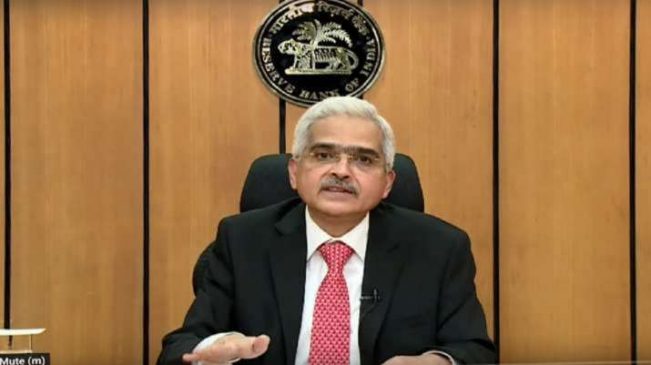

Reserve Bank of India (RBI) Governor Shaktikanta Das on Tuesday said the inflation in India has already peaked and it is expected to moderate going forward and inflation expectations are also getting “well anchored”. He, however, said the inflation is still above the RBI’s comfort zone and needs to bring down first to below 6 per cent and then at around 4 per cent in the medium term.

Read More:-Govt Issue Consolidated Overseas Investment Rules to Promote Ease of Doing Business

“So far as inflation is concerned, it is getting increasingly anchored. We (recently) reached the peak at 7.8 per cent and thereafter, the inflation has moderated in the subsequent three prints and the latest was 6.7 per cent (in July). If you see what analysts are saying and how market participants are looking at the economy, we do a survey of professional forecasters, we do a survey of investors, we also do a consumer survey and a household survey; all these are indicating to the fact the expectations around the inflation are getting anchored,” the RBI governor said in an interview with ET Now.

He, however, said there is absolutely no room for complacency as the consumer inflation is still around 6.7 per cent. “We need to bring it down to, first, below 6 per cent and then move closer to the target rate of 4 per cent.”

Read More:-ICRA Predicts Double-Digit GDP Growth For India In Q1 FY2023

Das also said there are uncertainties like geopolitical developments, spillovers, how the dollar appreciation is taking place, and inflation scenario in advanced economies.

Speaking in the cricket terminology on the RBI’s approach towards addressing the inflation issue, Das said that whether the central bank tackles inflation on frontfoot or backfoot depends upon the situation. “Our approach is to choose the short depending on each ball. In cricket, sometimes you have to play frontfoot, sometimes you have to play backfoot. But, by and large, in the last two-and-a-half or three years ever since the pandemic began, we have been playing in the frontfoot. Even at the current moment, we play in the frontfoot but when it is necessary we will step back and leave out one or two balls and maybe go for a slight late cut.”

Read More:-‘Trust my local cybercafe more’: Twitter users makes fun of Blinkit’s printout service

Easing for the third month in a row, the retail inflation in July, based on the Consumer Price Index (CPI), declined to 6.71 per cent, compared with 7.01 per cent in the previous month. The food inflation in July 2022 also moderated to 6.75 per cent as against 7.75 per cent in June.

However, July is the seventh consecutive month when the retail inflation remained above the RBI’s tolerance range of 2-6 per cent. The retail inflation in June had stood at 7.01 per cent, which was slightly lower than 7.04 per cent in May. Inflation in rural areas in June was at 7.09 per cent during June 2022, while that in urban areas was 6.92 per cent.