LIC Dhan Reha: On the life assured surviving to each of the specified duration during the policy term, provided policy is in force, a fixed percentage of the Basic Sum Assured shall be payable.

LIC Dhan Rekha: Life Insurance Corporation of India (LIC) has several plans in its kitty and one of them is LIC Dhan Rekha Plan 863. It’s a non-linked, non-participating, individual, savings and life insurance plan which comes with either a one-time investment option or a yearly premium payment choice. LIC says that the Dhan Rekha plan offers a maximum guaranteed addition of Rs 60 per thousand basic sum-assured. This plan provides financial support for the family in case of the unfortunate death of the policyholder during the policy term. “Periodic payments will also be made on survival of the policyholder at specified durations during the policy term and guaranteed lump sum payments to the surviving policyholder at the time of maturity,” reads the policy brochure.

On the life assured surviving to each of the specified duration during the policy term, provided policy is in force, a fixed percentage of the Basic Sum Assured shall be payable. If the policy term is 20 years, the investor will get 10% of the Basic Sum Assured at the end of each of the 10th and 15th policy years. If the policy term is 30 years, the investor will get 15% of the Basic Sum Assured at the end of each of the 15th, 20th and 25th policy years. In the case of a 40-year policy, 20% of the Basic Sum is Assured at the end of each of the 20th, 25th, 30th and 35th policy years.

Other rider benefits like LIC’s Accidental Death and Disability Benefit Rider and LIC’s New Term Assurance Rider shall be available under this plan and the policyholder can opt for these riders at the inception only if the mode of subscription is single premium payment.

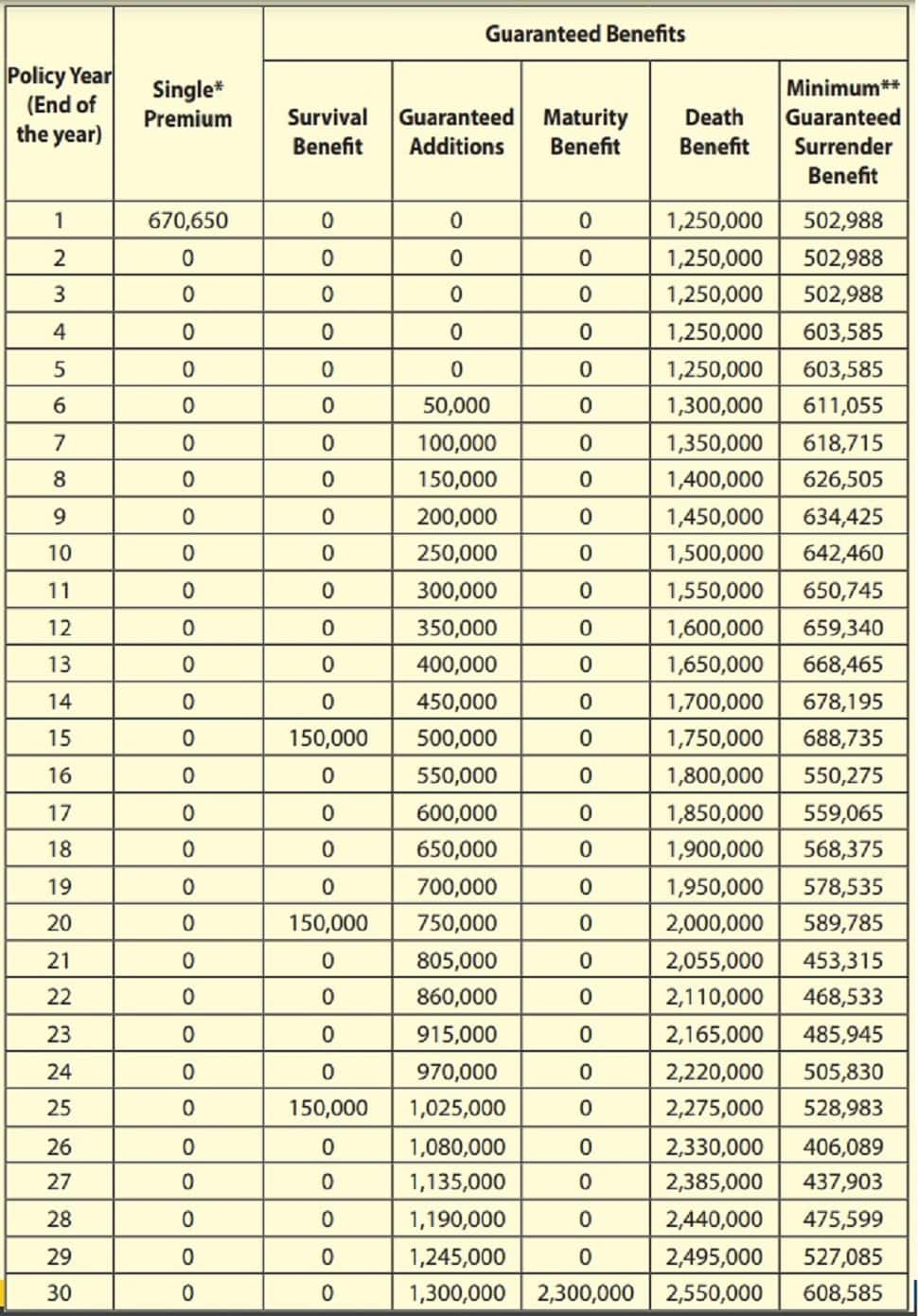

LIC Dhan Rekha Investment and Maturity Calculator

Suppose you are investing in this plan at the age of 30 years and the policy premium term is also 30 years, you will have to pay a single premium of Rs 6,70,650 for a basic sum assured of Rs 10,00,000 and a death sum assured of Rs 12,50,000. However, the maturity benefit for the survivor at the end of the 30th year will be Rs 23 lakhs. If the policyholder dies in the 30th year, the nominee will get Rs 25,50,000.

Read More: Personal loans starting at 8.9% – Check offers from 24 banks in festive season

However, in the case of a yearly premium for a person of the same age and same policy term, the premium payment term will be for 15 years and the annual premium will be Rs 73,342. The return remains the same – Rs 23 lakh for survivors and Rs 25,50,000 for nominees at the end of the 30th year.