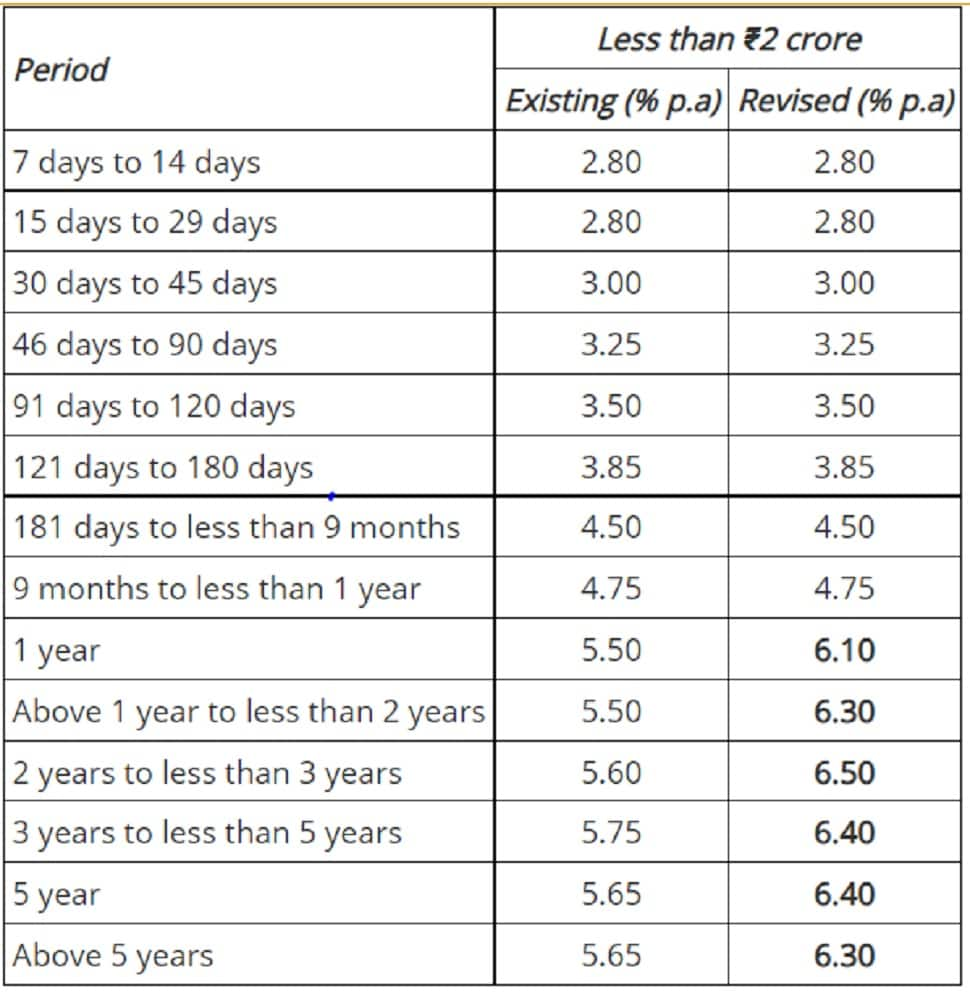

Indian Bank Fixed Deposit Rate 2022: For deposits less than Rs 2 crore, the Indian Bank has hiked interest rates for FD maturing in one year to 6.1 per cent from earlier 5.5 per cent.

Indian Bank Fixed Deposit Rate 2022: Leading public sector lender Indian Bank has revised its fixed deposit rates by up to 90 bps for deposits below Rs 2 crore and by up to 85bps for deposits between Rs 2 crore to Rs 5 crore. The new fixed deposit rates came into effect from October 29. For the deposits below Rs 2 crore, the changes have been made in interest rates for deposits maturing between one year to five years while for the FDs above Rs 2 crore, the changes have been made for deposits maturing between 9 months to three years.

Read More: Sugar Export Ban: Govt Extends Restriction By 1 Year Till October 2023; Check Details

For deposits less than Rs 2 crore, the Indian Bank has hiked interest rates for FD maturing in one year to 6.1 per cent from earlier 5.5 per cent. Deposits maturing between one year to two years will now earn an interest of 6.3 per cent, up from 5.5 per cent. Fixed deposits for a tenure of 2-3 years will get an interest of 6.5 per cent instead of the earlier 5.6 per cent. The fixed deposits in the three-year to less than five-year bracket will earn an interest of 6.4 per cent, up from 5.75 per cent. Fixed deposits for five years will now earn a return of 6.4 per cent and those above five years will get 6.3 per cent, up from earlier 5.65 per cent.

Read More: Gold Price Today, 29 October 2022: Yellow metal rate falls in THESE cities; check before buying

For deposits between Rs 2 crore to Rs 5 crore, the interest rate has been hiked to 6.25 per cent from earlier 5.4 per cent for 9 months to less than one year tenure. The bulk deposits for one-year maturity will now earn an interest of 6.6 per cent, up from 6.1 per cent. The FDs maturing in 2 years to less than 3 years will get a return at the rate of 6.65 per cent. The bank has reduced non-callable bulk deposit rates to 6.1 per cent from 6.5 per cent earlier for the deposits maturing in 2 years to less than 3 years tenor.

For domestic term deposits for senior citizens, the additional rate of interest payable would be 0.50% p.a. for an amount up to Rs 10 crore. The additional rate would be offered on deposits of 15 days to 10 years. Thus, senior citizens can now earn interest up to 7 per cent from the Indian Banks.