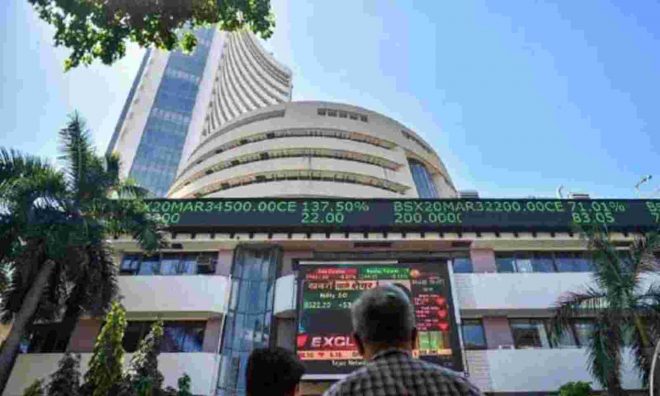

Trading in a narrow range, the BSE Sensex gained 125.13 points, or 0.23 per cent, to close at 54,402.85 on Monday.

Domestic stock markets logged modest gains on Monday, August 9, 2021. Both equity indices, Sensex and the Nifty added amid mixed global cues. The Sensex climbed above 54,400 and the Nifty surged above 16,250 level. Trading in a narrow range, the BSE Sensex gained 125.13 points, or 0.23 per cent, to close at 54,402.85. The NSE Nifty also appreciated 20.05 points, or 0.12 per cent, to settle at 16,258.25. But certain stocks came in the news after the market was closed. These stocks can impact the indices when it reopens on Tuesday, August 10, 2021. List of such five stocks:

IPO Updates

Chemplast Sanmar IPO: Specialty chemicals manufacturer Chemplast Sanmar’s initial public offering (IPO) will open for subscription today. The issue will close on Thursday, August 12, 2021. The price band for the offer has been fixed at Rs 530-541 per equity share. Investors can subscribe to the IPO by applying for a minimum of 27 shares or multiples thereof. The company aims to raise Rs 3,850 crore through its public offer. The issue comprises fresh issuance of shares, aggregating up to Rs 1,300 crore, and an offer for sale of up to Rs 2,550 crore by promoters and existing shareholders. Besides, the Specialty chemicals manufacturer on August 9, 2021, has garnered Rs 1,732 crore from anchor investors ahead of its IPO opening. The company has allocated 3.2 crore shares to anchor investors at Rs 541 per share. The anchor investors include names like Abu Dhabi Investment Authority, CLSA, Goldman Sachs, SBI Mutual Fund, Axis Mutual Fund, Mirae Asset, ICICI Prudential, HDFC Life Insurance among others.

Aptus Value Housing Finance IPO: South-India based home finance lender Aptus Value Housing Finance’s initial public offering (IPO) will open for subscription today. The issue will close on Thursday, August 12, 2021. The price band for the subscription of the offer has been fixed at Rs 346-353 per equity share. Investors can subscribe to the IPO by applying for a minimum of 42 shares or multiples thereof. The company aims to raise Rs 2,870 crore from the initial stake sale. The issue comprises fresh issuance of shares, aggregating up to Rs 500 crore, and an offer for sale of up to Rs 2,280 crore by promoters and existing shareholders. Besides, Aptus Value Housing Finance on August 9, 2021, has raised Rs 834 crore from anchor investors ahead of its initial share sale, which opens for public subscription today. The company has allocated 2,36 crore shares at Rs 353 per share to the anchor investors that include names like Small Cap World Fund, Nomura, WF Asian Fund, Copthall Mauritius and Axis Mutual Fund among others.

Nuvoco Vistas IPO: Cement major Nuvoco Vistas Corporation’s initial public offering (IPO) was subscribed 0.16 times on the first day of subscription, i.e., on Monday, August 9, 2021. Today is the second day of the issue which will close on Wednesday, August 11, 2021. The retail portion was subscribed 0.31 times and the NII was subscribed 0.01 times, while the subscription for the QIB portion has not begun yet. The price band for the offer has been fixed at Rs 560-570 per equity share. The company plans to raise Rs 5,000 crore through its public offer.

CarTrade Tech IPO: Multi-channel auto platform CarTrade Tech’s initial public offering (IPO) was subscribed 0.41 times on the first day of subscription, i.e., on Monday, August 9, 2021. Today is the second day of the issue which will close on Wednesday, August 11, 2021. The retail portion was subscribed 0.80 times, while the NII and QIB portions were subscribed 0.03 times and 0.01 times. The price band for the offer has been fixed at Rs 1,585–1,618 per equity share. The company plans to raise Rs 2,998.51 crore through its offer, at the upper end of the price band of Rs 1,618 per share.

Shree Cement + Indian Hotels

Shree Cement: The cement manufacturer has reported a 78% YoY rise in the profits at Rs 662 crore for the quarter ended June 30, 2021. It had posted a profit of Rs 371 crore in the same quarter of the previous financial year. Sales on a standalone basis grew 47.8% to Rs 3,449 crore as against Rs 2,332 crore posted last year. EBITDA grew 44.8% to Rs 1,014 crore as against Rs 700 crore posted last year. Margins remained almost flat at 29.3% in Q1FY22 as against 30% posted in Q1FY21.

Indian Hotels: Tata Group’s hospitality arm Indian Hotels Company Limited on Monday reported a consolidated loss of Rs 301.6 crore for the quarter ended June 30, 2021. It had posted a loss of Rs 313 crore in the year-ago quarter. Revenues grew 140% to Rs 344.5 crore in the quarter under review as against Rs 143.6 crore posted last year. EBITDA loss stood at Rs 149 crore in the reported quarter as against an EBITDA loss of Rs 266 crore posted last year. The company has incurred an exceptional gain of Rs 20.33 crore in the reported quarter against an exceptional gain of Rs 86.07 crore posted last year. Besides, the board approves fundraising of Rs 250 crore through Debt. Commentary: Whilst the effect of COVID-19 continues to impact growth in the hospitality industry, IHCL has seen considerable progress during the first quarter, which accelerated significantly in the month of July.

Hinduja Global Solutions Ltd: IT service management company Hinduja Global Solutions Ltd has reported a 10.2% QoQ decline in the consolidated profit at Rs 117 crore for the quarter ended June 30, 2021. It had posted a profit of Rs 130.3 crore in the year-ago quarter. The revenue from operations dropped 0.8% QoQ to Rs 1,550.5 crore as against Rs 1,563.6 crore posted in the previous quarter. The EBIT dropped 2.9% QoQ to Rs 156.1 crore as against an EBIT of Rs 160.8 crore posted in the previous quarter. The margin dropped marginally to 10.1% in Q1FY21 as against 10.3% posted in Q4FY22. Besides, Hinduja Global has sold its Healthcare outsourcing division to Baring Private Equity’s company Betaine BV at $120 crore (Rs 9,200 crore). Zee Business has earlier reported about the sale. Healthcare business accounts for 53% of the company’s total income. The price of $120 crore at which the Healthcare Services business was sold is better than the market estimates as the market had estimated the sales at $100 crore (Rs 7,500 crore).

New Stocks in F&O: Ten new stocks will make a debut in the Futures and Options (F&O) segment from the September series. The stocks that will be included in the series are MCX, Can Fin Homes, Dixon Tech, Hindustan Aeronautics, IEX, IndiaMART InterMESH, IPCA Lab, Oracle Financial Services Software, Polycab India and Syngene International.

Life Insurance Companies: Life insurance companies will be in focus today as life insurance companies saw an 11% YoY drop in new premium collection for July 2021. The drop is 32% QoQ. This was on the back of a decrease in premium collections by the Life Insurance Corporation of India (LIC). Private insurers saw a 7.5% YoY and 2.3% MoM rise in premium collection in July 2021. LIC saw a 20.7% YoY and 45% MoM degrowth in new premiums.

July Premium Collection (YoY)

– HDFC Standard Life: 3.63%

– ICICI Prudential Life: 36.3%

– Max Life: 22%

– SBI Life: -5.7%