The coming week is going to be critical as the Union Budget will be presented on February 1, which will have an impact on market sentiment and economy.

Bears dominated Dalal Street for the second consecutive week ended January 28, getting support from rising expectations of faster Fed tightening, inflation concerns as oil prices spike, relentless FII (foreign institutional investor) selling, and geopolitical tensions between Ukraine and Russia. Margin pressure reflected in corporate earnings and caution ahead of the Union Budget also prompted selling.

The BSE Sensex plunged 1,836.95 points or 3.11 percent to close the week at 57,200.23, and the Nifty50 declined 515.20 points or 2.92 percent to 17,101.95, taking two-week losses to more than six percent. The broader markets were also caught in a bear trap with the BSE Midcap and Smallcap indices falling in line with benchmarks.

IT stocks were hit the most, with Nifty IT index falling more than six percent, followed by metal, FMCG, pharma, realty, infrastructure and financial services. However, Nifty Bank outpaced others by gaining third of a percent amid a good set of earnings performances.

The coming week is going to be critical as the Union Budget will be presented on February 1, which will have an impact on market sentiment and economy. Apart from that, the focus will remain on earnings and economic data, so there could be volatility as well as stock-specific action, experts feel.

“We believe the Union Budget would set the tone for domestic markets amid the global sell-off. Volatility remains high during the budget week so participants should continue with a cautious stance and prefer hedged positions,” says Ajit Mishra, VP, research, Religare Broking.

Here are 10 key factors that will keep traders busy next week:

All focus next week will be on the much-awaited Union Budget that will be presented by finance minister Nirmala Sitharaman on February 1. The government is expected to continue its focus on growth with an investment-oriented approach as the economy is in recovery mode, but with a plan for fiscal prudence, experts feel. The Centre is likely to make announcements related to several segments including agriculture, rural development, infrastructure, healthcare, education, consumption, and segments that were affected by the COVID crisis; however, this time capital infusion for PSU banks is unlikely, according to experts.

Click Here To Read All Budget Related News

Also, they say there could be some populist measures focusing especially on state elections, but the major focus is expected to be on ‘Make in India’ to lift private capex and bring more foreign money. Further there could be a more concrete plan for divestment with a commentary on the much-awaited LIC IPO.

“Budget 2022 beckons for a dexterous balancing act and that should do all that it takes for a sustained eight percent growth path in the post-pandemic era while ensuring fiscal prudence,” says Niraj Kumar, chief investment officer at Future Generali Life Insurance India.

He further says with the monetary policy tightening, the onus is on the fiscal policy, that is, the government. However, “fiscal prudence would be the chosen path over fiscal profligacy, given that Budget 2022 will be presented against the backdrop of tighter global monetary policy, rising inflation and higher yields”.

Earnings and Auto stocks

It will also be an important week for earnings as we are in the second half of December quarter earnings season. Companies having more than 21 percent weightage in Nifty50 will release earnings next week.

More than 500 companies will release their quarterly numbers next week including State Bank of India, BPCL, HPCL, IOC, Tata Motors, Sun Pharma, UPL, Adani Ports, Tech Mahindra, HDFC, GAIL India, ITC, Titan Company, Divis Labs, Tata Consumer Products, Shree Cement, and Tata Steel.

Cilck Here To Read All Earnings Related News

Among others, these will also announce results next week: One 97 Communications, DLF, Bank of Baroda, InterGlobe Aviation, Cadila Healthcare, Emami, Jubilant FoodWorks, M&M Financial Services, Dabur, Exide Industries, KEC International, Jindal Steel & Power, Jubilant Ingrevia, Kansai Nerolac Paints, and Sona BLW Precision Forgings.

Others include TTK Prestige, Adani Green Energy, Apollo Tyres, Adani Total Gas, Balrampur Chini Mills, Blue Star, Shankara Building Products, Zee Entertainment Enterprises, Adani Power, Adani Transmission, and Barbeque-Nation Hospitality.

Still others include Godrej Properties, Lupin, Lux Industries, SIS, Torrent Power, Westlife Development, Bank of India, Devyani International, Minda Corporation, Siemens, Thermax, Affle (India), and Ujjivan Small Finance Bank.

Auto stocks including Tata Motors, Maruti Suzuki, Bajaj Auto, TVS Motor, Eicher Motors, M&M, Escorts, and Ashok Leyland will also be closely watched in the coming week as auto companies will release their monthly sales numbers for January from February 1, which experts feel could give a forecast for the industry.

FII Selling

Relentless selling by FIIs amid rising expectations of Fed rate hike by March to combat inflation dampened market sentiment, though domestic institutional investors (DIIs) poured in some funds. There has been a major FII outflow for the fourth consecutive month in January. Hence, the market will watch out for FII flow in coming days.

Last week, the Federal Reserve commentary turned more hawkish, hinting at about four interest rate hikes this year and announced further reduction in monthly bond purchases, with improving economic outlook and unemployment rate falling below four percent to pre-pandemic levels. As a result, US 10-year bond yields rose closer to 1.9 percent before settling largely flat at 1.77 percent on a week-on-week basis, while US dollar index climbed over the 97 mark and closed at 97.21, the highest level since June 2020, up significantly from 95.63 week-on-week.

FIIs have net sold more than Rs 22,000 crore worth of Indian equities last week, taking the total monthly outflow to over Rs 37,700 crore, while DIIs have net bought more than Rs 10,800 crore worth of shares during the week, taking the total monthly inflow to nearly Rs 18,300 crore in January 2022.

Oil Prices

Oil is always an important factor to watch out for as India is a net oil importer. International benchmark Brent March crude futures climbed up to $91.04 a barrel, the highest level since October 2014 and finally closed the week above $90 a barrel amid supply worries, which is a big concern for India, ahead of a meeting of Organization of the Petroleum Exporting Countries (OPEC) and its allies on February 2.

Brent crude futures rallied more than 27 percent in the last two months amid supply concerns. A Reuters report indicated that OPEC+ is likely to stick with a planned rise in its oil output target for March.

The rise in oil prices always puts pressure on India as the country imports more than 80-85 percent of oil requirement.

Global Cues

Globally the key factor to watch out for would be geopolitical tensions between Ukraine and Russia wherein the fear is that Russia may invade Ukraine soon, which if it happens could result in a wider conflict in the western world. The focus is also on the Bank of England (February 3) and European Central Bank which will hold monetary policy meetings next week.

Here are key global events to watch out for next week:

IPOs and Listing

The Rs 3,600 crore initial public offering of Adani Wilmar, the joint venture between Adani Group and Wilmar Group of Singapore, will close on January 31. So far the issue has been subscribed 1.13 times.

Click Here To Read All IPO Related News

On the same day, omnichannel payment solutions provider AGS Transact Technologies will make its debut on the bourses. The final issue price has been fixed at Rs 175 per share. Experts largely feel it could be a muted listing.

Vedant Fashions, which owns ethnic wear brand Manyavar, will open its initial public offering (IPO) for subscription on February 4, with a price band at Rs 824-866 per share, and the company is planning to raise Rs 3,149.2 crore via offer. This would be the third public offer of this year after AGS Transact Technologies and Adani Wilmar.

Coronavirus

The risk of coronavirus seems to be subsiding as the graph after hitting a peak of 3.47 lakh cases on January 20 has been moving southwards, but teh chart will still be closely watched by the market. And also several states gradually started reducing COVID restrictions, indicating normalcy in economic activities soon.

India reported more than 2.34 lakh COVID cases with 893 deaths in the last 24 hours ended 8 am on Sunday, while more than 165.7 crore vaccine doses have been administered in the country so far.

Technical View

The Nifty50 formed a bearish candle which resembles a shooting star pattern formation on the daily charts, and also back-to-back bearish candle pattern formations on the weekly scale, indicating nervousness among traders ahead of the Union Budget.

Experts feel if the index defends the 16,850-16,900 support zone in coming days there could be a bright chance of a sharp recovery up to 17,300-17,500 which could be near term hurdles. The above support zone has acted as an important upside reversal in the past.

“The underlying trend of Nifty remains choppy. There is no confirmation of any higher bottom reversal at the lows. The crucial support of uptrend line could be tested again around 16,850-16,900 levels by next week before showing another small upside bounce. The presentation of Union Budget is likely to influence the market by next week,” says Nagaraj Shetti, technical research analyst at HDFC Securities.

F&O Cues

On the option front, maximum Call open interest was seen at 18000 followed by 17500 and 17300 strikes with Call writing at 18000, 17300 and 17500 strikes and Call unwinding at 17000 and 16900 strikes. Maximum Put open interest was seen at 16500 followed by 16000, 16700 and 17000 strikes, with Put writing at 16700, 17300 and 16500 strikes. Option data largely indicated that the Nifty could trade in the range of 16500-17500 levels in the coming days amid volatility.

“From a data perspective, the Nifty holds highest Put concentration at 17000 strike while Call option concentration is placed at 17500 strike for the coming weekly settlement. Hence, we believe the Nifty may consolidate after witnessing sharp declines of almost 1,200 points in the last couple of weeks. A fresh directional bias is likely to be seen after the Union Budget,” says ICICI Direct.

The India VIX climbed over the 24 mark for the first time since May 2021 last week, but managed to cool down to settle at 20.69 on Friday. However, it was up nearly 10 percent week-on-week.

“India VIX closed the week a tad above 20 levels ahead of the Union Budget. We believe volatility will subside significantly after budget and may move towards 16 levels once again in the coming weeks,” says ICICI Direct.

Corporate Action & Economic Data Points

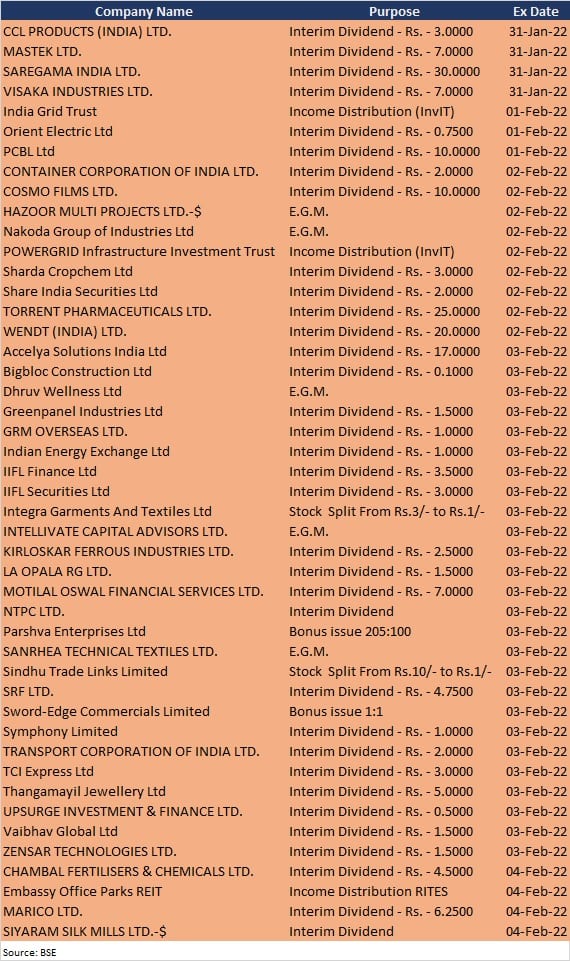

Here are key corporate actions taking place in the coming week:

Besides, on the economic front, infrastructure output and fiscal deficit data for December 2021 will be released on Monday, while Markit Manufacturing PMI data for January will be announced on Tuesday, and Markit Services PMI and Composite PMI data will be released on Thursday. Foreign exchange reserves for the week ended January 28 will be released on Friday