TDS represents part of Income-tax that is already paid by the assessee, which can be set off against Income tax and balance tax liability to be paid.

Taxpayers would surely come across these two common terms – Income Tax and Tax Deduction at Source and get confused while filing their taxes. Under both the scenarios, the government collects taxes. However, the mechanism differs in the computation part.

Therefore, before filing tax returns, it becomes necessary for salaried individuals to avoid confusion related to these terms and understand the relevance and implications of the same.

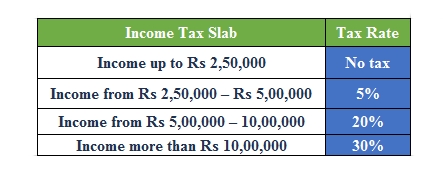

Income tax refers to a compulsory contribution levied on individual’s personal income as per his/her earning. There are a standard tax slab rates according to which the money gets deducted from your gross income. In other words, it basically refers to the total tax liability on an individual basis his annual taxable income after considering deductions & exemptions determined at the end of Financial Year.

Income tax slab for Assessment years 2018-19

->Surcharge of 10 percent of income tax, where the total income exceeds Rs 50 lakh up to Rs 1 crore.

->Surcharge of 15 percent of income tax, where the total income exceeds Rs 1 crore.

-> Health & Education Cess of 4 percent will be applied on Income Tax.

Tax Deducted at Source

In contrast, TDS represents part of Income-tax that is already paid by the assessee, which can be set off against Income tax and balance tax liability to be paid. ”Necessary adjustment of TDS is done while filing Income Tax return and in case any excess amount is deducted, the same can be claimed as refund,” said Agrawal.

It is a process through which the government can quickly and efficiently collect taxes. Thus, whatever the INCOME source may be, like income from salary, any commission, professional fee, interest from FD, etc., under the Income-Tax Act it has been incorporated that the process of deducting tax at the point of generation of income, will be known as “Tax Deducted at Source” or TDS.

“TDS as the name implies, is a part of your income tax which is deducted by your employer or other deductors while making payment to you and the same is deposited by them with Income Tax department,” said Vaibhav Agrawal, Head of Research and ARQ, Angel Broking.

Differences between Income Tax and TDS

Income tax and TDS are two forms to collect taxes in a different way. Here are four difference you should look at:

Annual Vs Periodic

Income tax: It is paid on the annual income where taxes are computed for a particular financial year.

TDS: It is deducted at source on a periodic basis in the particular year.

Direct Vs Indirect

Income Tax: The taxpayer determines his liability and makes the payment directly to the government.

TDS: It an indirect way of discharging of one’s tax liability where the deductor (Employer, Banks, financial institutions) of taxes facilitates the process of tax recovery for the government.

Gross Income Vs Certain Income

Income Tax: The tax is levied on the overall income earned by an individual (assessee) during a financial year.

TDS: The income tax law casts an obligation of deducting tax at source only on certain persons making certain prescribed payments.

After Vs Before

Income tax: It is levied on all salaried individuals or entities for the income they earned above the prescribed tax limit for that particular time period after a completion of a certain Financial Year.

TDS: The entire process of tax deduction and payment results in an obligation to pay taxes even before the taxpayer receives the income. “One may REcall TDS as a provision was introduced into the statute as a mechanism to check instances of tax evasion,” said Archit Gupta, Founder & CEO ClearTax.

What if tax gets deducted but salary is not taxable?

TDS is the amount that is deducted at certain specified rates by a person making certain specified payments to the taxpayer. Such amount deducted is subsequently paid to the credit of the central government by the deductor. In the event tax that is deducted at source exceeds what the income tax that the taxpayer is required today during the financial year, he or she may claim a refund of such TDS by filing his return of income.

“The law provides for a mechanism whereby a taxpayer can approach the income tax department to issue a lower or nil TDS certificate under circumstances where the former is of the view that he would have any tax liability for the concerned year. This certificate can be furnished by the taxpayers to their deductors who would have to adhere to the rate prescribed in the certificate (it could be either Nil or a lower rate of TDS) for a tax deduction,” said Gupta.