate loans, then how does this no-cost EMI work?

Read More: Sent money through PayTM, Google Pay, or PhonePe UPI to the wrong person? Here are your options

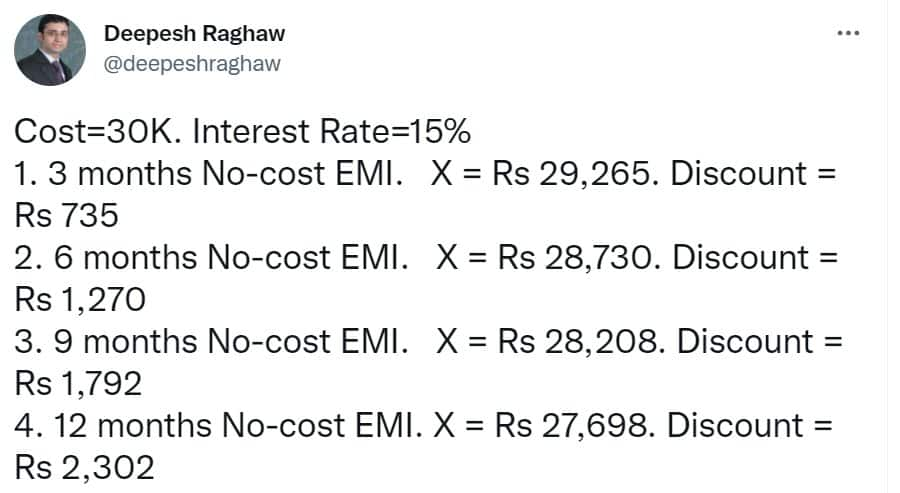

The answer lies in an upfront discount by the seller, said SEBI Registered Investment Adviser (RIA) Deepesh Raghaw on his Twitter handle. Raghaw said that when a customer opts for a no-cost EMI and makes the payment from a credit card – two things happen to enable that transaction. First, the merchant gives an invisible discount as per the tenure of the loan and the credit card facilitates a loan for the discounted amount at certain interest rates that adds up exactly to the total price of the good, said Raghaw.

Say, if an item was priced at Rs 30,000 and the customer opts for 6-month EMIs, he will be required to pay Rs 5000 per month. The customer gets the product and pays it back in six instalments. For him, there is no fluctuation in price. But what happens in the background is not known to him.

Let’s say that the credit card/bank lends the loan at 15% per annum, they first find the amount (discounted price) that when charged at 15% annually, translates into Rs 30,000 (including principal and interest rate) at the end of six months (Rs 5000 per month). In this case, the amount is Rs 28,730. So, the loan amount would be Rs 28,730 but since the item was priced at Rs 30,000, the merchant will bear a discount of Rs 1270 (Rs 30,000-Rs 28,730). This is between the seller and the bank. So, the actual price at which the good was sold is Rs 28,730 and the interest earned by the bank is Rs 1,270. The customer pays Rs 30,000 and the seller and the merchant gets their respective share out of that.

Read More: What is Top-up SIP? Should you opt for it while investing in mutual funds?

Now, coming to the tenure, why only 3, 6 or 9 months? Deepesh Raghaw says, the longer will be the tenure, the higher will be the interest on the amount and thus the seller will have to bear more discount. So, the seller first sets aside the maximum discount he/she can bear on a particular product and then banks decide their interest rate to bring the final calculation in sync with the price at which a buyer gets the product.

“The discount to provide you with the experience of No-cost EMI increases as you increase the loan tenure. The merchant can bear only so much discount. This automatically limits the loan tenure. Now you know why the tenures of No-cost EMIs are usually 3 to 9 months. Usually 3 and 6 months,” said Raghaw.

He said that while the scheme is called a no-cost EMI, it’s not actually a zero-charge offer. “There is GST on interest charged every month. In this example, you paid Rs 30,229 to close the loan. GST of Rs 229. Increases cost from 0% to 2.6% p.a. Hence, you pay slightly more than the purchase amount. Hence, not really a No-cost EMI,” he said.