With the Supreme Court striking down Section 57 of the Aadhaar Act in October, thereby nullifying the biometric e-KYC model used by telecom companies and banks for customer verification and onboarding, the hunt is on for a reliable alternative. According to The Times of India, the government and the Reserve Bank of India (RBI) are in talks to allow use of ‘offline Aadhaar’ that relies on QR codes for services such as opening bank accounts, operating payment wallets and purchasing insurance covers.

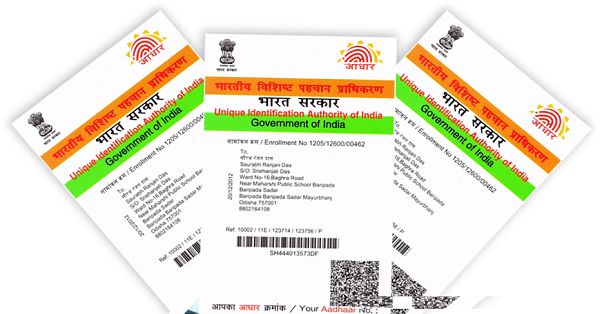

So what is the quick response (QR) code option? It’s basically a kind of barcode label containing machine-readable information that can be captured through a simple smartphone camera. Back in April, the Unique Identification Authority of India (UIDAI) had introduced secure digitally-signed QR Code on e-Aadhaar to facilitate better offline verification of an individual.

Significantly, since the above only boasts a cardholder’s name, address and photograph – without the Aadhaar number or Aadhaar authentication – the Aadhaar-issuing body claims it is equivalent to ration card or voter ID card. Only much more secure given that it is digitally signed. In fact, the UIDAI has been pushing offline Aadhaar as the tool for KYC, offering it as a secure solution.

The top court’s verdict that restricted the use of Aadhaar by private entities, including banks, while clearing it for welfare schemes had led to a discussion on the use of offline Aadhaar, where there is no link to the UIDAI’s servers.

The daily added that since the use of offline Aadhaar has to be facilitated by the RBI, the regulator needs to bring out a circular on the topic. In fact, the RBI has reportedly already held two-three rounds of discussions with UIDAI. The Aadhaar agency has suggested that the KYC master circular be amended, which will also ensure that the rules are in sync with the SC order.

It will also rule out the confusion that the verdict has spawned. For instance, SBI had recently informed the National Payments Corporation of India (NPCI) of its intention to discontinue the Aadhaar enabled payment system (AePS). The decision was purportedly based on the understanding that its continuation may be in violation of the Supreme Court judgement. But, on Friday, the UIDAI issued a clarification asking banks not to discontinue the AePS system as it may create obstruction in the delivery of welfare benefits, which would be going against the judgement. The confusion apart, several banks are yet to implement the apex court ruling since it requires them to tweak their systems.

The push for offline Aadhaar comes at a time when fintech companies have been prodding the government to amend the law to make Aadhaar mandatory. Significantly, the Centre has made it clear that no such plans are on the anvil.

However, sources told the daily that offline Aadhaar can only be optional at best, even for banks and insurance companies. Account-holders and those looking to buy a life cover are, after all, now legally allowed to offer other identification documents such as voter ID, ration card or driving licence to comply with KYC requirements.