Since all the sectors are participating in the move, traders should focus on stock selection and continue with the ‘buy on dips’ approach, Ajit Mishra of Religare Broking advised.

After moving in a range for more than a month, the Indian market finally resumed its uptrend and hit a 52-week high. It closed with a weekly gain of 1.5 percent amid positive global cues, good start to the June quarter earnings season, and supportive macroeconomic data

BSE Sensex climbed 753.87 points to 53,140.06, and the Nifty50 rallied 233.60 points to 15,923.40, while the broader markets also participated in the weekly run as the BSE Midcap index was up 1.4 percent and Smallcap index gained 2.3 percent.

Banks, capital goods, healthcare, technology, and metals stocks supported the market, while realty stocks outperformed every index.

The uptrend is expected to continue in the coming truncated week too along with stock-specific action will be amid the ongoing June quarter earnings season, experts feel.

On Monday, the market will first react to HDFC Bank after its quarterly earnings, and Reliance Industries after its acquisition of Just Dial and ahead of its quarterly earnings next week

Global cues and earnings announcements will continue to dictate the trend. Besides, Covid-related updates and the progress of the monsoon will remain the focus,” said Ajit Mishra, VP Research at Religare Broking.

He further said, “We reiterate our view that the performance of the banking pack would play a critical role in index regain momentum else the rise could be gradual.

Since all the sectors are participating in the move, traders should maintain their focus on stock selection and continue with the ‘buy on dips’ approach, Ajit Mishra advised.

Here are 10 key factors that will keep traders busy in coming week:

Earnings

The earnings season will be in full swing next week as we have a long list of major corporates announcing their quarterly numbers including Important names are ACC, HCL Technologies, HDFC Life Insurance Company, Asian Paints, Bajaj Finance, ICICI Prudential Life Insurance Company, Bajaj Finserv, Bajaj Auto, Hindustan Unilever, UltraTech Cement, Ambuja Cements, JSW Steel, Reliance Industries, ICICI Bank, ITC,

Among others, Indian Bank, Mastek, Nippon Life India Asset Management, Ceat, Gland Pharma, Havells India, Jubilant FoodWorks, Polycab India, Tanla Platforms, Biocon, CSB Bank, Hindustan Zinc, ICICI Lombard General Insurance Company, Indian Energy Exchange, IndiaMART InterMESH, India Pesticides, Bank of Maharashtra, Persistent Systems, South Indian Bank, Wockhardt, Federal Bank, SBI Cards and Payment Services, United Spirits, Yes Bank, and MCX India will also declare results.

Coronavirus & Vaccination

India reported 38,079 new Covid cases with 560 deaths in the last 24 hours ending at 8 am on Saturday, taking the total count of cases to 3.11 crore and deaths to 4.13 lakh.

The cumulative caseload further dropped to 4.24 lakh against 4.55 lakh week-on-week basis, while the positivity rate declined to 1.91 percent from 2.18 percent and the recovery rate improved to 97.31 percent from 97.20 percent in the same period, taking the total recovered cases to 3.02 crore now. The mortality rate remained steady at 1.33 percent.

Kerala reported the highest number of new cases (13,750), followed by Maharashtra, Andhra Pradesh, Tamil Nadu, Odisha, Karnataka and Assam.

More than 40 crore (40,44,67,526) people have been vaccinated so far in India, according to provisional data at 7 pm on Saturday. Over 46.38 lakh doses were administered in the last 24 hours on Saturday.

IPO

Given the positive sentiment in the secondary market and availability of ample liquidity, the primary market continues to remain active. Specialty chemical company Tatva Chintan Pharma Chem will remain open for two more days in the coming week.

The Rs 500-crore IPO has seen a healthy subscription of 4.5 times on the first day of bidding on July 16, the second-highest subscription after Nureca (5.73 times). The issue will close on July 20.

Listing

Road sector contractor GR Infraprojects and specialty chemical company Clean Science & Technology will debut on the bourses on Monday, July 19. The street seems to be excited about both listing as their shares traded at more than 60 percent premium in the grey market.

GR Infraprojects raised Rs 963 crore and Clean Science garnered Rs 1,546.62 crore through public issues during July 7-9. Both saw hefty subscription of 102.58 times and 93.41 times respectively.

At the time of publishing this copy, GR Infraprojects shares were available at a premium of Rs 520-530, resulted into a price of Rs 1,357-1,367, which is 62-63 percent higher over issue price of Rs 837 per share.

Clean Science shares traded at a premium of Rs 580-600 in the grey market. The trading price comes to Rs 1,480-1,500, which is a 64.4-66.7 percent premium over final IPO price of Rs 900.

Zomato Allotment

The street will also look at the IPO share allotment of Zomato, which is expected in later part of the next week around July 22. The Rs 9,375-crore public issue has received more than Rs 2 lakh crore of bids in three days – July 14-16, including over Rs 1.5 lakh crore of bids only by qualified institutional buyers, helping the issue get subscribed 38.25 times.

The funds will be refunded around July 23.

FII Flow

The market hit a fresh record high in the week gone by, but foreign institutional investors continued to take some money off the table, though domestic institutional investors came to support the market at the same time.

FIIs have net sold Rs 2,667.16 crore of shares during the week, taking the total selling to Rs 6,923.61 crore in the month of July, whereas DIIs have net purchased Rs 3,233 crore worth of shares in same period and their total buying in current month was Rs 5,136.45 crore.

Hence, the flow will be closely watched. Experts feel if the FII selling continues in coming weeks, then the market could turn cautious and as a result there could be rangebound trade again.

India’s foreign exchange reserves continued to remain strong, rising by $1.88 billion to a record high of $611.89 billion in the week ended July 9 due to increasing foreign currency assets.

Technical View

The Nifty50 formed Hanging Man kind of pattern on the daily charts on Friday, and there was bullish candle formation on the weekly scale. The index was down 0.8 points on Friday and gained 1.5 percent during the week, consistently holding 15,900 levels.

The Nifty failed to gather strength in upside momentum to move up decisively on Friday. This lack of strength could be a cause of worry for the bulls at the highs, experts feel. The index hit a record high of 15,962.25 on Friday, but closed at 15,923.40.

“If Nifty fails to sustain above 15,960 levels in the next 1-2 sessions and corrects down, then such market action could be considered as a failed upside breakout and that could possibly start selling enthusiasm from the highs,” said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further said a display of strength above 15,960 could only open the next upside levels of 16,100-16,200 in the short term. “Any weakness below 15,850 is likely to trigger broad based downward correction in the market,” he added.

F&O Cues

On weekly option front, the maximum Put open interest was seen at 15900 followed by 15800 and 15700 strikes while maximum Call open interest was seen at 16000 followed by 16500 and 16200 strikes.

Call writing was seen at 16000 strike followed by 16500-16200 strikes while Put writing was seen at 15300 strike followed by 15900 and 15700 strikes. Option data indicated an immediate trading range for the Nifty at 15,700-16,200 zones.

On the options front, “unlike the last couple of weeks, the options activity is relatively low. Considering recent Put writing and Nifty move above 15,900, we can expect some positive bias in the Nifty towards 16,200,” said ICICI Direct.

Thus, “long positons can be formed only till the Nifty sustains above 15,800, which is the major Put base. A move below 15,800 may keep the ongoing rangebound movement intact,” the brokerage added.

Going ahead, ICICI Direct expects banking to remain in focus as banking results will be in focus. It believes 36,000 should be a critical level and sustainability above this may open doors for fresh upsides. Bank Nifty gained 1.94 percent during the week, closing at 35,751.80.

The volatility index has fallen below 12 levels, which experts feel gives stability to the market.

Corporate Action

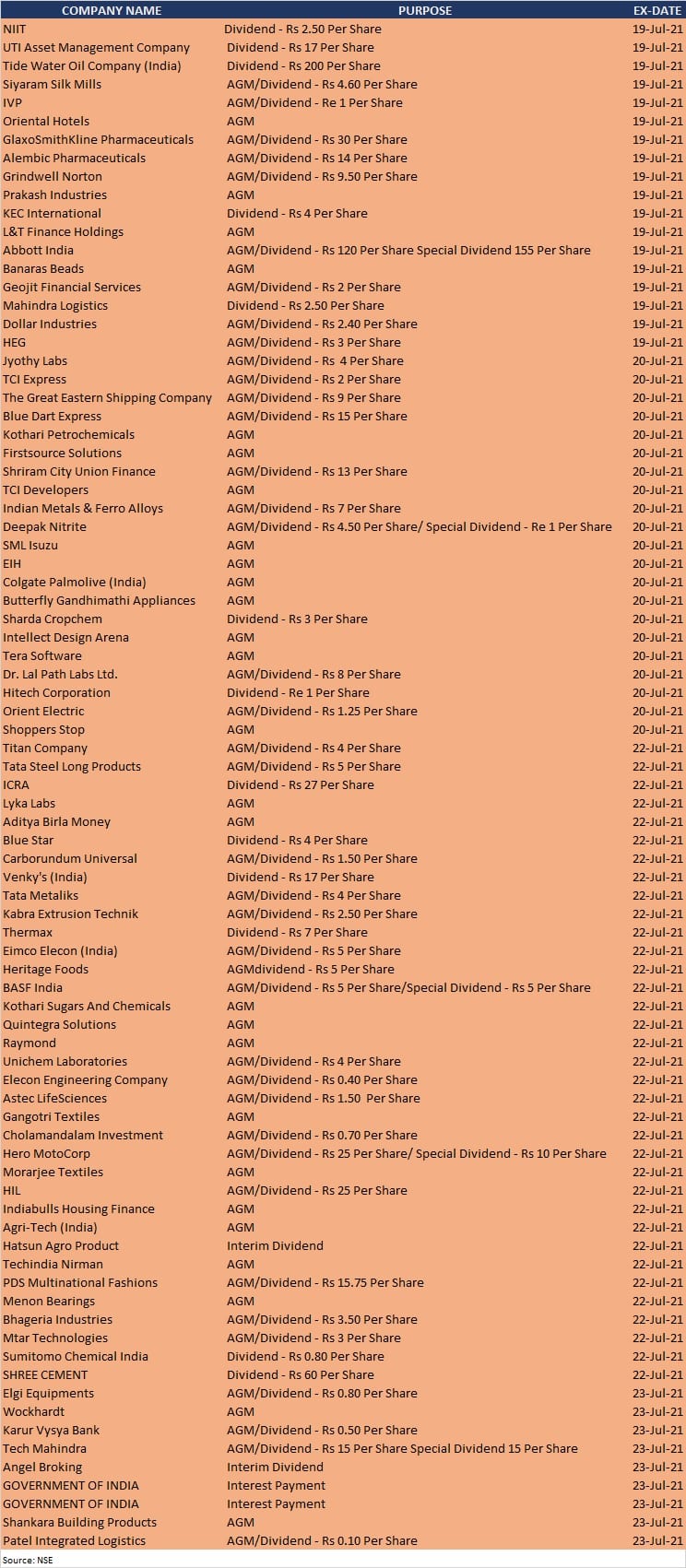

Here are key corporate actions taking place in the coming week:

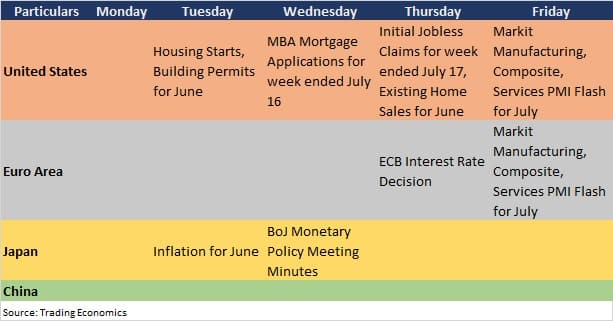

Here are key global data points to watch out for next week: