LIC policy: The minimum entry age for this policy is 8 years and the maximum entry age is 75 years.

LIC New Endowment Policy: Life Insurance Corporation of India (LIC) has several plans for different sets of customers and investment opportunity starts from as low as Rs 500 per month. LIC often updates and revises its Endowment Policy and now the policy helps you get a better return even if you save and invest an amount as low as Rs 74 per day. LIC’s New Endowment Plan is a Non-linked, Participating, Individual, Life Assurance plan which offers an attractive combination of protection and saving features. This combination provides financial support for the family of the deceased policyholder at any time before maturity and a good lump sum amount at the time of maturity for the surviving policyholders. This plan also takes care of liquidity needs through its loan facility.

Read More: NPS tax treatment: Is Section 80CCD benefit same for State and Central Govt Employees?

The minimum entry age for this policy is 8 years and the maximum entry age is 75 years. The minimum policy term is 12 years and the maximum policy term is 35 years. If someone takes this policy at the age of 20 years for a sum assured of Rs 1 lakh, then the minimum annual premium for a policy of 15 years will be Rs 6,978, Rs 3,930 for a policy term of 25 years and Rs 2754 for a policy term of 35 years.

For example, if an 18-year-old takes the endowment policy for a sum assured of Rs 10 lakh for a policy tenure of 35 years, the annual premium will be Rs 26,500. This breaks down to Rs 2209 per month or Rs 74 per day. Investing Rs 2209 per month will get you a maturity amount of Rs 48 lakh after 35 years. This comprises of sum assured of Rs 10 lakh, the bonus of Rs 15 lakh, and FAB is around Rs 23 lakh. The total premium amount paid will be Rs 9,27,500.

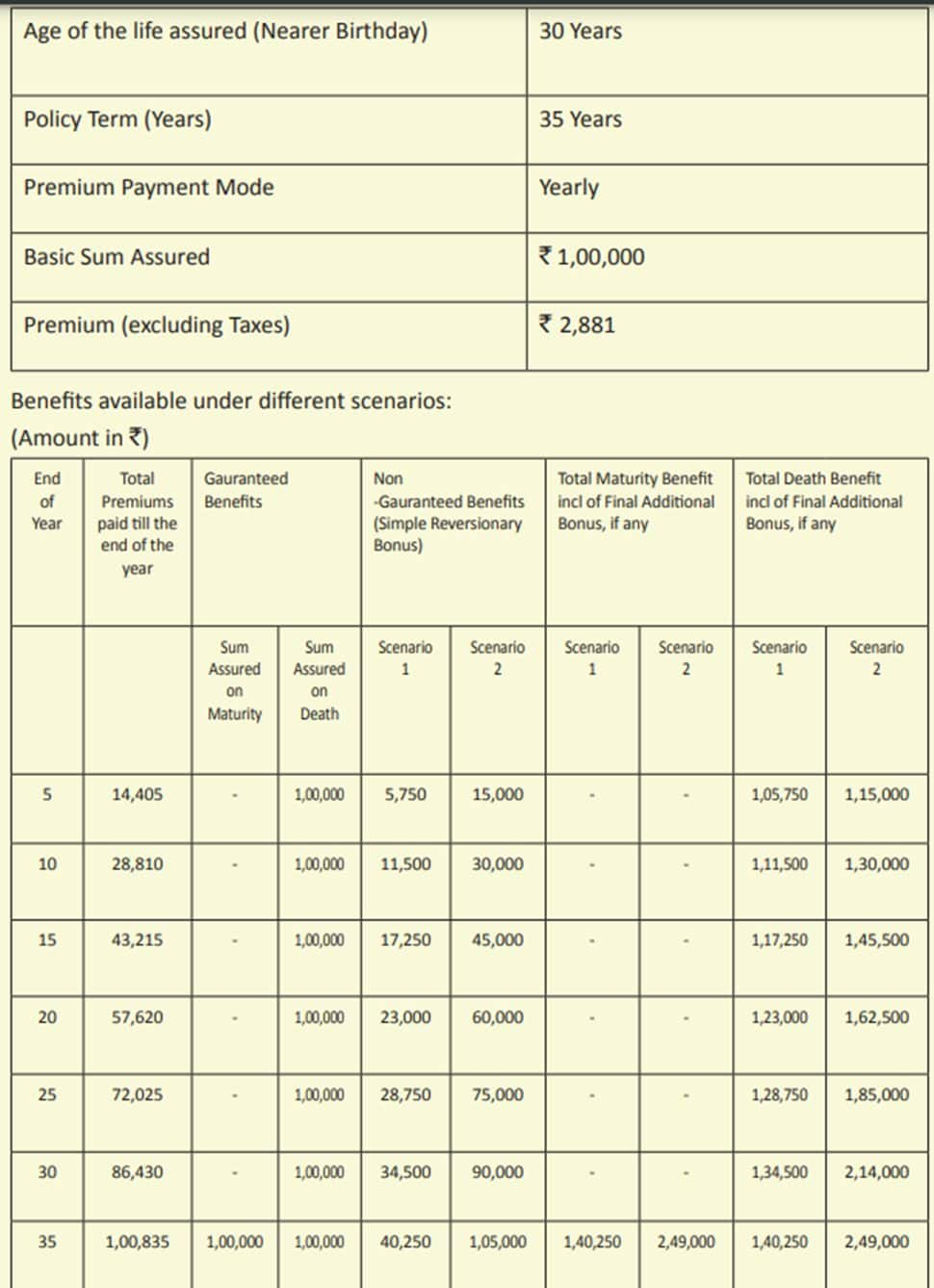

If a person aged 30 years takes the policy for a term of 35 years and the sum assured is Rs 1,00,000, then the premium will be Rs 2,881 per year. So at the end of the 35th year, the total premium paid will be Rs 1,00,835, and the total maturity amount will be Rs 2,49,000.

Read More: This post office scheme doubles your investment in just 10 years; details here

Since the monthly investment amount is not too much, if your kid is around 8 or 9 years old, you can take this policy in his name. If your child is below 8 years, you can buy the policy in your name. This policy term is good for those people who want to invest a small amount every month or per year for a longer period.

(This article is for information purposes. The calculator is also mostly based on an assumptive figure to give an example of a certain type. The article does not intend to give any financial advice of any sort. Investors/subscribers must check with their portfolio managers before investing in any scheme/policies.)