The due date to file ITR return is 10th January 2021 for non audit cases and for cases requiring audit, the due date is 15th February 2021. The Income tax return filing season is over. Are you waiting for your Income tax refund? Let’s understand various matters related to Income tax refund.

In this article we cover the following topics:

- What is an income tax refund?

- When can you claim income tax refund?

- How to claim Income tax refund?

- How much income tax refund is received by the taxpayer?

- How to check for refund status?

- Using income tax e-filing portal

- Using NSDL Portal

- Understanding various income tax refund status

- Within what time limit can income tax refund be claimed?

- Income tax refund on appeal

- Interest on income tax refund

- Is income tax refund taxable?

- Set-off of income tax refund

- Income tax refund helpline

- Important points about income tax refund

- What are the possible reasons for the delay in getting a tax refund?

- Can I rectify the mistakes before placing a request for re-issue of income tax refunds?

- FAQs

1. What is an income tax refund?

When a taxpayer makes excess payment of income tax to the government against its actual income tax liability for a given year, the excess amount paid is refunded by the Income tax department after due assessment. This refunded amount is known as “Income tax refund”

2. When can you claim income tax refund?

The following are situations when an Income Tax Refund can be claimed:

- Excess TDS deducted –

- The employer generally deducts taxes after taking into consideration various documentary proofs provided to him by an employee pertaining to say for example 80C investments, Medical insurance premium under 80D etc. However, there are instances where an employee is not able to furnish proof for few such investments before the end of a particular financial year and accordingly the employer goes ahead with a higher deduction. However, the benefit of such investment can be claimed by the employee while filing his return of income and therefore claim a refund of the higher taxes paid,

- Certain individuals may not fall within the taxable bracket at all i.e. their income would be less than Rs 2.5 lakhs. Hence, they would not have to pay any taxes. Yet, taxes would have been deducted on their income. This being so, they can claim a refund of the excess tax deducted;

- Excess TDS was deducted on your interestincome from bank FDs or bonds.

- Excess advance tax paid-The advance tax paid on the basis of self-assessment was more than the actual tax liability for the given FY. This advance tax can be claimed as a refund while filing ITR.

- Taxpayers may be called upon to pay additional taxes by their income-tax officer following certain additions made to their income during income tax proceedings. Such additions may be deleted by appeal authorities. Accordingly, the taxpayer will be refunded the taxes he would have paid.

- In case of income taxable in more than one countries i.e Double taxation –This situation can arise when a person is a citizen of one country but receives income from another country. However, India has entered into a Double Taxation Avoidance Agreement (DTAA) with many countries wherein the agreement allows you to claim a tax refund if you are a non-resident Indian and your income is taxable in other countries. Any payment of excess tax can be claimed as refund under this DTAA agreement.

3. How to claim Income tax refund?

Income tax refund can be claimed simply by filing ITR. Please note that the IT department will process the ITR for refund only if the ITR is verified through any of the online or offline modes of sending a signed copy of ITR V. Further the refund from the IT department is subject to assessment/ verification from the IT department. Refund is received only if the refund claim is found to be valid and legitimate.

4. How much income tax refund is received by the taxpayer?

When a taxpayer claims a refund in his return of income, the tax department processes such return and the taxpayer would receive an intimation from CPC under section 143(1) which will confirm the amount of refund that the taxpayer is eligible to receive. The refund can either match with or it could be higher / lower than what is claimed in the return of income based on assessment done by the income tax department. This refund amount is what the taxpayer would ideally receive from the income tax department.

5. How to check for refund status?

Once the refund is determined, the same will be processed by the tax department. The status of refund can be checked either from:

- The income tax e-filing portal or

- The NSDL website

6. Using income tax e-filing portal

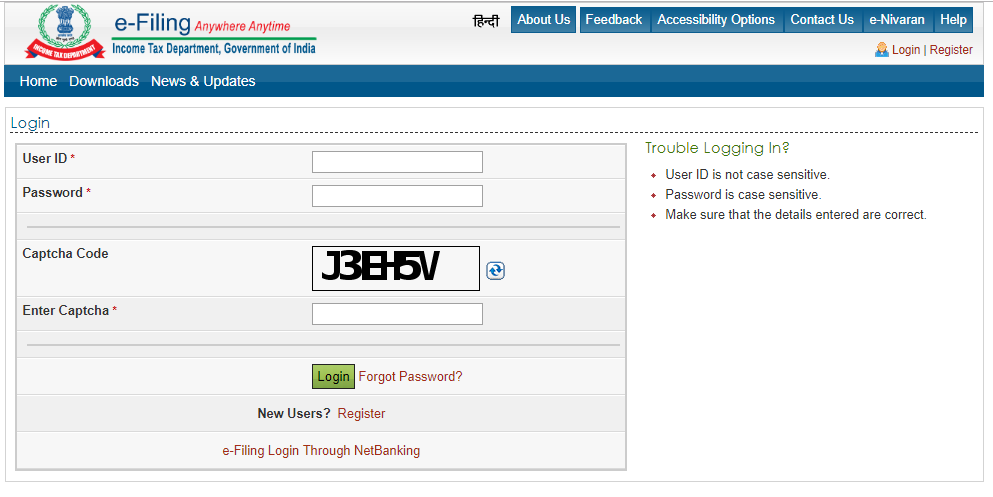

Step 1: Visit the income tax e-filing portal by clicking here

Step 2: Log into your account by entering the user id, password, and the “captcha” and then click on “login”.

Step 3: Click on “View Returns / Forms”

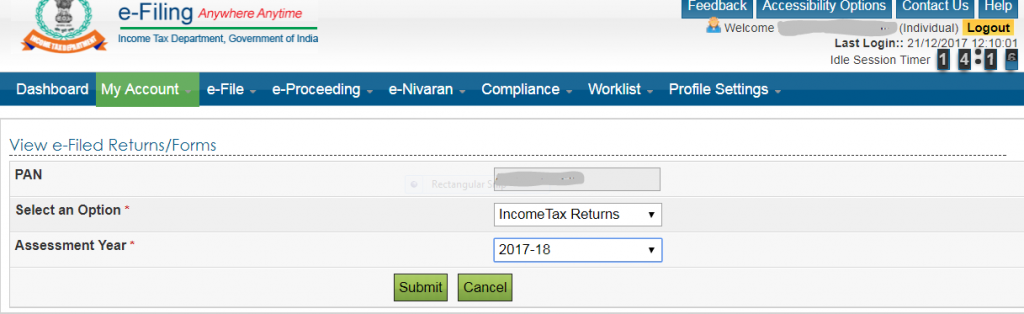

Step 4: Enter “Income Tax Returns” against “Select an option” and the relevant Assessment Year(AY) and click on “Submit”. To know more on what is Assessment Year.

Step 5: Click on the acknowledgement number

The income tax refund status appears as highlighted in the below screenshot

7. Using NSDL Portal

Step 1: Click here which takes you to the NSDL website for checking of the refund status

Step 2: The below screen appears where you can feed in details of your PAN, the AY and the image appearing in the screen and then click on “Submit”.

Once this is done, the below screen appears which shows the status of your refund in the following manner

8. Understanding various income tax refund status

| Refund status | Meaning | Action required |

| Refund paid | ITR filing processed and refund is credited to your account | Check with the bank for the refund received. If not recieved, contact your bank for finding out the issue. |

| No demand No refund | You are neither eligible for any refund nor you are required to be tax. | Review the comparison received from IT department if you have claimed refund and file rectified return if required |

| Refund unpaid | Refund has been accepted by the IT department but was not paid due to error in bank details or address details. | Please update the correct details on income tax portal and raise a refund reissue request |

| Refund status not determined | Your ITR has not been processed yet. | Recheck the status after a few days. |

| Refund Determined and sent out to Refund Banker | Refund request was accepted by IT department and refund banker has been informed | Wait for refund to be credited to account or contact refund banker to know the status of your refund payment |

| Demand determined | Your tax calculation does not match with that of the IT department and an additional tax has to be paid. | Verify the calculation provided in 143(1) to figure out the mismatch/error. In case of error ,make a payment to the IT Department within the specified timeline. In case of nil error, file a rectification along with all the supporting information and documents to justify your refund claim. |

| Rectification Processed, Refund Determined and Details sent to Refund Banker | Rectification return has been accepted, Moreover, the refund amount has been recalculated and the refund amount has been sent to the bank for processing | Check your bank account to confirm the receipt of refund. |

| Rectification Processed and Demand Determined | Rectification return has been accepted, However, there are outstanding tax dues (tax demand) which needs to be paid within a specified time. | Pay the outstanding tax/ tax demand after cross-verifying all the details within the specified time period. |

| Rectification Processed, No demand and No Refund | Rectified return has been accepted by the Income Tax department. Additionally, you are neither required to pay any additional tax nor eligible for a tax refund. |

9. Within what time limit can income tax refund be claimed?

A taxpayer can claim income tax refund only when the Income tax return if filed. As the process of claiming income tax refund depends on ITR filing, the time limit for claiming an IT refund is the same. For any AY, the latest time limit for filing your returns and claiming a refund is the end of the assessment year. For example, for AY 2019-20 , the last date to claim an income tax refund is 31st March 2021, which is also the last date for delayed filing of ITR for FY 2018-19.

10. Income tax refund on appeal

When the taxpayer is eligible for a refund due to any order passed in response to an appeal, then there is no requirement of making a claim for such refund amount as the ITR department will itself credit the amount of refund. In short, there is no requirement for the taxpayer to place any additional request for refund cases related to appeal. Please note that if the assessment of taxpayers’ return of income was cancelled with a decision to make a fresh assessment, the refund shall become due only after making the fresh assessment.

11. Interest on income tax refund

Section 244A deals with interest on income tax refund and provides for interest at the rate of 0.5% per month or part of the month on refund amount. Such interest shall be calculated from 1st April of the assessment year till the date of grant of refund, if the refund is due to excess advance tax paid or TDS deduction.

12. Is income tax refund taxable?

Income tax refund is not taxable because it is the excess of tax liability paid from the total taxable income considered for tax liability for a given year, however interest on income tax refund is taxable as income from other sources.

13. Set-off of income tax refund

If there is an income tax liability along with a refund , the assessing officer or commissioner can decide to set off the refund amount against the liability.

14. Income tax refund helpline

In respect of any queries related to income tax refund, you can contact income tax department helpline number Toll-Free No. 1800-180-1961 or e-mail at refunds@incometaxindia.gov.in. For queries related to any modification in refund processed at CPC Bangalore, you may call on the Toll-free No. 1800-425-2229 or 080-43456700.

15. Important points about income tax refund

- Cross verify the bank account details with the passbook twice so that there is no error in bank account details.

- Verify the address details with the income tax department for any refund in cheque.

- File your ITR before the due date for speedy processing of income tax refund

- Download your form 26AS and verify that the amount excess paid in tax is reflected in 26AS.

16. What are the possible reasons for the delay in getting a tax refund?

There could be various reasons for delay of refunds. We could list some of the reason which could delay the refund :

- Non verification of the Income tax return-filing of ITR is incomplete in case it is not verified. So make sure ITR is verified within 120 days of filing your return. The later you verify, later will be the refund.

- Old bank account details with the income tax department.

- Manual filing of Income tax return-In case income tax is filed in physical, processing of refund could take longer than e-filing of return.

- Lastly, in case the income tax department feels that there is some under reporting of income, there is a possibility they scrutinize the return which may be the reason for delay of refund.

17. Can I rectify the mistakes before placing a request for re-issue of income tax refunds?

If you have received an intimation from the Income-tax Department or Refund Banker(SBI) that the refund processing has failed due to in-correct bank details, you need to follow the below guide. You will have to submit a refund re-issue request in your Income-tax Department’s website login and update your Correct or New bank Account Number.

- Login or Register on Income-tax website

- From the Top Menu, select My Account >> Service Request

- Select “New request” in Request type.

- Select “ refund reissue” and click submit

- Select Assessment year > enter CPC communication reference number which will be mentioned in intimation u/s 143(1) recieved from the income tax department.

- Enter refund sequence number

- Select the mode of refund issue and update the correct account number.