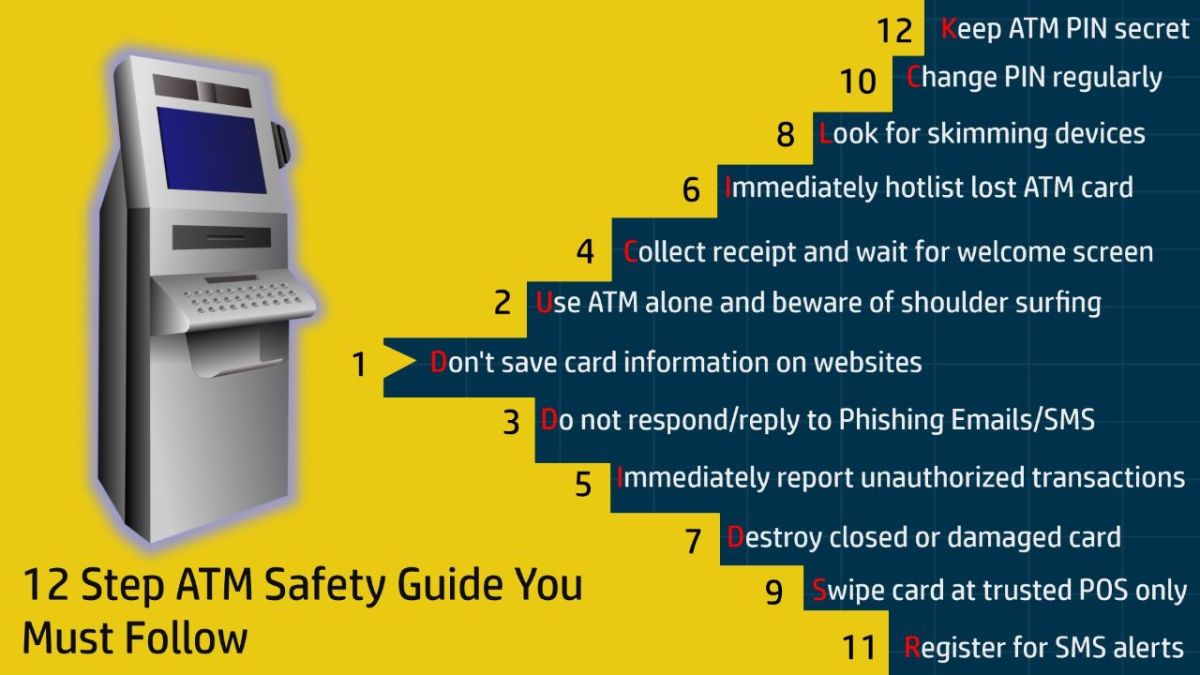

SBI ATM Safety Tips: Your ATM debit or credit card is vulnerable to threats like card cloning and skimming from fraudsters. It is always important to be on guard and practice ways that could mitigate the risk of fraud on your hard earned money. The largest public sector bank, the State Bank of India (SBI) offers some valuable piece of advice to its customers. See here!

- Memorise your PIN. Do not write it down anywhere and certainly never on the card itself.

- Your card is for your own personal use. Do not share your PIN or card with anyone, not even your friends or family

- Use your hand to cover the keypad while using the ATM card at the ATM or POS machines. Stand close to the ATM machine.

- Do not respond to text messages, emails or calls asking for your call details or PIN.

- Do not take help from strangers for using the ATM card or handling your cash.

- Dispose of or safely put away your transaction receipt.

- Don not use numbers from your birth date, phone numbers or account numbers as your pin.

- Look for spy cameras before you begin your transaction.

- Beware of keypad manipulation, heat mapping and shoulder surfing while using the ATM or POS machines.

- Make sure for signup for transaction alert.

- Opt for an OTP-based cash withdrawal system to safeguard yourself from unauthorised transactions.

Contact the bank:

1) If your credit/debit card gets stolen/lost.

2) If your card doesn’t function and you need a replacement card.

3) To report unauthorised transactions.

4) If your card gets stuck in the ATM, or if cash is not dispensed after you have keyed in a transaction, call your bank immediately

5) When you deposit a cheque or card into your ATM, check the credit entry in your account after a couple of days. If there is any discrepancy, report it to your bank