On a post-tax basis, returns are lower than inflation in the case of FDs

Interest rates on fixed deposits (FDs) are nearly at their all-time lows. These are not the best of times if you wish to invest in a financial instrument for getting some regular income. For instance, State Bank of India’s three-year FD for senior citizens gives 5.80 percent interest. A one-year FD offers interest of 5 percent. The prevailing inflation rate is around 5.59 percent. So, on a one-year FD, you would be earning just about the inflation rate, and may be lower on a post-tax basis, especially if you fall in the higher slabs.

A rise in the interest rates, which many experts predicted would happen, hasn’t yet come to pass. If interest rates rise, bank FD would also yield more. But given that credit offtake is slow, banks may not be in a rush to raise interest rates due to a good stock of retail deposits already with them. That is not good news for depositors who depend on fixed deposits for their regular income. But there are still pockets of opportunities around.

Senior citizens must go for SCSS and PMVVY

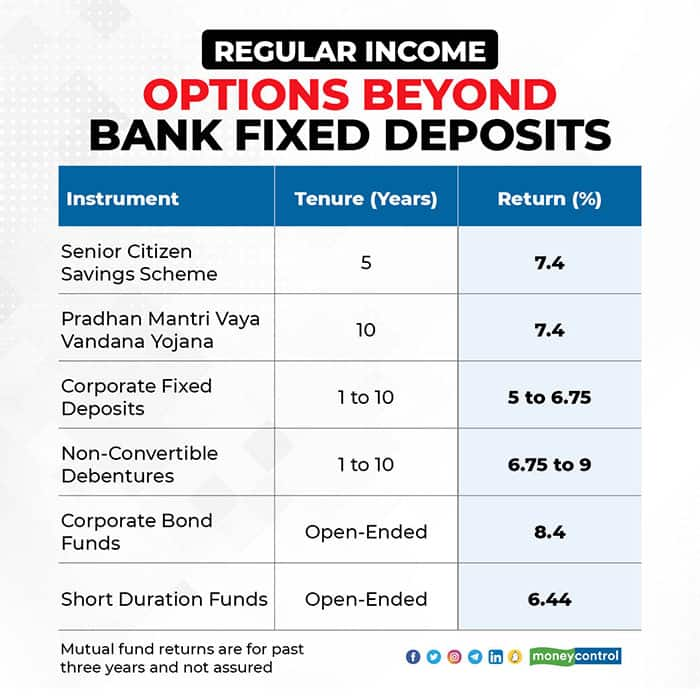

The Senior citizens saving scheme (SCSS) comes with a tenure of five years and pays quarterly interest at 7.4 percent a year. To further sweeten the deal, contributions to this scheme are eligible for deduction under section 80C of the Income Tax Act, up to Rs 1.5 lakh. But you can invest only Rs 15 lakh in the SCSS.

If you exhaust this limit, then opt for the Pradhan Mantri Vay Vandana Yojana (PMVVY). The Government of India backs this scheme, which is administered by Life Insurance Corporation of India. It pays monthly interest at the rate of 7.4 percent. You can invest up to Rs 15 lakh in the PMVVY.

Post office monthly income scheme

After a total of Rs 30 lakh is invested in the above two schemes, you can opt for two other schemes that earn you a reasonable monthly income. The Post Office Monthly Income Scheme Account (POMIS) offered through India Post can earn you a monthly income. The maximum investment allowed is Rs 4.5 lakh and the interest offered is 6.6 percent. “POMIS, along with SCSS, can be a good combination for seniors looking for regular income without risking their capital,” says Vinayak Kulkarni, Mumbai-based mutual fund distributor. The scheme is suitable even for those less than 60.

What if interest rates rise?

If you want to benefit from rising interests, as and when they do, you can deploy some money now and leave some for later as interest rates rise. Such laddering of deposits can help you ride out interest rate risk.

“RBI’s Floating Rate Savings bonds (FRS) make sense in a rising interest rate environment. If the interest rates rise materially, then investors may see higher payoffs in future, despite a longer lock-in period,” says Sridevi V, a SEBI-registered investment advisor. These bonds carry no credit risk and pay interest twice a year – 35 basis more than the National Saving Certificate (NSC). Since the NSC now pays 6.8 percent interest, FRS offers 7.15 percent a year. Given the semi-annual payout, it may not really appeal to regular income seekers. But a small allocation to these bonds can be considered.

Company fixed deposits and NCDs: Higher rates, risks

Private-sector companies offer FDs and non-convertible debentures at higher interest rates. But some of them also come with added credit risk. Some government-owned companies also offer NCDs periodically, with slightly lower credit risks. Kulkarni says that FDs of large firms such as HDFC offer monthly interest payments, and are a good investment options.

These deposits can be made for a period of one to 10 years. The rate of interest also goes up as the tenure increases. A five-year HDFC FD pays 6.2 percent interest at present.

Many NCDs with ratings below AA+ offer up to 9 percent rate of interest for the long term. Most of these may not suit conservative investors given the high credit risk involved. “Most investors think that bonds are safe investment avenues and they tend to overlook credit risks associated with low-rated non-convertible debentures,” says Sridevi.

Volatile returns, but better tax efficiency

All interest incomes are taxed at your slab rates.

If you fall in a higher income-tax bracket, then make sure you also diversify with corporate bond funds. After three years, start a systematic withdrawal plan. Debt funds give long-term capital gains tax benefits on withdrawals made after three years.Experts say that you can consider a combination of SCSS, PMVVY, fixed deposits and corporate bond funds. For example, SCSS and PMVVY can fetch some regular income. Any shortfall can be bridged by building a ladder of short-term fixed deposits – from three months to three years. Each time a fixed deposit matures, the money can be used. After the end of three years, money kept in corporate bond funds can be tapped into.