The chart pattern suggests that if Nifty crosses and sustains above 17800 level it would witness buying which would lead the index towards 18000-18300 levels.

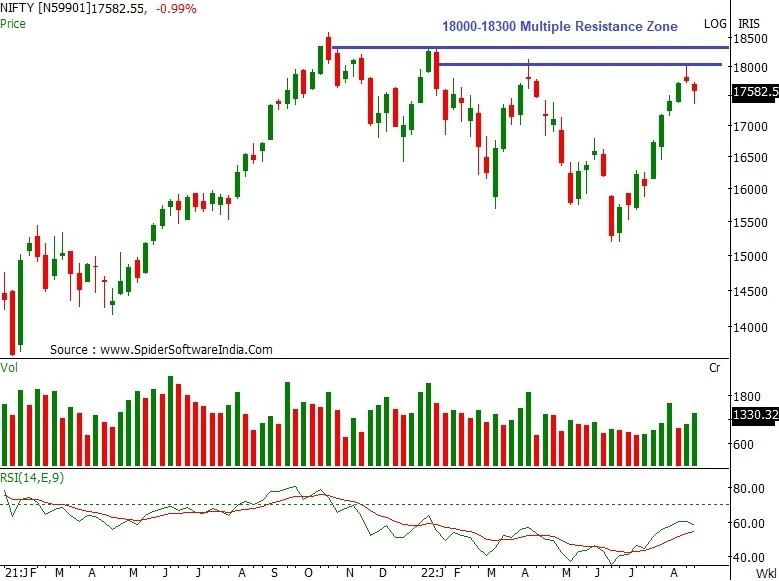

Nifty closed at 17559 with a loss of 200 points on a weekly basis. On the weekly chart the index has formed a Bearish candle with a long lower shadow indicating buying at lower levels. The chart pattern suggests that if Nifty crosses and sustains above 17800 level it would witness buying which would lead the index towards 18000-18300 levels. However if the index breaks below 17400 level it would witness selling which would take the index towards 17200-17000. For the week, we expect Nifty to trade in the range of 18300-17400 with mixed bias. The weekly strength indicator RSI is moving upwards and is quoting above its reference line indicating positive bias.

Bank Nifty Outlook

Bank Nifty started the week on a flat note and traded with extreme volatility on either side for most part of the week, however buying momentum at lower levels pulled the index higher to close on a flat note. On the weekly chart the index has formed a “Doji” candlestick formation indicating indecisiveness amongst market participants regarding the direction. The chart pattern suggests that if Bank Nifty crosses and sustains above 39500 level it would witness buying which would lead the index towards 39800-40400 levels. However if the index breaks below 38700 level it would witness selling which would take the index towards 38000-37500. For the week, we expect Bank Nifty to trade in the range of 39500-37500 with mixed bias. The weekly strength indicator RSI is moving upwards and is quoting above its reference line indicating positive bias.

Also Read : PM Kisan eKYC deadline ends in 3 days– Here is how to do Aadhaar OTP-based authentication

Sectors and stocks for this week

We expect the Capital Goods, Chemical, Power, Automobile and Cement sectors are likely to show buying interest. One can focus on stocks like Siemens, L&T, DCB Bank, Ambuja Cements, GNFC, Concor, ABFRL, Coal India, Crompton Greaves while LTI, Mindtree, AU Bank may witness some supply pressure.

Also Read : Global market trends, macro data to guide domestic stocks in holiday-shortened week

Nifty trading strategy for 1st September F&O expiry

Global markets may witness a sharp sell-off as J. Powell said Fed needs to keep interest rates high to tame the high inflation and hence the strategy which we are suggesting for the weekly expiry scheduled 1st September is a Bearish strategy namely PUT LADDER, which involves Buying of one lot of Nifty 17,500 PUT @ 102 & selling of one lot each of 17,300 PUT @ 48 & one lot of 17,100 PUT @ 20. The maximum profit of Rs 8,300 will be attained at 17,300 levels, while strategy will start making loss below 16,850. The cost of the strategy involves outflow of Rs 1,700 which is the maximum loss if Nifty closes & remains above 17,466 levels on expiry, however any sharper movement on lower side could result in losses and hence it’s advisable to exit the strategy in total below 16,900. Break Even points of the strategy are 17,466 on Upside & 16,866 on the lower side.