KOLKATA: In its first budget after returning to office, the Mamata Banerjee government has stuck to the economic mantra of injecting cash at the grassroots to stimulate demand so that increased spending leads to a supply-side boost. Accordingly, much of the government spending — 84.5% of the state budgetary outlay of Rs 3,08,727 crore — is focused on social sector and agriculture.

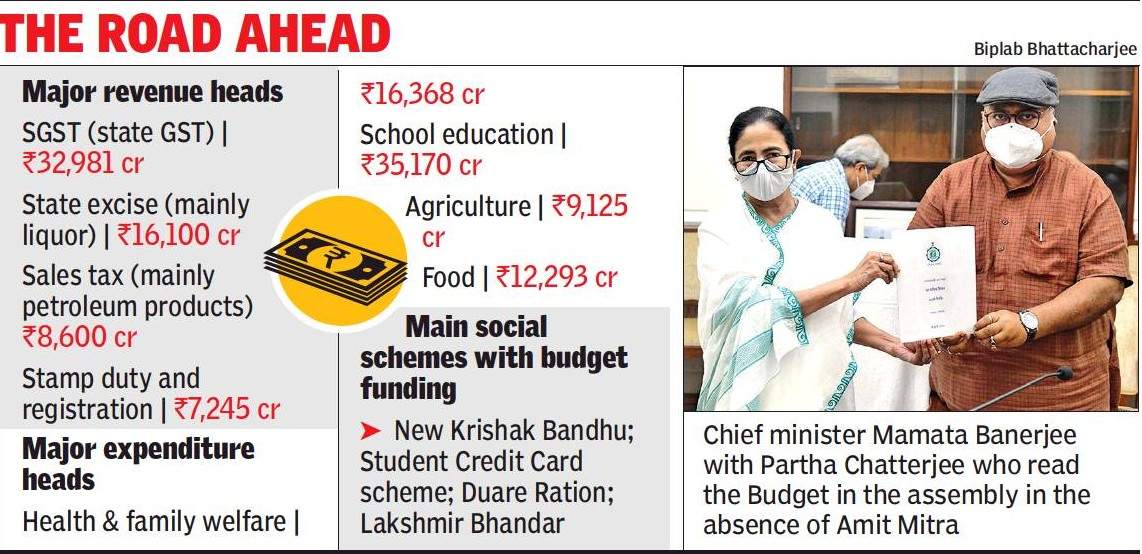

The Rs 18,650 crore increase in the budgetary outlay over last year has been entirely used to fund people-oriented schemes like the Lakshmir Bhandar, a basic monthly income plan for women heads of families, the new Krishak Bandhu for farmers, Duare Ration, student credit card, Swasthya Sathi besides allocations for Covid management, chief minister Mamata Banerjee said on Wednesday. Her government has allocated Rs 10,000 crore alone for the Lakshmir Bhandar scheme.

Beside, to boost demand in the real estate sector, stamp duty on registration has been reduced to 4% from the existing 6% for property below Rs 1 crore and circle rate or market value slashed by 10%. For the transport sector that is reeling under increased operating costs due to spiralling fuel prices, the waiver on road tax for commercial passenger vehicles has been extended till December 31; earlier the waiver was till June 30, 2021.

Taken together, these “demand stimulus” is estimated at Rs 15,650 crore and leaves the government with a limited budget deficit of Rs 7 crore.

The government’s efforts to boost demand has also helped the state retain a positive growth rate — GSDP 1.2% — when the Centre has registered a negative GDP growth rate of -7.7%. Based on the positive growth rate, the government has pegged its own revenue generation at Rs 75,415 crore for 2021-2022 despite the ongoing pandemic as against Rs 60,609 crore in 2020-2021.

“When the entire world is following the model of stimulating demand, the Centre is taking the reverse route of trying to boost the supply side by releasing loans. It also gave a 10% corporate tax relief to big businesses hoping that they will invest more. It didn’t work because the corporates don’t have confidence in the government,” said finance minister Amit Mitra.

The increased public spending to boost demand and to protect the state plan, however, is causing considerable stress on the state coffers. The state’s total debt outstanding of Rs 3,36,757crore till March 2021 is projected to increase by Rs 1,15,672crore in the 2021-22 fiscal while the annual outgo on debt serving is estimated at Rs 61,042 crore as against Rs 44,289crore last year. The FM pointed out that the state’s debt to GSDP ratio is 35.54% when the Centre’s debt to GDP ratio stands at 62.22%.

Mitra also pointed out how the Centre had increased cess on commodities over the years even after the country’s tax regime switched to GST. “Under the GST regime, 42% of the tax collected goes to the states. But this doesn’t apply for cess. Money mopped up as cess goes entirely to the Centre. The Centre has consistently increased the cess component over the years from 6% to 11%,” he said.

The CM later provided the political reason behind the stress on state finances. “We have been denied our dues in terms of devolution of tax shares and grants which is a constitutional provision. The Centre deprived us of Rs 25,225 crore in two financials. The state got Rs 14,225 crore less than the Rs 58,952.55 crore mentioned in the Union Budget in 20-21. We also got Rs 11,000 crore less in the year before that. These are apart from the Rs 33,314 crore that the Centre owes to the state with regard to centrally sponsored schemes,” Banerjee said after placing the budget in the Assembly.