The Reserve Bank of India (RBI) on Thursday said it would waive the fee currently imposed on banks for availing of its NEFT/RTGS payment servers. And in turn, it expects the banks to pass on the resultant savings to customers. The RBI has led from the front. Its initiative could have a ripple, nay shaming, effect on:

• Goods and services tax (GST) regime where the government always suspects that manufacturers and traders don’t pass on the full benefit of input tax credit to the customers;

• The government and state-run companies do not practice what they preach. National Thermal Power Corporation (NTPC), for example, keeps coal mines’ bills pending and electricity boards known for their sloth in their turn keep NTPC’s bills pending; and

• Airlines, which far from rewarding the online bookers penalise them with ‘convenience charges’ for booking tickets from the convenience of their home or while on the move from their mobile apps.

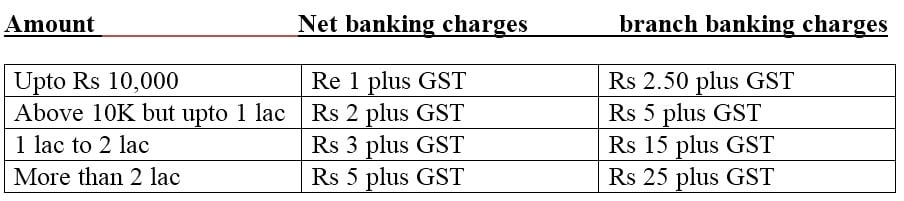

As it is the bellwether State Bank of India’s (SBI) charges for NEFT are as follows:

RTGS charges are more reasonable considering their size but the minimum amount of RTGS transaction is Rs 2 lakh. For Rs 2 lakh to Rs 5 lakh through the do-it-yourself mode i.e., net banking, it is Rs 5 plus GST and from branches Rs 25 plus GST. And above Rs 5 lakh, the charges are exactly double. RTGS is an instant transfer service and hence reserved for larger transactions. For transactions smaller than Rs 2 lakh, one has to use IMPS (immediate payment service) which is pricier. The price differential for do-it-yourself and branch modes are rooted in the logic that branch officials’ time is precious and net banking is not exactly a rocket science.

Will banks merely pass on the savings to the customers or go the whole hog and completely abolish these service charges? It is believed that the banks charge more than what they themselves are charged by the RBI. Be that as it may, banks must encourage net banking more and more because the issuance of cheques and drafts involves a huge amount of paperwork and hence error-prone besides running the risk of being lost in transit. What is more, they have to be presented for collection and then go for clearance, all adding to delay in the payment process.

The net banking payments are superior to card payments because they do away with intermediaries viz. Visa cards, MasterCard and our own Rupay. In the process, service charges payable to these intermediaries can be avoided thus bringing the transaction cost down. But then the net banking is not always possible especially when one is on the move and in merchant establishments. Mobile wallets like PhonePe and Paytm rule the roost at these places.

The Narendra Modi government’s Digital India drive has definitely got a boost with this RBI initiative. Already, the government departments and companies swear by net banking payments. Income tax refunds are credited directly to taxpayers’ accounts thus dispensing with cheques which could be rejected on the grounds of spelling mistakes or get misplaced due to wayward ways of the postal department.

Now, the private businesses and even small businesses would think in terms of embracing the net banking. Many small businesses are already happy with making instant GST payments with a click of the mouse, a pleasant retreat from the days of filling up challans and queuing up at bank counters.