- Info Edge’s investment streak coincides with Zomato hitting the public market and PolicyBazaar’s attempt to do so.

- Nearly half of Info Edge’s investments this year have been announced post Zomato’s public listing on July 14.

- Info Edge has invested in rounds worth $161.7 million in 2021 so far.

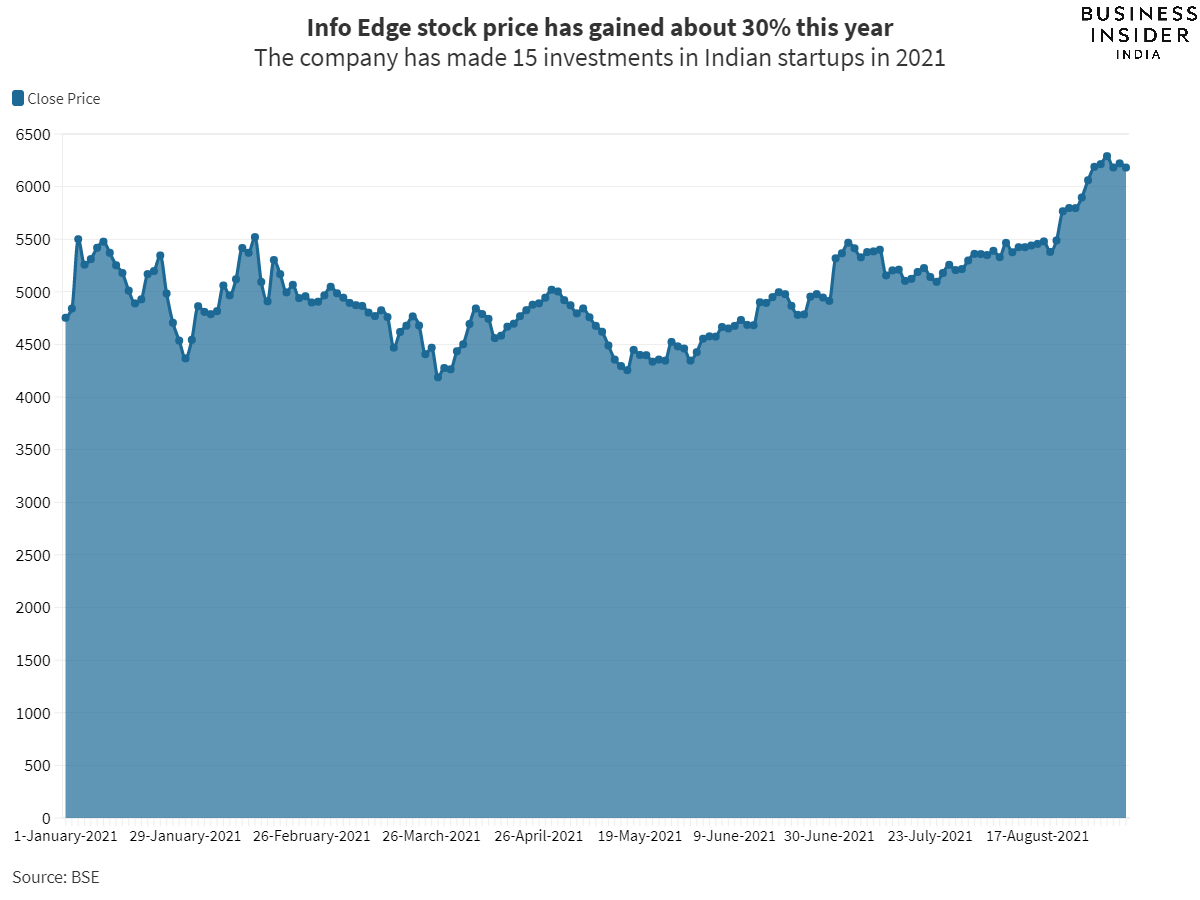

Info Edge, one of the oldest internet companies in India, has been going heavy on startup investments this year. The Sanjeev Bikhchandani-led company has invested in 15 startups in 2021 so far.

The development coincides with two of its portfolio companies — Zomato and PolicyBazaar — moving away from the ‘startup’ tag to a maturity stage. While Zomato has already hit the public market, PolicyBazaar has filed the preliminary papers for its initial public offering (IPO) scheduled for this year.

Maybe it’s the increased interest in the Indian startups or really optimum market conditions that has compelled Info Edge to go heavy on its investments. Nearly half of Info Edge’s investment this year has been announced post Zomato’s public listing on July 14.

This also includes travel ticketing app ixigo that filed for its IPO last month. By the end of this year, Info Edge may end up having stake in three publicly listed companies if all goes as per plan.

Info Edge has invested in rounds worth $161.7 million in 2021 so far. These investments were mostly made in early stage companies across sectors.

| Company | What does it do? | Round | Date |

| Geniemode | Cross-border sourcing and supply chain company | $2.3 million | September 6 |

| Lumiq | Data platform that allows financial enterprises to monetise their data | $2 million | August 24 |

| 1K Kirana Bazaar | Hyperlocal omnichannel grocery chain | $7 million | August 17 |

| Yojak | Online marketplace for building materials | $3.8 million | August 17 |

| Attentive | SaaS company for property measurement | $1.1 million | July 31 |

| Zingbus | Intercity mobility | $6 million | July 27 |

| ixigo | Travel booking app | $53 million | July 37 |

| Shiprocket | Shipping and logistics solutions startup | $41.3 million | July 5 |

| Skylark Drones | Enterprise drone solution provider | $3 million | July 5 |

| Airblack | Online makeup and beauty learning platform | $5.2 million | June 29 |

| Truemeds | Online pharmacy that helps customers save cost by recommending alternative medicines | $5 million | June 8 |

| QuickSell | Product cataloguing and sales platform | $2 million | June 7 |

| LegitQuest* | Legal research engine | $681,000 | April 5 |

| DotPe* | Commerce and payments platform | $27.5 million | March 26 |

| Udayy* | Live online learning platform for kids in class 1-5 focused on smart communication. | $2.5 million | January 18 |

| Total | $161.7 million | 13 investments |

*These investments were carried out by Info Edge Limited

The 26-year-old company carried out most of these deals through its investment arm Info Edge Ventures, which was founded in 2008. Info Edge owns 67% stake in Info Edge Ventures Fund.

The firm holds net assets worth ₹236 crore, as of March 31 of 2021.

Info Edge Ventures is a $100 million fund, for which Info Edge has committed $50 million and the balance is committed by Temasek Holdings Private Limited.

Info Edge had made only three investments between January to April 2021, before Zomato filed its preliminary papers to go public.