All major banks, both in the public and private sector, allow a limited number of free transactions at the ATMs every month. Beyond the free transactions, which include financial and non-financial services, the lenders levy a charge with applicable taxes.

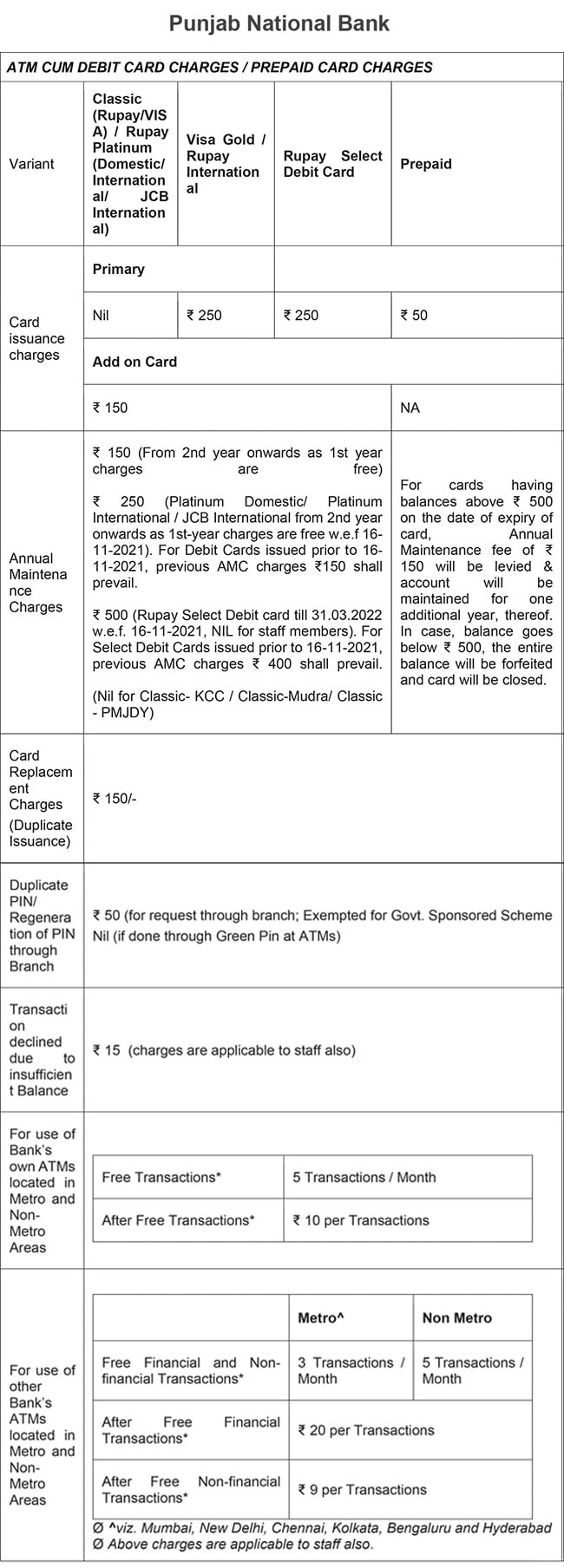

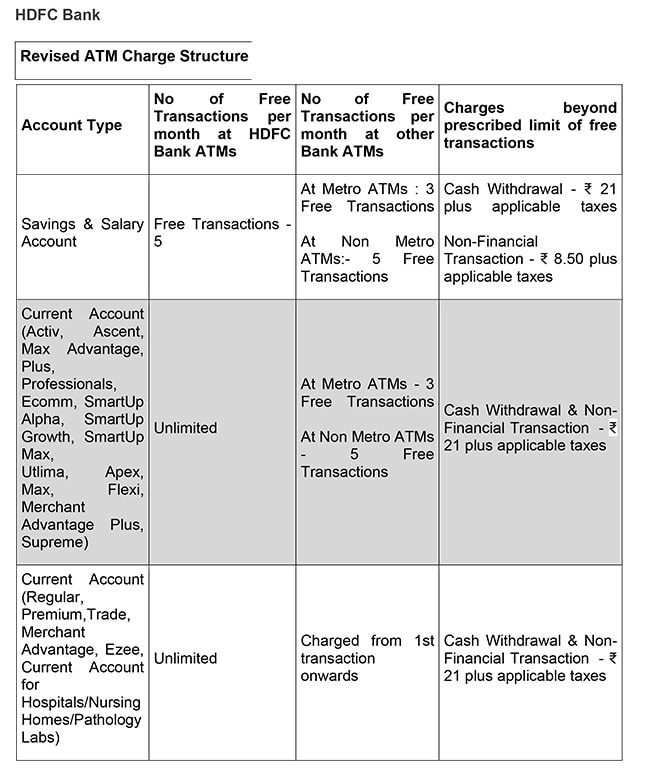

The number of free transactions at the ATMs may differ on the type of account and the debit card you hold.

Read More:-Mutual funds bought Zomato in July when everyone else was dumping it

Using the ATMs beyond the permissible limit of free monthly transactions will be chargeable.

According to a notification issued by the Reserve Bank of India in June last year, the banks were allowed to charge ₹ 21 per transaction at the ATM above the monthly free transaction limit, effective from 1 January 2022.

Earlier, the banks were allowed to charge ₹ 20 for each such transaction.

Read More:-Adani Green Energy Gets Provisional Approvals For 2 Projects In Sri Lanka

Customers are allowed five free transactions at their bank ATMs every month, and the limit is three free transactions for other bank ATMs. Customers in non-metro centres can avail of five free transactions at other bank ATMs.

The RBI allowed banks to levy an interchange fee of ₹ 17 per financial transaction and ₹ 6 for each non-financial transaction at all centres starting 1 August 2022.

The banks collect ATM service charges to meet the increasing ATM installation and maintenance costs.

All the major banks also charge an annual fee on debit cards or ATM cards, depending on the kind of card a customer possesses.

Read More:-After Apple, These Companies END Work From Home, Ask Employees to be in Office. Deets Here

Here’s a comparison of various types of ATM charges levied by SBI, PNB, HDFC Bank, ICICI Bank and Axis Bank: