The public lender SBi has introduced a new rule for cash withdrawal from ATMs. The bank said that the new rule will enhance the security system and enrich secure transactions from ATMs.

New rule

SBI changes the rule for cash withdrawals from the ATM. Customers have to enter the OTP for cash transactions now. The public lender said that the new rule will enhance the security system and enrich secure transactions with ATMs.

Cash withdrawal

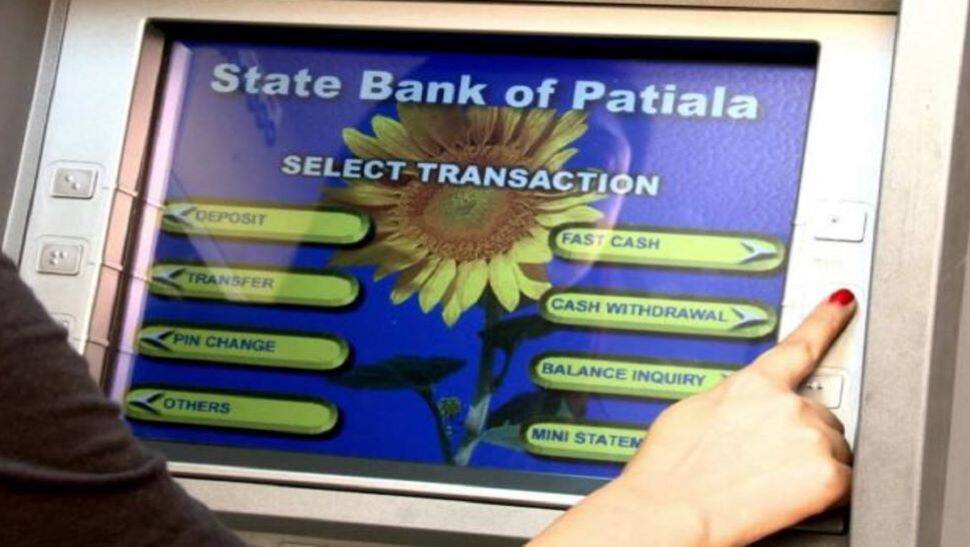

Customers of State Bank of India (SBI) are required to enter a one-time password (OTP) for cash withdrawal in order to complete their transactions when using an ATM. OTPs are accessible around-the-clock. All of the bank’s ATMs offer the feature for withdrawals above Rs 10,000.

Also Read-:EPFO: Know benefits given to widow/widower or children under the EPS’95 scheme – details

Avoid fraud

By implementing their OTP-based Cash Withdrawal Facility, State Bank ATMs have raised the bar for cash withdrawal security. The OTP will be sent to the customer’s bank-registered mobile number.

Proccess of OTP

One-time passwords (OTPs), which are created by the system, are used to confirm a user’s identity for a single transaction. Our OTP-based cash withdrawal mechanism for transactions at SBI ATMs is immunisation against scammers, according to the SBI’s Twitter account. Our first aim will always be to protect you from fraud.

Also Read-: Covid distress? Sharp surge in surrender of insurance policies

OTP on registered mobile number

To the mobile number you have on file, an OTP will be issued. For a single transaction, the user is authenticated using a four-digit number called the OTP.

For the purpose of making a cash withdrawal, the SBI cardholder must enter the OTP that was sent to the mobile phone that is registered with the bank on this screen.

Secure transactions

This will guard against unauthorised ATM cash withdrawals for SBI cardholders.