Stocks To Watch: On Monday, the NSE Nifty continued its consolidation movement on Monday and closed the day on a flat note amidst a range-bound movement.

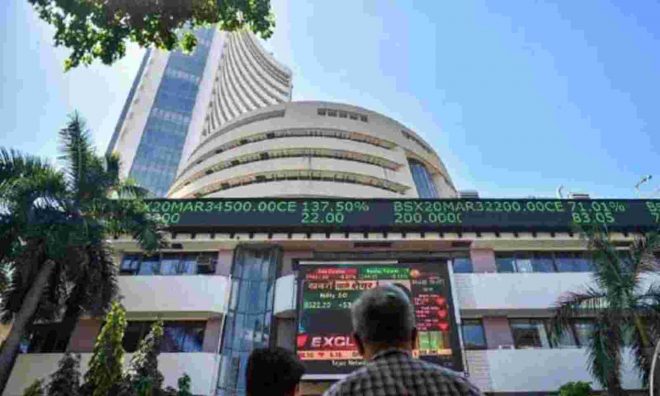

Indian market taking positive cues from the global market may open in the positive territory on Tuesday. On Monday, the NSE Nifty continued its consolidation movement on Monday and closed the day on a flat note amidst a range-bound movement. BSE Sensex sustained above 60,000 and closed at 60,077 levels — 29 points higher from its previous trade session. At 0740 hours IST, the Nifty Futures was trading at 17,945, up 83.75 points, or 0.47 per cent signaling a positive start for the Indian markets. On Tuesday, Asian shares also fell fretting over China’s Evergrande’s group’s unsolved debt crisis. The MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.13 per cent lower on Tuesday, following a mixed session on Wall Street. In early trade Tuesday, Australia’s benchmark S&P/ASX200 index was down nearly 1 per cent, while Japan’s Nikkei was off 0.6 per cent.

China’s blue chip index CSI300 edged up 0.1 per cent at the open, as Hong Kong’s Hang Seng Index gained 0.44 per cent. However, the US Stock markets also acted in cautious manner, the Dow Jones Industrial Average futures fell just 20 points. S&P 500 futures were flat, and Nasdaq 100 futures fell 0.2 per cent.

Here are some stocks that would be in focus today.

Raymond: The company announced that its board has approved consolidation of tools & hardware and auto components businesses into engineering business for improving synergies and exploring monetization options for deleveraging Raymond.

Websol Energy System: Kolkata-based company that manufactures solar cells and modules has received approval for its Websol Module from the MNRE, Government of India under the list of “Approved Module Manufacturer (ALMM) issued by the Government of India.” Also the company has received approval of its module from BIS and IEC61215. This has made Websol modules eligible to be sold in the domestic market for the project approved under the various schemes of the Government of India.

Indian Metals & Ferro Alloys: ICRA has upgraded the rating of the company for the long term and short term loan facilities to A+ from A and to A1+ from A1 respectively. The outlook also has been revised to “Positive” from “Stable”.

Bharat Forge: Bharat Forge’s aerospace business division, raises the bar for quality standards for its products and manufacturing facility by becoming the first organization to successfully achieve the Nadcap accreditation for metallic materials manufacturing.

Ansal Housing: The company ,Housing Development Finance Corporation (HDFC) has sold 12,67,504 equity shares in the company through through invocation of pledge on various dates starting from August 5.

IRIS Business Services: ICRA has upgraded the long-term rating of IRIS Business to BB(stable) from BB-(stable) and the short-term rating to A4+ from A4, with respect to the bank facilities of Rs 18 crore, as well as an enhancement of Rs 1.75 crore to the bank facilities.

Pondy Oxides & Chemicals : The company commenced trial production of copper recycling/ refining at existing plant in Chittoor, Andhra Pradesh

Athena Global Technologies: Subsidiary MedleyMed has entered US and other global markets with a suite of digital health solutions for both pharmacy businesses and patient care.

Adani Enterprises : Subsidiary Adani Airport Holdings has signed Share Subscription Agreement with April Moon Retail (AMRPL) for strategic partnership to operate duty free outlets in airports.

GMR Infrastructure: Promoter GMR Enterprises sold 5.75 crore equity shares to its subsidiary Hyderabad Jabilli Properties at Rs 36.3 per share through open market transaction on the NSE, the bulk deals data showed

McLeod Russel India: IndusInd Bank sold 43,69,267 equity shares in the company at Rs 30.99 per share, whereas Jaikarni Holdings acquired 20 lakh shares in the company at Rs 30.96 per share and Supremus Projects LLP bought 7.5 lakh shares at Rs 31 per share on the NSE, the bulk deals data showed.

Royal Orchid Hotels: Promoter Keshav Baljee sold 2,71,591 equity shares in the company at Rs 103.25 per share on the NSE, the bulk deals data showed.