It is noteworthy that mutual funds are seen as an option for seniors who require flexibility in investing. Additionally, MFs can help seniors beat inflation with ease.

Also Read – How NPS acts as a tax optimiser for salaried employees: Save up to Rs 15,600 if in 30% tax bracket

The key to success is to make your money work for you, regardless of your age. As age is a major constraint for senior citizens, it is imperative that they invest wisely in India. There are a variety of investment options available to senior citizens. However, what works for one investor might not work for another.

Investments in mutual funds and subscriptions to NFOs are gaining equal traction. A common misconception about mutual funds is that they are too risky for seniors. It is important to note that there are also mutual funds designed to meet the needs and risk tolerance of senior citizens.

Although traditional financial instruments like fixed deposits and recurring deposits still exist, their returns are at an all-time low at the moment. As a result, traditional investment avenues do not provide you with inflation-beating returns in India at the moment.

The purpose of mutual funds (MFs) is to diversify investors’ investments and to place their money in securities such as stocks, bonds, ETFs, and bonds, among others. Their performance is influenced by the market. Mutual funds offer investors the advantage of having their hard-earned money managed by professionals. Investing in mutual funds can be done through systematic investment plans (SIPs) or lump sum payments. It is noteworthy that MFs are seen as an option for seniors who require flexibility in investing. Additionally, MFs can help seniors beat inflation with ease.’

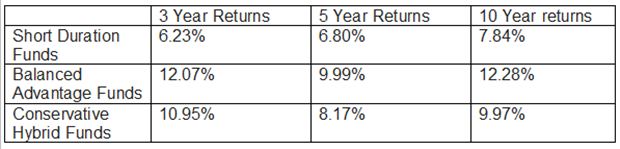

Senior citizens generally don’t invest in risky investments. The reason is that they are already retired and cannot afford the losses and vulnerabilities associated with market-related instruments. They are looking for investment schemes that promise a guaranteed return. The Post Office savings option, banks fixed deposits, or even national pension schemes (NPS) are preferred in these situations. The truth is, however, that MFs are actually beneficial to elderlies and can be a vital investment option for them. It is true that markets experience short-term shocks, but mechanisms here have produced better long-term returns than so-called traditional investment strategies.

Unlike NPS or any other annuity product, mutual funds generally do not have any restrictions on withdrawals, allowing senior citizens to create their own withdrawal plans.

Additionally, mutual funds allow senior citizens to create a diversified portfolio tailored to their needs across asset classes.

For the first five years, senior citizens should invest in debt mutual funds. You can invest the money you need for regular expenses in the next five years in balanced mutual funds. A large cap equity fund can be used for funds that will be needed post-ten years. After retirement, it is recommended that the investor consult a financial advisor who will be able to provide recommendations based on his or her risk appetite and other goals.

Current fixed deposit rates offered by banks to senior citizens range from over 3% to a little over 7%. The government has recently increased the interest rate on the Post Office Senior Citizen Savings scheme to 7.6% with effect from October 1st. Meanwhile, the National Pension Scheme (NPS) allows investors to earn 9% to 12%.

Each type of Mutual Fund has exposure to a different type of asset and provides a different level of return. The returns of mutual funds are market-linked, so they are never fixed. However, it is in this exposure to risk that there is an opportunity for wealth creation and growth. If you’re retired and looking for a short-term investment, you can invest in short-term bonds lending to companies with good credit ratings that lend for a period of one to three years by investing in short-term debt funds. Compared to a bank FD, these Debt Funds can provide better returns.

According to the current mutual fund taxation rules, you are liable to pay capital gains tax on your investments when you redeem them. For Debt Funds and Debt-oriented Hybrid Funds’ investments held for less than 3 years are subject to short-term capital gains tax (STCG) and you need to pay taxes according to your income tax bracket. Redeemed investments are treated as long-term capital gains (LTCG) if the gains are realized after holding them for at least three years. After indexation, LTCG is taxed at 20%.

Also Read – Higher than Senior Citizen Savings Scheme (SCSS) interest rate offered on these bank FDs: Get up to 8.75%

According to studies, human life may extend beyond 100 years within a few generations. According to research, Indians live an average of 70.8 years. Therefore, it’s important to plan well in advance, assess all your life goals, and anticipate the costs associated with the years of hard work that must be followed by years of rest and rejuvenation. Investing in the best senior citizens’ schemes guarantees exactly that. In this way, you can retire cheerfully from work without having to give up living a full life.